How much should health insurance cost sets the stage for this exploration, offering readers a glimpse into a complex world of factors influencing premiums and plan choices. From age and health history to location and coverage levels, understanding these variables is crucial to navigating the health insurance landscape.

This guide delves into the intricacies of health insurance costs, empowering individuals to make informed decisions about their coverage. By analyzing different plan types, assessing personal needs and budgets, and exploring cost-saving strategies, you can gain valuable insights into how to find affordable and effective health insurance.

Factors Influencing Health Insurance Costs: How Much Should Health Insurance Cost

The cost of health insurance is influenced by a variety of factors, some of which are within your control and some of which are not. Understanding these factors can help you make informed decisions about your health insurance coverage and potentially save money.

Age

As people get older, they tend to experience more health problems, which can lead to higher healthcare costs. As a result, insurance companies charge older people higher premiums. This is because they are more likely to use healthcare services. For instance, a 65-year-old individual may have a higher premium than a 30-year-old individual, even if they both have the same health history.

Health History and Pre-existing Conditions, How much should health insurance cost

Individuals with a history of health problems or pre-existing conditions are more likely to require healthcare services. This increases the risk for insurance companies, so they often charge higher premiums to these individuals. For example, someone with a history of diabetes or heart disease may have a higher premium than someone with no pre-existing conditions.

Location

The cost of healthcare varies by location, which can affect health insurance premiums. Insurance companies adjust premiums based on the average healthcare costs in a particular area. For example, premiums in a major metropolitan area may be higher than in a rural area due to higher healthcare costs in the city.

Lifestyle

Certain lifestyle choices can impact health insurance premiums. For instance, smokers tend to have higher premiums than non-smokers because smoking increases the risk of health problems. Similarly, individuals who are overweight or obese may also have higher premiums due to their increased risk of health problems.

Coverage Levels

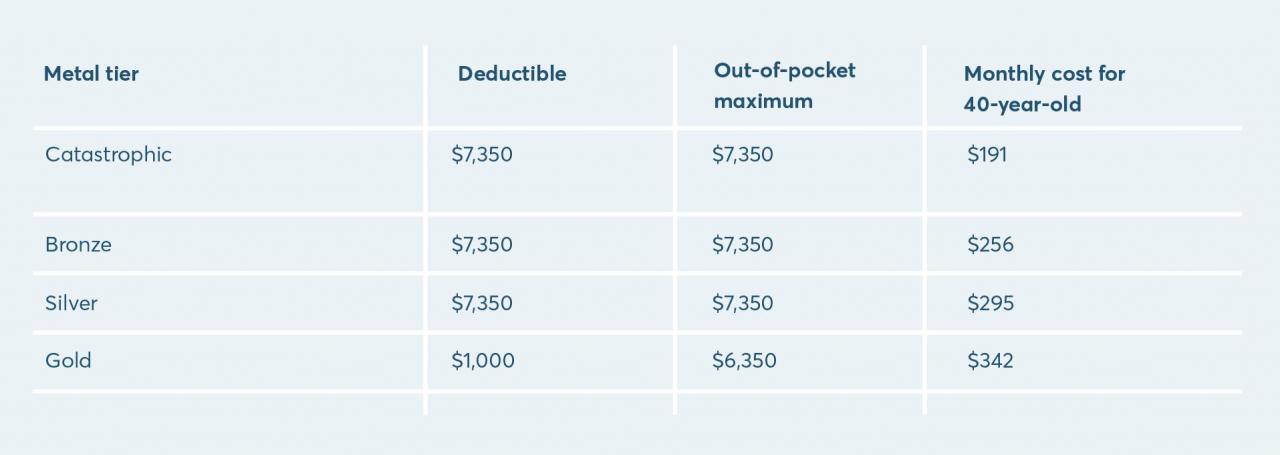

Health insurance plans are often categorized into different coverage levels, such as bronze, silver, gold, and platinum. These levels represent different levels of coverage and cost-sharing. Bronze plans have the lowest premiums but also have the highest out-of-pocket costs. Platinum plans have the highest premiums but the lowest out-of-pocket costs.

Understanding Different Health Insurance Plans

Choosing the right health insurance plan can be overwhelming, as there are various options with different coverage and costs. Understanding the key features of each plan type is crucial to make an informed decision that best suits your individual needs and budget.

