Is life insurance tax deductible in Australia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Whether you’re a business owner, an individual seeking financial security, or simply curious about the intricacies of Australian tax laws, understanding the tax implications of life insurance is crucial. This guide delves into the complexities of life insurance premiums and their potential tax deductibility, providing valuable insights for navigating the Australian tax landscape.

From exploring the general rules and specific types of life insurance policies eligible for tax deductions to outlining the criteria for claiming deductions, this guide covers all aspects of this important financial topic. We’ll also discuss the implications of claiming incorrect deductions and the importance of seeking professional advice to ensure compliance with Australian tax regulations.

Life Insurance Premiums and Tax Deductibility in Australia

Life insurance premiums are generally not tax deductible in Australia. This means you can’t claim a deduction for the cost of your life insurance premiums when you lodge your tax return. However, there are some exceptions to this rule, and certain types of life insurance premiums may be deductible in specific circumstances.

Deductible Life Insurance Premiums

Life insurance premiums may be tax deductible if the insurance policy is taken out for business purposes. This means that the insurance policy must be linked to your income-producing activities and provide cover for risks associated with your business. For example, if you are a sole trader and take out a life insurance policy that covers your business debts, you may be able to claim a tax deduction for the premiums.

Here are some specific examples of situations where life insurance premiums may be tax deductible:

- Life insurance for a business loan: If you take out a business loan and the lender requires you to have life insurance as a condition of the loan, the premiums may be tax deductible. This is because the life insurance is directly linked to your income-producing activities and is essential for the continuation of your business.

- Key person insurance: Key person insurance is a type of life insurance that covers a business owner or key employee. If the business takes out a key person insurance policy, the premiums may be tax deductible. This is because the policy protects the business from financial loss in the event of the death of a key person.

- Life insurance for a business partnership: If you are a partner in a business and take out life insurance to cover your share of the partnership’s debts, the premiums may be tax deductible. This is because the insurance policy is directly linked to your income-producing activities and is essential for the continuation of your business.

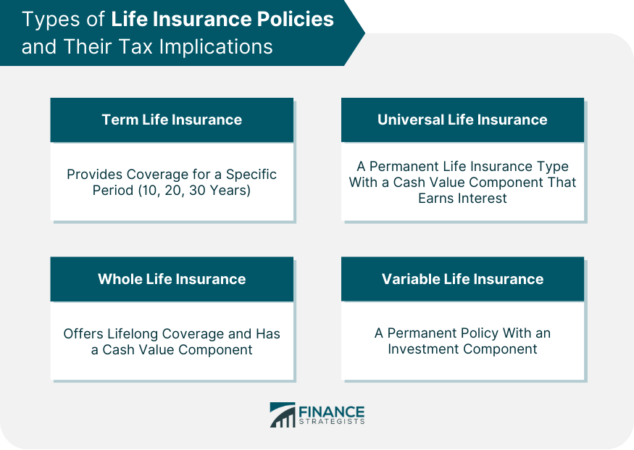

Types of Life Insurance Policies and Tax Deductibility

The type of life insurance policy you have can also impact whether or not the premiums are tax deductible. For example, term life insurance is typically not tax deductible, while some types of permanent life insurance, such as whole of life insurance, may be deductible in certain circumstances.

Here are some common types of life insurance policies and their tax deductibility:

- Term Life Insurance: Term life insurance provides coverage for a specific period, such as 10 or 20 years. It is generally not tax deductible in Australia, regardless of whether it is taken out for personal or business purposes.

- Whole of Life Insurance: Whole of life insurance provides coverage for your entire life. It typically includes a savings component, and premiums are often higher than term life insurance. In some cases, premiums for whole of life insurance may be tax deductible if the policy is taken out for business purposes.

- Endowment Insurance: Endowment insurance is a type of life insurance that provides a lump sum payment upon death or at the end of a specific term, whichever comes first. Premiums for endowment insurance may be tax deductible in some cases, but this depends on the specific policy and the purpose for which it was taken out.

