Insurance companies in Australia play a vital role in the financial well-being of individuals and businesses, providing a safety net against unforeseen risks. The Australian insurance market is diverse, encompassing a wide range of products and services catering to various needs. This guide delves into the intricacies of the industry, exploring its structure, key players, and the evolving landscape shaped by technology and innovation.

From understanding the different types of insurance companies and their business models to navigating the complex world of insurance products and services, this comprehensive overview aims to empower readers with valuable insights and knowledge.

Consumer Experience and Customer Service: Insurance Companies In Australia

The insurance industry in Australia is highly competitive, with consumers having a wide range of options to choose from. In this environment, providing a positive customer experience is crucial for insurance companies to attract and retain customers. This involves ensuring that customers have a seamless and enjoyable experience throughout their interactions with the company, from the initial inquiry to the claim process.

Importance of Customer Service in the Insurance Industry

Customer service plays a vital role in the success of insurance companies. Satisfied customers are more likely to renew their policies, recommend the company to others, and remain loyal to the brand. Conversely, negative customer experiences can lead to customer churn, negative online reviews, and damage to the company’s reputation.

Key Factors Contributing to a Positive Customer Experience

Several factors contribute to a positive customer experience in the insurance industry. These include:

- Accessibility and Responsiveness: Insurance companies need to be easily accessible to customers through various channels, such as phone, email, online chat, and social media. They should also be responsive to customer inquiries and provide timely solutions to their problems.

- Personalized Service: Customers appreciate personalized service that caters to their individual needs. This can include providing tailored insurance quotes, offering relevant product recommendations, and proactively communicating with customers about their policy updates.

- Transparency and Clarity: Customers want to understand their insurance policies and the process involved in making a claim. Companies should provide clear and concise information about their products and services, as well as transparently communicate any changes or updates.

- Efficient Claim Process: The claim process is often a stressful experience for customers. Insurance companies need to streamline the process, making it as easy and hassle-free as possible. This includes providing clear instructions, prompt communication, and timely claim settlements.

- Proactive Communication: Insurance companies should proactively communicate with customers, providing regular updates on their policies, reminding them of upcoming renewal dates, and offering relevant information about new products or services.

Innovative Approaches to Customer Service

Australian insurance companies are embracing innovative approaches to enhance the customer experience. These include:

- Artificial Intelligence (AI) Chatbots: AI chatbots are being used to provide 24/7 customer support, answer frequently asked questions, and guide customers through the policy selection process.

- Mobile App Integration: Insurance companies are developing mobile apps that allow customers to manage their policies, track claims, and access customer support directly from their smartphones.

- Data Analytics and Personalization: Insurance companies are using data analytics to understand customer preferences and behavior, allowing them to personalize their interactions and provide more relevant product recommendations.

- Social Media Engagement: Insurance companies are actively engaging with customers on social media platforms, responding to queries, addressing complaints, and building relationships with their audience.

Technology and Innovation in Insurance

The Australian insurance industry is undergoing a rapid transformation, driven by advancements in technology and the increasing adoption of digital solutions. This shift is profoundly impacting how insurance companies operate and how consumers interact with them.

The Role of Technology in the Insurance Industry, Insurance companies in australia

Technology plays a pivotal role in modernizing the insurance industry, enabling greater efficiency, enhanced customer experiences, and the development of innovative products and services. Key trends shaping this evolution include:

- Artificial Intelligence (AI): AI is transforming various aspects of insurance, from risk assessment and fraud detection to customer service and claims processing. AI-powered chatbots are becoming increasingly common for handling routine inquiries, while AI algorithms can analyze vast amounts of data to identify patterns and predict potential risks.

- Big Data Analytics: Insurance companies are leveraging big data analytics to gain deeper insights into customer behavior, market trends, and risk factors. This data-driven approach enables them to personalize policies, optimize pricing, and improve underwriting decisions.

- Internet of Things (IoT): The proliferation of connected devices is creating new opportunities for insurers. IoT sensors can collect real-time data on insured assets, enabling more accurate risk assessments and proactive prevention measures. For example, telematics devices in vehicles can track driving behavior, leading to personalized insurance premiums based on individual risk profiles.

- Cloud Computing: Cloud-based platforms provide insurance companies with scalable and flexible infrastructure, enabling them to manage data, applications, and operations more efficiently. This shift to the cloud also allows for greater agility and faster deployment of new technologies and services.

- Blockchain Technology: Blockchain technology holds the potential to revolutionize insurance processes, particularly in areas such as claims processing and fraud prevention. Its decentralized and transparent nature can streamline transactions, enhance security, and reduce administrative costs.

