- Life Insurance Premiums

- Death Benefits

- Types of Life Insurance

-

Tax Laws and Regulations: Is Life Insurance Taxable In Australia

- Taxation of Life Insurance Premiums

- Taxation of Death Benefits

- Taxation of Different Types of Life Insurance Policies

- Taxation of Life Insurance Proceeds

- Taxation of Life Insurance Surrenders

- Taxation of Life Insurance Bonuses

- Taxation of Life Insurance Claims

- Taxation of Life Insurance Trust

- Taxation of Life Insurance Advice

- Tax Planning Considerations

- Last Point

- Clarifying Questions

Is life insurance taxable in Australia? This question often arises when individuals consider purchasing life insurance or receive a death benefit. Understanding the tax implications of life insurance is crucial for both individuals and businesses, as it can significantly impact financial planning and estate administration.

Australia’s tax laws regarding life insurance are complex, with various factors determining the taxability of premiums, death benefits, and policy types. This guide aims to provide a comprehensive overview of the tax treatment of life insurance in Australia, covering key aspects such as premium deductibility, death benefit taxation, and tax planning considerations.

Life Insurance Premiums

Life insurance premiums are the regular payments you make to your insurer in exchange for the coverage provided by your policy. The tax implications of these premiums can vary depending on the type of policy and your circumstances.

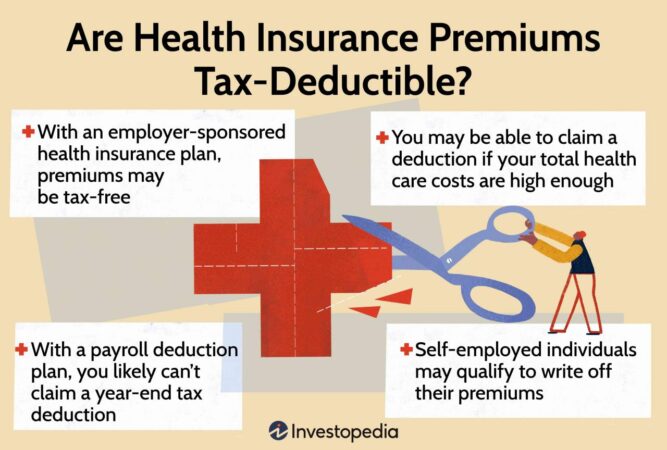

Tax Deductibility of Life Insurance Premiums

Generally, life insurance premiums are not tax deductible for individuals. However, there are some exceptions. For example, if you are self-employed and you take out a life insurance policy to cover your business debts, the premiums may be tax deductible as a business expense.

- Self-employed individuals: If you are self-employed and take out a life insurance policy to cover your business debts, the premiums may be tax deductible as a business expense. This is because the policy is seen as a way to protect your business from financial hardship in the event of your death.

- Businesses: Businesses can generally deduct life insurance premiums for key employees as a business expense. This is because the policy is seen as a way to protect the business from the financial impact of losing a key employee.

- Superannuation funds: Life insurance premiums paid by superannuation funds are generally not tax deductible. However, there are some exceptions, such as when the premiums are paid for a policy that provides death benefits to members of the fund.

Examples of Tax Deductible Life Insurance Premiums

Here are some examples of situations where life insurance premiums might be tax deductible:

- A sole trader takes out a life insurance policy to cover their business loan. The premiums may be tax deductible as a business expense because the policy is protecting the business from financial hardship in the event of the sole trader’s death.

- A company takes out a life insurance policy on its CEO. The premiums may be tax deductible as a business expense because the policy is protecting the company from the financial impact of losing its CEO.

It’s important to note that the tax deductibility of life insurance premiums can be complex and depends on individual circumstances. It’s always best to seek professional advice from a qualified tax advisor to determine the tax implications of your specific situation.

Death Benefits

The tax treatment of life insurance death benefits in Australia is generally favorable. In most cases, beneficiaries do not have to pay tax on the money they receive.

Tax-Free Death Benefits, Is life insurance taxable in australia

The Australian Taxation Office (ATO) considers death benefits to be non-assessable income, meaning they are not subject to income tax. This applies to the following situations:

- Death benefits paid to a beneficiary named in the life insurance policy.