Health Insurance Plan Types

There are several types of health insurance plans available, each with its own unique features and costs. Here’s a comparison table highlighting some of the most common plan types:

| Plan Type | Coverage Details | Monthly Premiums | Deductibles | Co-pays |

|---|---|---|---|---|

| HMO (Health Maintenance Organization) | Typically offers lower premiums but restricts you to a specific network of doctors and hospitals. | Lower | Lower | Lower |

| PPO (Preferred Provider Organization) | Provides more flexibility, allowing you to see doctors and hospitals outside the network, though it comes with higher costs. | Higher | Higher | Higher |

| POS (Point-of-Service) | Combines features of HMO and PPO, offering a network of providers but also allowing out-of-network access with higher costs. | Moderate | Moderate | Moderate |

| HDHP (High Deductible Health Plan) | Offers lower premiums but has a high deductible, meaning you pay more out-of-pocket before insurance kicks in. | Lower | Higher | Lower |

Advantages and Disadvantages of Different Plan Types

Each plan type comes with its own set of advantages and disadvantages, which can influence your decision. Let’s explore them in detail:

HMO

- Advantages: HMOs often have lower monthly premiums and deductibles, making them a cost-effective option for individuals with predictable healthcare needs. They also emphasize preventive care and wellness services.

- Disadvantages: HMOs restrict you to a specific network of doctors and hospitals, limiting your choice of healthcare providers. You’ll typically need a referral from your primary care physician to see specialists. Additionally, you may face higher out-of-pocket costs for out-of-network care.

PPO

- Advantages: PPOs offer more flexibility, allowing you to see doctors and hospitals outside the network without needing a referral. This is beneficial if you prefer a wider range of healthcare providers or need specialized care not available within the network.

- Disadvantages: PPOs generally have higher monthly premiums and deductibles compared to HMOs. You may also face higher co-pays for out-of-network services.

POS

- Advantages: POS plans combine features of HMOs and PPOs, offering a network of providers while allowing out-of-network access with higher costs. This provides flexibility and affordability, making them suitable for individuals with varying healthcare needs.

- Disadvantages: POS plans can be more complex to understand and navigate compared to HMOs or PPOs. You may need to be mindful of the network restrictions and out-of-network costs.

HDHP

- Advantages: HDHPs offer lower monthly premiums and often come with a Health Savings Account (HSA), which allows you to save pre-tax money for healthcare expenses. They are a good option for healthy individuals who rarely need medical care.

- Disadvantages: HDHPs have high deductibles, meaning you’ll need to pay a significant amount out-of-pocket before insurance kicks in. This can be challenging for individuals with chronic health conditions or who require frequent medical care.

Evaluating Your Personal Needs and Budget

Before diving into specific health insurance plans, it’s crucial to understand your individual needs and budget. This will help you make informed decisions and choose a plan that offers the right coverage at a price you can afford.

Assessing Individual Health Insurance Needs

Understanding your healthcare needs is the first step in choosing the right health insurance plan. This involves considering your health history, current health status, and future healthcare needs.

- Review your medical history: Look back at your medical records and identify any recurring health issues or conditions that require regular medical attention. This will give you an idea of your potential healthcare costs.

- Consider your current health status: If you are currently healthy, you may be able to opt for a lower-cost plan with a higher deductible. However, if you have pre-existing conditions or are at a higher risk for health problems, you may need a more comprehensive plan with lower deductibles and copayments.

- Evaluate your future healthcare needs: Think about your age, family planning, and lifestyle. If you are planning to have children, you’ll need a plan that covers prenatal care and childbirth. If you are expecting any major medical procedures or treatments in the near future, consider a plan that provides adequate coverage for these services.

Estimating Annual Healthcare Expenses

To get a better understanding of your potential healthcare costs, you can estimate your annual healthcare expenses based on your past usage.

- Review past medical bills: Gather your medical bills from the past year or two and calculate your total healthcare spending. This will provide a realistic estimate of your annual healthcare costs.

- Consider prescription costs: If you take regular medications, factor in the cost of your prescriptions. You can use online tools or consult with your pharmacist to estimate the annual cost of your medications.