Impact of Digitalization on Insurance Companies and Consumers

The digitalization of the insurance industry has had a profound impact on both insurance companies and consumers:

- For Insurance Companies: Digitalization has enabled insurers to automate processes, improve efficiency, and reduce operational costs. It has also allowed them to reach new customers through online channels and develop personalized products and services. The use of digital platforms has also allowed insurers to collect and analyze data more effectively, leading to better risk assessments and pricing models.

- For Consumers: Consumers benefit from digitalization through increased convenience, transparency, and personalization. They can now access insurance quotes and policies online, manage their accounts digitally, and file claims through mobile apps. Digital platforms also provide consumers with access to a wider range of insurance products and services, allowing them to compare prices and find the best coverage for their needs.

Emerging Technologies Shaping the Future of Insurance in Australia

Several emerging technologies are poised to further transform the Australian insurance landscape:

- Artificial Intelligence (AI): AI will continue to play a major role in insurance, with advanced applications like natural language processing (NLP) and machine learning (ML) becoming increasingly prevalent. These technologies will enable insurers to automate complex tasks, personalize customer interactions, and develop more sophisticated risk assessment models.

- Extended Reality (XR): XR technologies, including virtual reality (VR) and augmented reality (AR), are opening up new possibilities for insurance. VR can be used to create immersive training simulations for insurance agents, while AR can be used to assist customers with claims inspections or provide interactive product demonstrations.

- Quantum Computing: Quantum computing has the potential to revolutionize the insurance industry by enabling faster and more accurate risk modeling and data analysis. This technology can help insurers develop more personalized and affordable insurance products, as well as improve fraud detection and risk management.

Innovative Insurance Products and Services

| Product/Service | Technology Used | Benefits | Impact on Industry |

|---|---|---|---|

| Usage-based insurance (UBI) | IoT sensors, telematics devices | Personalized premiums based on driving behavior, potential discounts for safe driving | Shifting focus from static risk profiles to real-time data, promoting safer driving practices |

| AI-powered claims processing | Artificial intelligence (AI), machine learning (ML) | Faster claims processing times, reduced manual intervention, improved accuracy | Streamlining claims processes, enhancing customer satisfaction, reducing operational costs |

| Personalized insurance recommendations | Big data analytics, AI algorithms | Tailored insurance solutions based on individual needs and preferences | Increased customer engagement, improved product relevance, fostering long-term relationships |

| Smart home insurance | IoT sensors, smart home devices | Discounts for installing smart home devices, proactive risk prevention through real-time monitoring | Promoting safer homes, reducing claims frequency, enhancing customer peace of mind |

| Digital health insurance | Wearable fitness trackers, health data analytics | Personalized health plans, wellness programs, potential discounts for healthy lifestyle choices | Encouraging preventative healthcare, promoting healthier lifestyles, fostering a more holistic approach to insurance |

Concluding Remarks

The Australian insurance industry is a dynamic and ever-evolving sector, constantly adapting to meet the changing needs of its customers. By understanding the key trends, challenges, and opportunities facing insurance companies, individuals and businesses can make informed decisions about their insurance needs and navigate the complexities of the market with confidence.

FAQ Corner

What are the main types of insurance available in Australia?

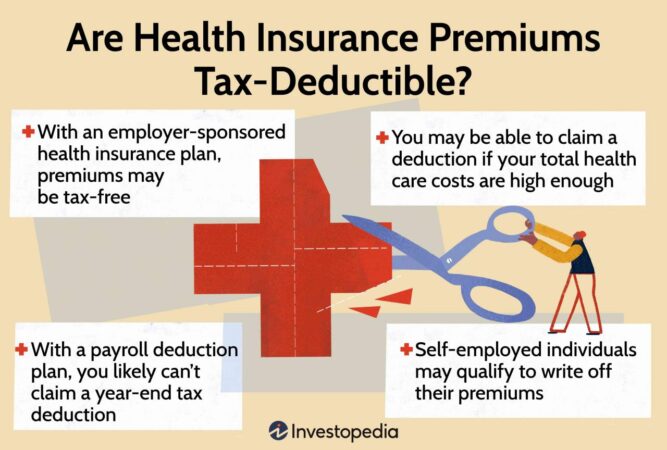

Australia offers a wide range of insurance products, including general insurance (covering property, motor vehicles, and liability), life insurance (providing financial protection in case of death or disability), and health insurance (covering medical expenses).

How do I choose the right insurance company for my needs?

When choosing an insurance company, consider factors such as product coverage, pricing, customer service, financial stability, and claims handling process. It’s also advisable to compare quotes from multiple insurers to find the best value for your specific needs.

What are the latest trends in the Australian insurance industry?

The Australian insurance industry is witnessing significant technological advancements, with digitalization, artificial intelligence, and data analytics playing increasingly important roles. These trends are transforming the way insurance companies operate and interact with their customers.