- Death benefits paid to a dependant of the deceased person.

- Death benefits paid to a trustee for the benefit of a dependant of the deceased person.

This means that if you are a beneficiary of a life insurance policy, you will generally not have to pay tax on the death benefit you receive.

Taxable Death Benefits

While death benefits are typically tax-free, there are some exceptions where they may be subject to income tax.

- Death benefits paid to a non-dependant: If the death benefit is paid to someone who is not a dependant of the deceased, it may be considered assessable income. For example, if a death benefit is paid to a business partner or a friend, it may be taxed as income.

- Death benefits used for business purposes: If a death benefit is used for business purposes, it may be considered assessable income. For example, if a death benefit is used to purchase a business asset, the profit from the sale of that asset may be taxed.

- Death benefits paid to a superannuation fund: If a death benefit is paid to a superannuation fund, it may be subject to tax depending on the fund’s rules and the deceased’s tax status.

It is important to note that these are just general guidelines. The tax treatment of death benefits can be complex, and it is always best to seek professional advice from a tax advisor or financial planner.

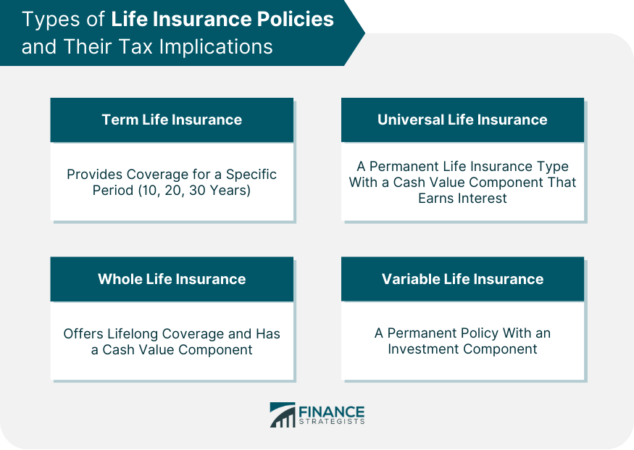

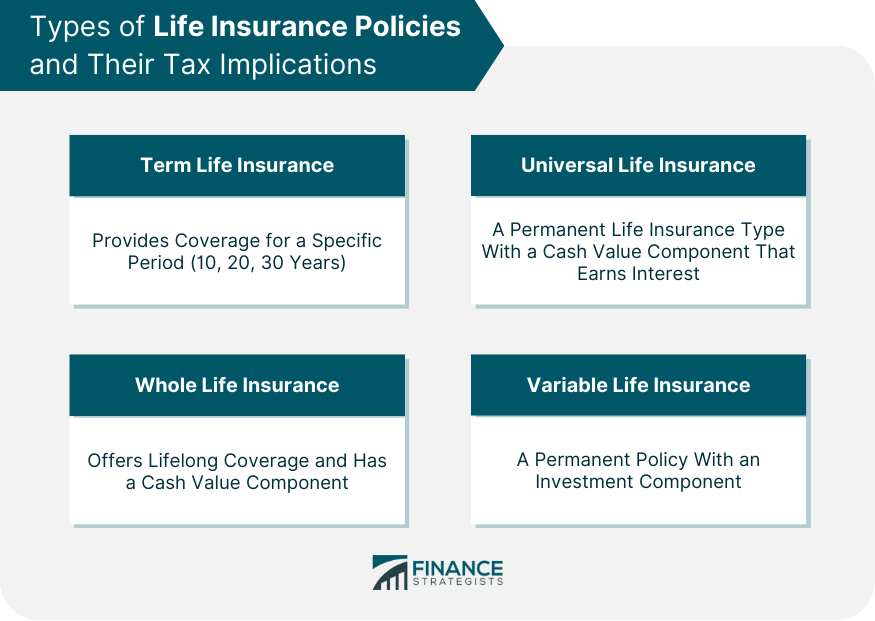

Types of Life Insurance

In Australia, different types of life insurance policies come with varying tax implications. Understanding these differences is crucial for making informed decisions about your life insurance needs. This section delves into the tax treatment of common life insurance types in Australia, focusing on term life insurance, whole life insurance, and endowment policies.