- Estimate future healthcare needs: If you anticipate any upcoming medical procedures or treatments, factor in the estimated costs of these services. You can consult with your doctor or healthcare provider for an estimate.

Budgeting for Health Insurance Premiums and Out-of-Pocket Costs

Once you have a better understanding of your healthcare needs and potential costs, you can start budgeting for health insurance premiums and out-of-pocket costs.

- Set a budget: Determine how much you can afford to spend on health insurance each month. Consider your overall financial situation and prioritize health insurance within your budget.

- Factor in out-of-pocket costs: Remember that health insurance premiums are only part of the total cost. You’ll also need to budget for deductibles, copayments, and coinsurance.

- Consider a health savings account (HSA): If you choose a high-deductible health plan (HDHP), you may be eligible to open a health savings account (HSA). An HSA allows you to save pre-tax money for healthcare expenses and can help you lower your overall healthcare costs.

Risk Tolerance and Plan Selection

Your risk tolerance is another crucial factor to consider when choosing a health insurance plan. Risk tolerance refers to your willingness to accept the potential for financial risk in exchange for lower premiums.

- High-risk tolerance: Individuals with a high risk tolerance may be willing to choose a plan with a higher deductible and lower premiums. This means they are comfortable paying more out-of-pocket for healthcare services, but they benefit from lower monthly premiums.

- Low-risk tolerance: Individuals with a low risk tolerance may prefer a plan with a lower deductible and higher premiums. This means they are willing to pay more for monthly premiums to have more coverage and lower out-of-pocket costs.

Exploring Cost-Saving Strategies

Navigating the world of health insurance can feel overwhelming, but understanding the various cost-saving strategies available can significantly impact your budget. Whether you’re looking to reduce your monthly premiums, minimize out-of-pocket expenses, or simply make the most of your existing plan, this section will guide you through effective ways to save.

Discounts and Subsidies

Knowing about available discounts and subsidies can significantly reduce your overall healthcare costs.

- Government subsidies: The Affordable Care Act (ACA) provides subsidies to individuals and families who meet certain income requirements, making health insurance more affordable. These subsidies are available through the Health Insurance Marketplace.

- Employer-sponsored discounts: Some employers offer discounts on health insurance premiums for employees who participate in wellness programs, such as smoking cessation or weight loss initiatives.

- Discounts for seniors: Many insurance companies offer discounts for seniors, particularly those who are enrolled in Medicare.

- Group discounts: If you belong to a professional organization, alumni association, or other group, you may be eligible for discounted health insurance rates.

Maximizing Employer-Sponsored Insurance Benefits

If you have employer-sponsored health insurance, it’s crucial to understand and maximize the benefits offered.

- Open enrollment period: Be aware of the open enrollment period for your employer-sponsored plan, as this is the time to make changes to your coverage.

- Flexible spending accounts (FSAs): These accounts allow you to set aside pre-tax dollars to pay for eligible medical expenses, reducing your taxable income and overall healthcare costs.

- Health savings accounts (HSAs): HSAs are similar to FSAs but are available to individuals with high-deductible health plans. They offer tax advantages and can be used to pay for healthcare expenses both now and in the future.

- Wellness programs: Participate in wellness programs offered by your employer, as they can often lead to lower premiums or even cash incentives.

Reducing Healthcare Expenses

Adopting a preventive approach to healthcare can significantly reduce your overall expenses.

- Preventive care: Regularly schedule checkups, screenings, and vaccinations, as these can help detect and prevent serious health conditions, potentially saving you money on costly treatments later.

- Healthy lifestyle choices: Engage in regular physical activity, maintain a balanced diet, and avoid unhealthy habits like smoking and excessive alcohol consumption. These choices can contribute to better health and reduce your risk of developing chronic diseases.

- Generic medications: When possible, opt for generic medications, as they are often significantly cheaper than brand-name alternatives while providing the same therapeutic benefits.

- Negotiating medical bills: Don’t hesitate to negotiate medical bills, especially if you have a high deductible or are facing unexpected expenses. Hospitals and healthcare providers are often willing to work with patients to find solutions.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

FSAs and HSAs are valuable tools for managing healthcare costs.

