How much of health insurance do employers pay? This question is central to understanding the complex landscape of healthcare financing in the United States. Employer-sponsored health insurance has become a cornerstone of the American healthcare system, offering coverage to millions of workers and their families. But the financial burden of providing this coverage is shared between employers and employees, with varying levels of contribution depending on factors like industry, company size, and employee demographics.

This exploration delves into the intricacies of employer contributions, examining the different models used, the impact on employees’ out-of-pocket costs, and the role of government regulations in shaping this dynamic landscape. We’ll also discuss emerging trends, such as the rise of high-deductible plans and the integration of wellness programs, and consider the future direction of employer-sponsored health insurance in the face of evolving healthcare costs, workforce demographics, and technological advancements.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a critical component of the US healthcare system, providing health coverage to a significant portion of the population. This type of insurance is offered by employers to their employees as a benefit, typically in the form of group health insurance plans. It plays a crucial role in ensuring access to affordable and comprehensive healthcare for many Americans.

The Evolution of Employer-Sponsored Health Insurance

Employer-sponsored health insurance has a long history, evolving over time in response to various factors, including economic conditions, government policies, and societal trends.

- Early Origins: The roots of employer-sponsored health insurance can be traced back to the early 20th century, when some companies began offering health benefits to their employees as a way to attract and retain talent. This was particularly prevalent in industries with high rates of occupational hazards, such as mining and manufacturing.

- World War II: During World War II, wage freezes were implemented to control inflation. To attract and retain employees, companies began offering health insurance as a non-wage benefit, which was not subject to wage controls. This practice became widespread after the war, as employers realized the value of health insurance as a competitive advantage.

- The Rise of Employer-Sponsored Health Insurance: The passage of the Internal Revenue Code in 1954 made employer-sponsored health insurance premiums tax-deductible for businesses, further incentivizing its adoption. This tax advantage, coupled with the growing availability of affordable health insurance plans, led to a rapid increase in the prevalence of employer-sponsored health insurance.

- The Role of Unions: Labor unions played a significant role in promoting the adoption of employer-sponsored health insurance. They negotiated for health benefits as part of collective bargaining agreements, ensuring that their members had access to affordable healthcare.

- The Affordable Care Act: The Affordable Care Act (ACA) of 2010 introduced several provisions related to employer-sponsored health insurance, including requirements for employers with 50 or more full-time employees to offer health insurance or pay a penalty. The ACA also expanded access to affordable health insurance through the creation of health insurance marketplaces and subsidies.

The Legal Framework of Employer-Sponsored Health Insurance

The legal framework governing employer-sponsored health insurance is complex and multifaceted, encompassing a variety of federal and state laws and regulations.

- The Employee Retirement Income Security Act (ERISA): ERISA is a federal law that regulates employer-sponsored retirement and health plans, including health insurance. It sets standards for plan administration, disclosure, and fiduciary responsibility.

- The Health Insurance Portability and Accountability Act (HIPAA): HIPAA is a federal law that protects the privacy and security of health information. It applies to employer-sponsored health plans, requiring them to comply with certain standards for the handling and disclosure of protected health information.

- The Affordable Care Act (ACA): The ACA has had a significant impact on employer-sponsored health insurance, introducing several new requirements and regulations. For example, the ACA requires employers with 50 or more full-time employees to offer health insurance or pay a penalty. It also prohibits insurers from denying coverage based on pre-existing conditions and establishes minimum essential coverage requirements.

- State Laws: In addition to federal laws, state laws also play a role in regulating employer-sponsored health insurance. For example, states may have laws governing the types of health insurance plans that employers can offer, the benefits that must be included in plans, and the rates that insurers can charge.

Employer Contributions

Employers offer a variety of ways to contribute to employee health insurance costs, each with its own financial implications for both parties. Understanding these approaches can help employees make informed decisions about their health insurance choices and employers optimize their benefits packages.