Impact of Life Insurance Policies on Tax Deductibility

It is important to note that the tax deductibility of life insurance premiums can be complex and depends on a number of factors, including the type of policy, the purpose for which it was taken out, and your individual circumstances. If you are unsure whether or not you can claim a tax deduction for your life insurance premiums, it is best to seek advice from a qualified tax advisor.

Tax Deductible Life Insurance for Business Owners

Life insurance premiums can be tax-deductible for business owners in Australia, providing a valuable financial advantage. Understanding the specific types of policies, criteria, and requirements is crucial for maximizing tax benefits.

Types of Life Insurance Policies for Business Owners

Life insurance policies relevant to business owners fall into two main categories: key person insurance and business loan insurance.

- Key person insurance: This policy covers the financial losses a business might experience if a key employee, such as a founder, CEO, or highly skilled professional, passes away. The policy’s payout can help the business cover costs like replacing the employee, training a new employee, or maintaining operations.

- Business loan insurance: This type of insurance protects a business from financial strain if the owner or a key borrower dies while still owing money on a business loan. The insurance payout helps repay the outstanding loan, preventing financial hardship for the business.

Tax Deductibility Criteria

To claim a tax deduction for life insurance premiums, the Australian Taxation Office (ATO) requires that the premiums meet specific criteria:

- The insurance policy must be directly related to the business. This means the policy must be taken out to protect the business from financial losses resulting from the death of a key person or borrower.

- The policy must be held for business purposes. The insurance must be used to protect the business from financial risks, not for personal reasons.

- The premiums must be paid for a business purpose. This means the premiums must be paid from the business’s bank account and used to cover the costs of the insurance policy.

Requirements for Claiming Deductions

To claim a tax deduction for life insurance premiums, business owners must provide supporting documentation to the ATO. This includes:

- Policy documents: The insurance policy document, including the policy terms and conditions, must be kept as evidence of the insurance coverage.

- Premium receipts: Receipts for all premiums paid must be retained to show the costs incurred.

- Business records: Business records, such as financial statements and loan agreements, must be kept to demonstrate the business purpose of the insurance policy.

Examples of Tax Deductible Life Insurance Policies

| Policy Type | Tax Deductibility |

|—|—|

| Key Person Insurance for a small business owner | Tax Deductible |

| Business Loan Insurance for a loan taken out to purchase business equipment | Tax Deductible |

| Life Insurance policy taken out on a business partner to cover potential financial losses | Tax Deductible |

| Life Insurance policy taken out on a key employee to cover training costs for a replacement | Tax Deductible |

| Life Insurance policy taken out on a family member who is not involved in the business | Not Tax Deductible |

It’s essential to consult with a qualified financial advisor and tax professional to determine the specific tax deductibility of life insurance premiums for your business situation.

Tax Deductibility for Individuals

Generally, life insurance premiums are not tax deductible for individuals in Australia. This is because life insurance premiums are considered personal expenses and are not directly related to generating income. However, there are some exceptions to this rule, and individuals may be able to claim tax deductions on life insurance premiums in certain circumstances.

Situations Where Individuals Can Claim Tax Deductions

Individuals can potentially claim tax deductions on life insurance premiums if the policy is taken out for business purposes. For example, if an individual is self-employed and takes out a life insurance policy to protect their business in the event of their death, they may be able to claim the premiums as a business expense.

- Life insurance premiums taken out as part of a salary sacrifice arrangement. This means that the individual agrees to receive a lower salary in exchange for their employer paying the premiums on their behalf. In this case, the premiums are considered a fringe benefit and are generally tax deductible for the individual.

- Life insurance premiums paid by a superannuation fund. If an individual has a life insurance policy that is part of their superannuation fund, the premiums may be tax deductible. However, this will depend on the specific rules of the superannuation fund.