- FSAs: These accounts allow you to set aside pre-tax dollars to pay for eligible medical expenses, such as deductibles, copayments, and prescription drugs. The money you contribute to an FSA is not subject to federal income tax, effectively reducing your overall healthcare costs.

- HSAs: These accounts are available to individuals with high-deductible health plans. They offer tax advantages similar to FSAs, but the funds can be rolled over year after year, making them ideal for long-term healthcare savings.

Resources and Support

Navigating the complex world of health insurance can feel overwhelming, but numerous resources and support systems are available to help you find the right coverage. Understanding these options can make the process smoother and more efficient.

State and Federal Marketplaces

State and federal marketplaces, also known as health insurance exchanges, are online platforms designed to simplify the process of finding affordable health insurance plans. These marketplaces offer a variety of plans from different insurance companies, allowing you to compare options and choose the one that best suits your needs and budget.

- Eligibility and Enrollment: To be eligible for coverage through the marketplace, you must meet certain income and residency requirements. You can apply for coverage during open enrollment periods or in certain situations, such as a qualifying life event.

- Financial Assistance: The marketplaces offer financial assistance, including premium tax credits and cost-sharing reductions, to help individuals and families afford coverage. The amount of assistance you qualify for depends on your income and family size.

- Plan Options: The marketplaces offer a range of plans, including bronze, silver, gold, and platinum, with varying levels of coverage and premiums. You can use the marketplace’s tools to compare plans based on factors like cost, coverage, and provider networks.

Insurance Brokers and Agents

Insurance brokers and agents are licensed professionals who can provide guidance and support throughout the health insurance process. They can help you understand your options, compare plans, and choose the best coverage for your needs.

- Expertise and Knowledge: Brokers and agents have in-depth knowledge of the health insurance market and can provide expert advice on various plans, benefits, and regulations.

- Personalized Guidance: They can tailor their recommendations to your specific needs, considering factors like your health status, budget, and coverage preferences.

- Streamlined Enrollment: They can assist with the enrollment process, ensuring you have the necessary documentation and completing the application accurately.

Consumer Protection Resources

Several consumer protection resources are available to help you navigate the health insurance market and protect your rights.

- State Insurance Departments: State insurance departments regulate the insurance industry and handle consumer complaints. You can contact your state’s insurance department for information on your rights and to file a complaint if you have issues with your insurer.

- Centers for Medicare & Medicaid Services (CMS): CMS is the federal agency that oversees Medicare and Medicaid programs. It also provides information and resources for consumers regarding health insurance, including the Affordable Care Act (ACA) and the health insurance marketplaces.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of various products and services, including health insurance plans. You can access their website for information on plan quality, customer satisfaction, and other factors to consider when choosing coverage.

Government Assistance Programs

Several government assistance programs are available to help low-income individuals and families afford health insurance.

- Medicaid: Medicaid is a federal-state program that provides health insurance to low-income individuals and families. Eligibility requirements vary by state, and you can apply through your state’s Medicaid agency.

- Children’s Health Insurance Program (CHIP): CHIP is a federal-state program that provides health insurance to children in families that do not qualify for Medicaid. Eligibility requirements vary by state, and you can apply through your state’s CHIP agency.

- Premium Tax Credits: The Affordable Care Act provides premium tax credits to help individuals and families afford health insurance through the marketplaces. The amount of the credit depends on your income and family size.

Final Review

Navigating the world of health insurance can be daunting, but by understanding the key factors influencing costs, exploring different plan options, and taking advantage of available resources, you can make informed choices that fit your needs and budget. Remember, health insurance is an essential investment in your well-being, and by taking the time to understand your options, you can secure the coverage you need while managing your expenses effectively.

FAQ Guide

How can I compare different health insurance plans?

Use online comparison tools, contact insurance brokers or agents, or visit the state or federal health insurance marketplace to compare plans side-by-side based on factors like coverage, premiums, deductibles, and co-pays.

What are some common health insurance terms?

Common terms include premium (monthly cost), deductible (amount you pay before insurance kicks in), co-pay (fixed amount you pay for services), and coinsurance (percentage you pay for services after deductible).

Can I get financial assistance for health insurance?

Yes, depending on your income and household size, you may be eligible for government subsidies or tax credits to reduce your health insurance costs. Check with the state or federal marketplace for eligibility information.