Premium Contributions

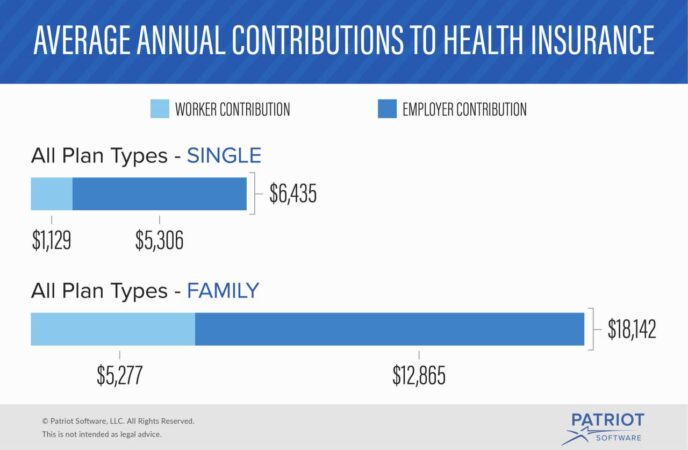

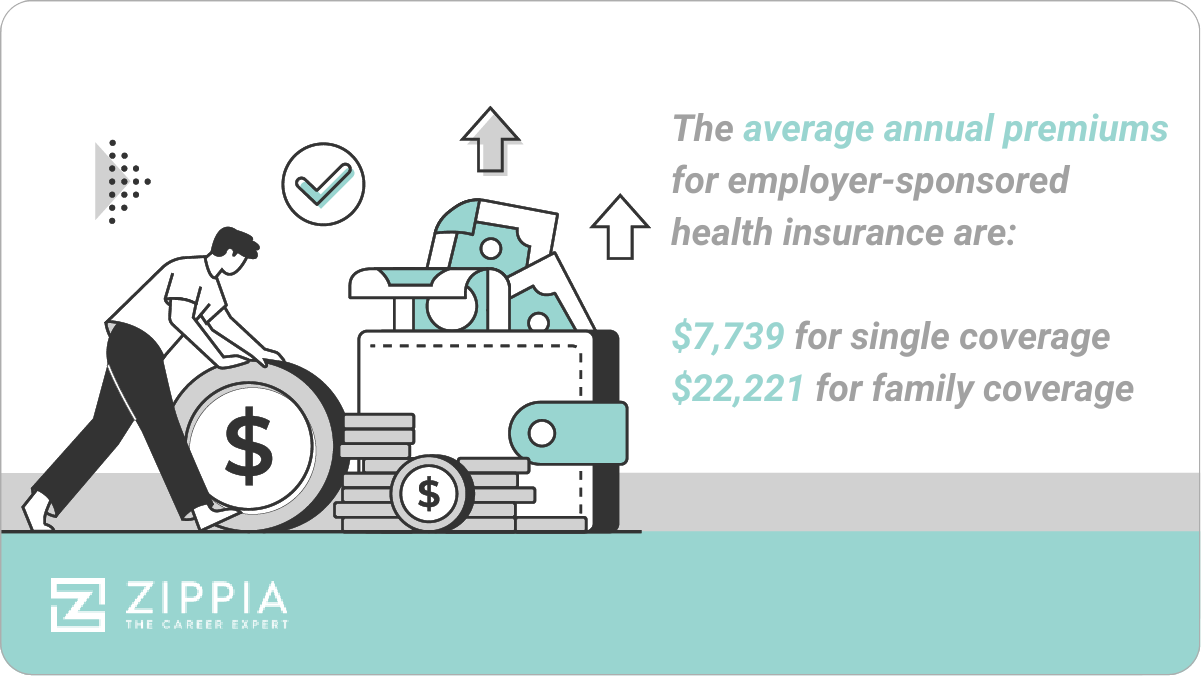

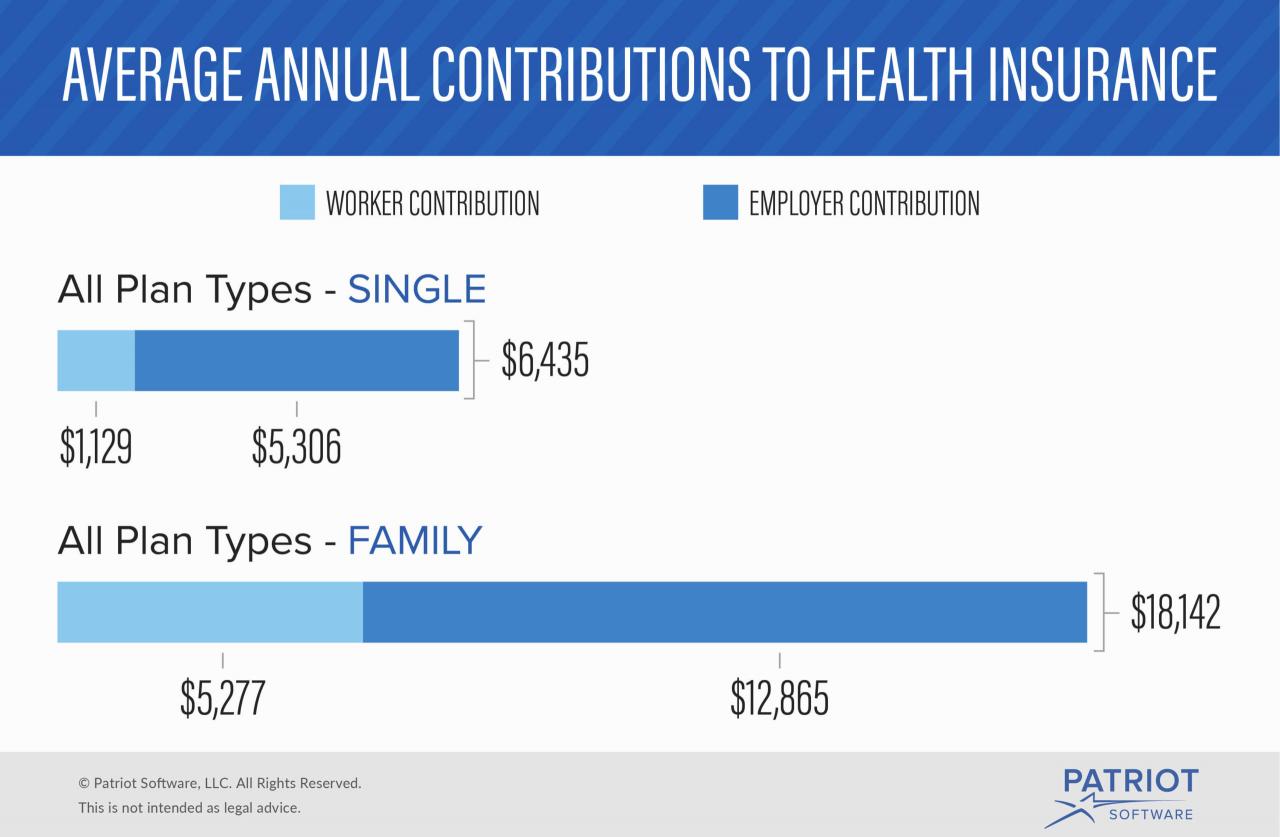

Employers typically contribute a significant portion of the health insurance premium, which is the monthly cost of coverage. The amount of employer contribution can vary widely, depending on factors such as industry, company size, and employee demographics. For instance, some employers may pay the entire premium, while others may contribute a percentage, such as 80%, leaving employees to cover the remaining 20%.

Cost-Sharing Arrangements

Cost-sharing arrangements, such as deductibles, copayments, and coinsurance, are another common way employers contribute to health insurance costs. These arrangements involve employees paying a portion of the healthcare expenses incurred. For example, an employer might contribute towards the premium but require employees to pay a deductible before coverage kicks in.

Deductible: The amount an employee must pay out-of-pocket before health insurance coverage begins.

Copayment: A fixed amount an employee pays for each medical service, such as a doctor’s visit or prescription.

Coinsurance: A percentage of the cost of medical services that an employee pays after meeting the deductible.

Self-Funded Plans

Self-funded health plans, also known as self-insured plans, are another option where employers take on the financial responsibility for covering employee healthcare costs. In this model, the employer assumes the risk of paying for healthcare claims, rather than relying on an insurance company. Self-funded plans often offer more flexibility in customizing coverage and managing costs, but also carry a higher risk for the employer.

Financial Implications

The different contribution models have distinct financial implications for both employers and employees. For employers, offering generous contributions can attract and retain talent, improve employee morale, and potentially reduce healthcare costs by encouraging preventive care. However, high contributions can also increase employer expenses, especially if employee healthcare costs rise.

For employees, higher employer contributions can lead to lower out-of-pocket costs and a wider range of health insurance options. However, if employers contribute less, employees may face higher premiums, deductibles, or copayments, which can strain their personal budgets.

Factors Influencing Employer Decisions

Several factors influence employer decisions regarding health insurance contributions, including:

- Industry: Certain industries, such as healthcare or technology, may have higher average healthcare costs and offer more generous benefits packages.