- Life insurance premiums paid by a trust. If an individual is a beneficiary of a trust that pays life insurance premiums, the premiums may be tax deductible for the trust. However, this will depend on the specific rules of the trust.

Potential Tax Benefits

While life insurance premiums are generally not tax deductible for individuals, there are some potential tax benefits associated with life insurance policies. For example, the death benefit paid out from a life insurance policy is generally tax-free for the beneficiary. This means that the beneficiary will not have to pay any tax on the money they receive from the policy. Additionally, if the policy is held within a superannuation fund, the death benefit may be tax-free for the beneficiary, depending on the specific rules of the superannuation fund.

Tax Deductibility of Different Types of Life Insurance Policies

| Type of Life Insurance Policy | Tax Deductibility |

|—|—|

| Term Life Insurance | Generally not tax deductible |

| Whole of Life Insurance | Generally not tax deductible |

| Endowment Life Insurance | Generally not tax deductible |

| Investment-Linked Life Insurance | Generally not tax deductible |

| Superannuation Life Insurance | May be tax deductible depending on the specific rules of the superannuation fund |

Considerations for Claiming Tax Deductions: Is Life Insurance Tax Deductible In Australia

It’s important to understand the requirements and implications of claiming tax deductions for life insurance premiums. Knowing these factors can help you ensure you are claiming correctly and avoiding potential penalties.

Documentation and Evidence

To successfully claim tax deductions for life insurance premiums, you must have proper documentation and evidence. This is crucial for supporting your claim and demonstrating that the premiums are eligible for a deduction.

- Policy Documents: Provide copies of your life insurance policy documents, including the policy contract, premium receipts, and any relevant clauses that specify the purpose of the insurance.

- Financial Statements: If you’re claiming deductions for business life insurance, you’ll need to provide your business’s financial statements. These documents help establish the relationship between the insurance and your business activities.

- Tax Advice: Seeking advice from a qualified tax professional is highly recommended. They can help you understand the specific requirements for claiming deductions and ensure you’re complying with all relevant tax laws.

Implications of Incorrect Claims

Claiming incorrect tax deductions can lead to significant consequences. The Australian Taxation Office (ATO) conducts regular audits and may investigate claims that seem inaccurate or unsupported.

- Penalties: If you’re found to have claimed incorrect deductions, the ATO may impose penalties. These penalties can include fines, interest charges, and even legal action.

- Audits: Incorrect claims can trigger an audit of your tax return, which can be a lengthy and stressful process.

- Reputational Damage: Incorrect claims can damage your reputation and make it difficult to obtain loans or other financial services in the future.

Claiming Tax Deductions

To claim tax deductions for life insurance premiums, follow these steps:

- Gather Documentation: Compile all necessary documentation, including your policy documents, financial statements, and tax advice.

- Identify Eligible Premiums: Determine which premiums qualify for deductions. This depends on your circumstances and the purpose of the insurance.

- Complete Your Tax Return: Use the relevant sections of your tax return to claim the deductions. Ensure you provide accurate information and supporting documentation.

- Keep Records: Maintain detailed records of your claims and supporting documents. These records will be helpful if the ATO requests them for verification.

Flowchart for Claiming Tax Deductions

[Flowchart Image Description: This flowchart begins with a “Start” box. It then branches into two paths: “Life Insurance for Business” and “Life Insurance for Personal Purposes.” The “Life Insurance for Business” path continues with a “Meet Deductibility Criteria” box. If yes, the path leads to a “Claim Deduction on Business Tax Return” box. If no, the path ends at a “Not Deductible” box. The “Life Insurance for Personal Purposes” path continues with a “Meet Deductibility Criteria” box. If yes, the path leads to a “Claim Deduction on Individual Tax Return” box. If no, the path ends at a “Not Deductible” box. Both paths then converge at a “End” box.]

Seeking Professional Advice

Navigating the complexities of life insurance tax deductibility can be challenging. Seeking professional advice from a qualified tax advisor or financial planner is crucial to ensure you maximize your tax benefits and make informed decisions.