Tax Implications of Different Life Insurance Types

The tax treatment of life insurance policies in Australia largely depends on the type of policy and its specific features.

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically 10 to 30 years. It is generally considered a pure protection policy, meaning it offers death benefits but doesn’t build up cash value. Premiums paid for term life insurance are not tax-deductible. However, death benefits received are generally tax-free in Australia, provided the policy meets certain conditions, such as being taken out for genuine financial protection purposes.

- Whole Life Insurance: Whole life insurance offers lifelong coverage, unlike term life insurance. It also includes an investment component, which allows the policyholder to build up cash value over time. Premiums paid for whole life insurance are not tax-deductible. However, death benefits received are generally tax-free, similar to term life insurance. The cash value component of a whole life insurance policy can be accessed by the policyholder through withdrawals or loans. Withdrawals from the cash value component are generally taxed as ordinary income. However, loans taken against the cash value are not taxed until the policy is surrendered or the policyholder dies.

- Endowment Policies: Endowment policies combine life insurance coverage with a savings element. They offer a lump sum payout at the end of a predetermined term, whether the policyholder is alive or not. Premiums paid for endowment policies are not tax-deductible. However, death benefits received are generally tax-free. The savings element of an endowment policy can be accessed through withdrawals or loans. Withdrawals from the savings element are generally taxed as ordinary income. Loans taken against the savings element are not taxed until the policy is surrendered or the policyholder dies.

Tax Treatment of Investment Components in Life Insurance

Life insurance policies with investment components, such as whole life insurance and endowment policies, can offer the potential for tax-deferred growth. However, it’s important to understand the tax implications of these investment components.

- Cash Value: Cash value is the accumulated value of the investment component in a whole life insurance policy. It grows tax-deferred, meaning that interest and dividends earned on the cash value are not taxed until they are withdrawn or the policy is surrendered. Withdrawals from the cash value component are generally taxed as ordinary income.

- Investment Funds: Some life insurance policies allow policyholders to invest in a range of investment funds. The growth of these funds is generally tax-deferred until the funds are withdrawn or the policy is surrendered. Withdrawals from investment funds are generally taxed as capital gains. Capital gains tax rates in Australia vary depending on the length of time the funds have been held.

Tax Laws and Regulations: Is Life Insurance Taxable In Australia

In Australia, the taxation of life insurance is governed by a combination of legislation and rulings from the Australian Taxation Office (ATO). Understanding these laws is crucial for individuals and businesses involved in life insurance, as they impact the tax treatment of premiums, death benefits, and policy types.

Taxation of Life Insurance Premiums

Life insurance premiums are generally not tax-deductible. This means that you cannot claim a tax deduction for the premiums you pay on your life insurance policy. However, there are some exceptions to this rule. For example, if you are self-employed and you take out a life insurance policy to cover business debts, you may be able to claim a tax deduction for the premiums.

Taxation of Death Benefits

Death benefits paid out from life insurance policies are generally tax-free in the hands of the beneficiary. This means that the beneficiary does not have to pay any tax on the death benefit they receive. However, there are some exceptions to this rule. For example, if the death benefit is paid to a company, it may be subject to company tax.

Taxation of Different Types of Life Insurance Policies

The tax treatment of life insurance policies can vary depending on the type of policy. For example, the following table Artikels the tax treatment of some common types of life insurance policies:

| Policy Type | Premiums | Death Benefits |

|---|---|---|

| Term Life Insurance | Not tax-deductible | Tax-free |

| Whole of Life Insurance | Not tax-deductible | Tax-free |

| Endowment Policy | Not tax-deductible | Tax-free |

| Superannuation Death Benefit | Not tax-deductible | Tax-free |

Taxation of Life Insurance Proceeds

The tax treatment of life insurance proceeds depends on whether the proceeds are received by an individual or a company.

Individuals

Life insurance proceeds received by individuals are generally tax-free. This is because the proceeds are considered to be a personal gift and are not subject to income tax.