- Company Size: Larger companies often have more resources to dedicate to employee benefits, including health insurance. They may also have more negotiating power with insurance providers.

- Employee Demographics: The age, health status, and family size of employees can influence healthcare costs and employer contributions. For example, a company with a large number of older employees may have higher healthcare costs.

Employee Perspective

From an employee’s perspective, understanding the cost and coverage of employer-sponsored health insurance is crucial for making informed decisions about healthcare and personal finances. This section will explore the typical cost-sharing arrangements for employees, including deductibles, copayments, and coinsurance. We will also examine how employer contributions impact employee out-of-pocket expenses and overall healthcare affordability. Finally, we will discuss the benefits and drawbacks of employer-sponsored health insurance from the employee perspective, considering factors like coverage, accessibility, and cost.

Cost-Sharing Arrangements

Employees typically share the cost of healthcare with their employers through cost-sharing arrangements. These arrangements involve deductibles, copayments, and coinsurance, which are explained below:

- Deductible: The amount an employee must pay out-of-pocket before their health insurance plan starts covering healthcare expenses. For example, if an employee has a $1,000 deductible, they will need to pay the first $1,000 of healthcare costs themselves before the insurance plan begins covering the rest.

- Copayment: A fixed amount an employee pays for a specific healthcare service, such as a doctor’s visit or prescription medication. Copayments are typically a small amount, ranging from $10 to $50, depending on the plan and the service.

- Coinsurance: A percentage of the healthcare costs that the employee pays after meeting the deductible. For example, if an employee has a 20% coinsurance rate, they will pay 20% of the healthcare costs after meeting the deductible, while the insurance plan covers the remaining 80%.

Impact of Employer Contributions

Employer contributions to health insurance plans significantly impact employee out-of-pocket expenses and overall healthcare affordability.

When employers contribute a larger portion of the premium costs, employees typically pay lower premiums and have access to more comprehensive coverage. This can lead to lower out-of-pocket expenses and improved access to healthcare.

For example, an employee whose employer contributes a significant portion of the premium might pay a monthly premium of $100, while an employee whose employer contributes less might pay a monthly premium of $250. The difference in premium costs can significantly impact an employee’s ability to afford healthcare.

Benefits and Drawbacks

Employer-sponsored health insurance offers several benefits for employees, including:

- Coverage: Employer-sponsored plans typically provide comprehensive coverage for a wide range of healthcare services, including preventive care, hospital stays, and prescription medications.

- Accessibility: Employees often have access to a wider network of healthcare providers through employer-sponsored plans compared to individual plans.

- Cost Savings: Employer contributions to premiums can significantly reduce employee out-of-pocket expenses, making healthcare more affordable.

However, employer-sponsored health insurance also has some drawbacks:

- Limited Choice: Employees often have limited choice in selecting their health insurance plan, as their employer typically offers a small number of options.

- Potential for High Deductibles and Copayments: Some employer-sponsored plans may have high deductibles and copayments, which can make healthcare expensive for employees.

- Job Security: Losing a job can result in the loss of health insurance coverage, leaving employees without health insurance until they find new employment.

The Role of Government

The government plays a significant role in shaping employer contributions to health insurance. Through legislation, tax incentives, and regulations, the government influences employer behavior and the overall health insurance landscape.

Impact of the Affordable Care Act

The Affordable Care Act (ACA) has had a substantial impact on employer-sponsored health insurance. The ACA mandated that most employers with 50 or more full-time equivalent employees offer health insurance to their employees or face a penalty. This mandate aimed to increase the number of Americans with health insurance coverage. The ACA also introduced various provisions related to employer contributions, such as:

- Minimum Value Standards: Employers must offer health insurance plans that meet minimum value standards, ensuring that they provide a certain level of coverage.

- Essential Health Benefits: Plans must cover essential health benefits, including preventive care, hospitalization, and prescription drugs.

- Premium Tax Credits: The ACA provides tax credits to individuals and families who purchase health insurance through the Marketplace, potentially reducing the cost of coverage for employees.

These provisions have encouraged employers to offer more comprehensive and affordable health insurance plans, contributing to the overall increase in health insurance coverage.