Benefits of Seeking Professional Advice

Consulting with experts offers several advantages when it comes to understanding the tax deductibility of life insurance premiums. They can provide personalized guidance tailored to your specific circumstances, taking into account factors like your income, occupation, and financial goals. A professional can help you:

- Understand the intricate rules and regulations surrounding life insurance tax deductions.

- Identify eligible life insurance premiums for tax deductions.

- Determine the optimal strategy for claiming deductions to maximize your tax savings.

- Ensure compliance with tax laws and avoid potential penalties.

- Receive unbiased and expert advice on life insurance policies and their tax implications.

Scenarios Where Professional Advice Is Crucial

There are various scenarios where seeking professional advice is particularly important:

- Self-Employed Individuals: Tax deductions for life insurance premiums can be more complex for self-employed individuals, as the rules differ from those for employees. A tax advisor can guide you through the intricacies and ensure you claim all eligible deductions.

- Business Owners: Life insurance policies taken out by business owners often have unique tax implications. Consulting a professional can help you understand how to structure your policy to maximize tax benefits and minimize potential liabilities.

- High-Income Earners: Individuals with higher incomes may face more complex tax situations, especially when it comes to life insurance. A financial planner can assess your overall financial picture and recommend the most suitable life insurance strategies for tax optimization.

- Complex Family Structures: If you have a complex family structure, such as blended families or multiple dependents, the tax implications of life insurance can be intricate. A tax advisor can help you navigate these complexities and ensure you claim all eligible deductions.

- Significant Life Changes: Major life changes, such as marriage, divorce, or the birth of a child, can affect your tax situation and your need for life insurance. Seeking professional advice can help you adjust your life insurance coverage and ensure you claim all relevant tax deductions.

Questions to Ask a Tax Advisor or Financial Planner, Is life insurance tax deductible in australia

| Question | Explanation |

|---|---|

| What types of life insurance premiums are tax deductible in Australia? | This question helps you understand which specific life insurance policies qualify for tax deductions. |

| What documentation do I need to claim life insurance tax deductions? | Knowing the required documentation ensures you have all the necessary information to support your claim. |

| Are there any specific requirements or limitations for claiming life insurance tax deductions? | This question helps you understand any specific conditions or restrictions that may apply to claiming deductions. |

| What are the potential tax benefits of claiming life insurance tax deductions? | Understanding the potential tax savings can help you assess the financial benefits of claiming deductions. |

| What are the potential risks or consequences of claiming life insurance tax deductions incorrectly? | This question helps you understand the potential consequences of claiming deductions incorrectly, such as penalties or audits. |

Closing Notes

Navigating the world of life insurance and its tax implications can be complex, but with the right knowledge and guidance, you can make informed decisions that benefit your financial well-being. Remember, understanding the tax rules surrounding life insurance premiums can help you maximize your savings and ensure you’re compliant with Australian tax regulations. This guide provides a comprehensive overview of the topic, but it’s essential to consult with a qualified tax advisor or financial planner to receive personalized advice tailored to your specific circumstances.

Essential FAQs

What are the general rules regarding the deductibility of life insurance premiums in Australia?

Generally, life insurance premiums are not tax deductible for individuals. However, there are exceptions for business owners and specific types of life insurance policies.

Can I claim a tax deduction for life insurance premiums if I’m self-employed?

If you’re self-employed and your life insurance policy is taken out for business purposes, you may be able to claim a tax deduction for the premiums. It’s important to consult with a tax advisor to determine your eligibility.

What types of life insurance policies are eligible for tax deductions?

Some types of life insurance policies that may be eligible for tax deductions include business life insurance, key person insurance, and income protection insurance.

What documentation do I need to claim a tax deduction for life insurance premiums?

You’ll need to provide evidence of your life insurance premiums, such as policy statements or receipts, to support your claim for tax deductions.