Companies

Life insurance proceeds received by companies are generally subject to company tax. This is because the proceeds are considered to be a business asset and are subject to the company’s income tax rate.

Taxation of Life Insurance Surrenders

If you surrender a life insurance policy, you may receive a surrender value. The surrender value is the amount of money you receive when you cancel the policy. The surrender value is generally taxed as income.

Taxation of Life Insurance Bonuses

Life insurance policies may accrue bonuses over time. Bonuses are additional amounts of money that are added to the policy’s value. Bonuses are generally taxed as income.

Taxation of Life Insurance Claims

Life insurance claims are generally tax-free. This is because the claims are considered to be a personal gift and are not subject to income tax.

Taxation of Life Insurance Trust

A life insurance trust is a legal structure that can be used to hold a life insurance policy. The trust can be used to distribute the proceeds of the policy to beneficiaries in a tax-efficient way.

Taxation of Life Insurance Advice

Life insurance advice is generally not subject to Goods and Services Tax (GST). However, there are some exceptions to this rule. For example, if the advice is provided as part of a financial planning service, it may be subject to GST.

Tax Planning Considerations

Life insurance in Australia can be a valuable tool for financial planning, but it’s crucial to consider the tax implications to ensure you’re maximizing its benefits. Understanding the tax rules surrounding life insurance can help you minimize your tax liabilities and optimize your financial strategy.

Strategies for Minimizing Tax Liabilities

Minimizing tax liabilities associated with life insurance requires a comprehensive approach, considering various aspects of the policy and your overall financial situation. Here are some key strategies to explore:

- Choose the Right Type of Policy: Different types of life insurance policies have varying tax implications. For instance, a term life insurance policy generally doesn’t generate taxable income for the beneficiary, while a whole-of-life policy may produce taxable investment gains. Careful consideration of your needs and financial goals is essential when selecting a policy.

- Utilize Superannuation: If you’re considering life insurance as part of your superannuation plan, the death benefits received by your beneficiaries may be tax-free. However, contributions to your superannuation may be subject to tax depending on your income level.

- Structure the Policy Strategically: Depending on your circumstances, structuring your life insurance policy as a trust can help minimize tax liabilities for your beneficiaries. Consult with a financial advisor to determine the most suitable structure for your situation.

- Consider a Family Trust: Setting up a family trust can offer tax advantages for life insurance proceeds, potentially reducing the tax burden on your beneficiaries.

- Utilize Tax-Free Thresholds: The Australian government provides a tax-free threshold for certain life insurance payments. Understanding these thresholds can help you minimize the amount of tax you pay.

Common Tax Planning Tips

- Seek Professional Advice: Consulting with a qualified financial advisor or tax specialist can provide tailored advice specific to your individual needs and circumstances.

- Keep Accurate Records: Maintaining detailed records of your life insurance policies, premiums paid, and any related expenses is crucial for tax purposes.

- Review Your Policy Regularly: Periodically review your life insurance policy to ensure it aligns with your current financial goals and tax situation.

- Stay Updated on Tax Laws: Tax laws in Australia are subject to change. Staying informed about the latest updates and regulations is vital to avoid potential tax penalties.

Last Point

Navigating the tax implications of life insurance in Australia can be challenging, but understanding the key aspects discussed above can help individuals and businesses make informed decisions. It’s crucial to consult with a qualified financial advisor or tax professional to determine the specific tax treatment of your life insurance policies and ensure compliance with Australian tax laws.

Clarifying Questions

Can I claim life insurance premiums as a tax deduction?

In some cases, you may be able to claim life insurance premiums as a tax deduction, particularly if the insurance is related to your business or employment. Consult with a tax professional for specific advice.

What are the tax implications of receiving a life insurance death benefit?

Generally, life insurance death benefits are not taxable in Australia. However, there are exceptions, such as if the policy was taken out for investment purposes or if the beneficiary is a company. Seek professional advice for your specific situation.

Are there different tax implications for different types of life insurance policies?

Yes, the tax treatment can vary depending on the type of life insurance policy, such as term life insurance, whole life insurance, or endowment policies. It’s important to understand the specific tax implications of your policy.