Tax Incentives and Penalties

The government offers various tax incentives to encourage employers to offer health insurance. These incentives can include:

- Tax Deductions: Employers can deduct the cost of providing health insurance as a business expense, reducing their tax liability.

- Employer Contribution Tax Credit: Small businesses may be eligible for a tax credit for contributing to their employees’ health insurance premiums.

However, the government also imposes penalties on employers who fail to comply with certain requirements, such as:

- Employer Shared Responsibility Payment: Employers with 50 or more full-time equivalent employees who do not offer affordable health insurance coverage to their employees face a penalty known as the Employer Shared Responsibility Payment.

These tax incentives and penalties aim to incentivize employers to offer health insurance and ensure that employees have access to affordable coverage.

Potential Implications of Future Regulations

The government’s role in shaping employer contributions is likely to continue evolving. Future regulations could focus on:

- Expanding Coverage: The government may consider expanding coverage requirements to include smaller employers or increasing the penalty for non-compliance.

- Controlling Costs: Regulations could focus on controlling the rising cost of health insurance by promoting transparency, price negotiation, and value-based care.

- Promoting Health Equity: Future regulations could address health disparities by encouraging employers to offer culturally competent care and support programs for vulnerable populations.

These potential regulations could have a significant impact on employer contributions, employee benefits, and the overall health insurance landscape.

Trends and Future Directions

The landscape of employer-sponsored health insurance is constantly evolving, driven by factors such as rising healthcare costs, changing demographics, and technological advancements. Understanding these trends is crucial for both employers and employees to navigate the future of healthcare benefits.

Emerging Trends in Employer Contributions, How much of health insurance do employers pay

Employers are increasingly adopting strategies to manage healthcare costs, often shifting some of the financial burden to employees. This trend is reflected in the rise of high-deductible health plans (HDHPs) and the growing popularity of wellness programs.

- High-Deductible Health Plans (HDHPs): HDHPs have gained traction due to their lower monthly premiums compared to traditional plans. However, they require employees to pay a higher deductible before insurance coverage kicks in. The rise of HDHPs is partly attributed to their potential to incentivize employees to make more informed healthcare decisions and potentially reduce unnecessary spending.

- Wellness Programs: Employers are increasingly incorporating wellness programs into their benefits packages. These programs aim to promote healthy behaviors among employees, such as regular exercise, healthy eating, and stress management. Wellness programs can potentially lower healthcare costs by reducing chronic disease prevalence and promoting preventive care.

Impact of Technological Advancements

Technological advancements are transforming the healthcare landscape, impacting employer contributions and employee benefits in significant ways.

- Telemedicine: Telemedicine allows patients to consult with healthcare providers remotely through video conferencing or phone calls. This technology can potentially reduce healthcare costs by minimizing the need for in-person visits, especially for routine checkups and consultations. Employers can leverage telemedicine to offer more affordable healthcare options to their employees, potentially lowering their overall healthcare spending.

- Personalized Medicine: Personalized medicine uses genetic information and other factors to tailor treatments to individual patients. This approach can lead to more effective treatments and potentially reduce the need for costly and unnecessary interventions. As personalized medicine becomes more widely adopted, employers may offer benefits that include genetic testing and personalized treatment plans, potentially improving employee health outcomes and lowering healthcare costs.

Wrap-Up: How Much Of Health Insurance Do Employers Pay

Understanding how much of health insurance employers pay is essential for navigating the complexities of the American healthcare system. From the perspective of both employers and employees, the financial implications of these contributions are significant. As we move forward, the balance between employer contributions, employee cost-sharing, and government regulation will continue to shape the landscape of employer-sponsored health insurance, impacting the accessibility, affordability, and quality of healthcare for millions of Americans.

Clarifying Questions

What are the most common types of employer contributions to health insurance?

Employers can contribute to employee health insurance through various methods, including premium contributions, cost-sharing arrangements (deductibles, copayments, coinsurance), and self-funded plans.

How do employer contributions affect employee out-of-pocket costs?

Higher employer contributions generally translate to lower out-of-pocket costs for employees, while lower contributions lead to higher out-of-pocket expenses. This can impact an employee’s overall healthcare affordability.

What are the advantages and disadvantages of employer-sponsored health insurance?

Advantages include potentially lower premiums, access to a wider range of healthcare providers, and tax benefits. Disadvantages can include limited choice in plans, potential for high out-of-pocket costs, and employer-driven decisions about coverage.