- Overview of the Australian Insurance Market

- Top Insurance Companies in Australia

- Market Share and Competitive Landscape

- Financial Performance and Trends

- Customer Experience and Service

- Technological Advancements and Innovation

- Social Responsibility and Sustainability

- Future Outlook and Trends

- Summary

- FAQ Overview: Largest Insurance Companies In Australia

The largest insurance companies in Australia play a crucial role in providing financial security to individuals and businesses across the nation. From general insurance to life and health coverage, these companies offer a wide range of products and services to meet diverse needs. This comprehensive overview delves into the Australian insurance market, examining the key players, their market share, financial performance, and the future outlook for the industry.

The Australian insurance market is a complex and dynamic landscape, characterized by a diverse range of providers and a strong regulatory framework. This overview will explore the major insurance segments, including general insurance, life insurance, and health insurance, and discuss the key regulatory bodies that govern the industry. We will also analyze the competitive landscape, highlighting the strategies employed by leading insurance companies to maintain their market dominance.

Overview of the Australian Insurance Market

The Australian insurance market is a significant sector of the country’s economy, providing essential financial protection to individuals and businesses against a wide range of risks. It encompasses various insurance products that cater to diverse needs, including general insurance, life insurance, and health insurance.

General Insurance

General insurance covers a broad range of risks that individuals and businesses face, including property damage, liability, and accidents. Key segments within general insurance include:

- Home insurance: Protects homeowners against damage to their property and possessions from events such as fire, theft, and natural disasters.

- Motor vehicle insurance: Covers damage to vehicles, injuries to drivers and passengers, and liability for accidents.

- Business insurance: Provides coverage for businesses against various risks, such as property damage, business interruption, and liability.

- Travel insurance: Offers protection against unexpected events during travel, such as medical emergencies, flight cancellations, and lost luggage.

Life Insurance

Life insurance provides financial protection to beneficiaries upon the death of the insured individual. Key types of life insurance include:

- Term life insurance: Provides coverage for a specific period, typically 10 to 30 years. It is generally more affordable than permanent life insurance.

- Whole life insurance: Provides lifetime coverage and includes a savings component. It is typically more expensive than term life insurance.

- Universal life insurance: Offers flexible premiums and death benefits, allowing policyholders to adjust their coverage needs over time.

Health Insurance

Health insurance provides financial protection for medical expenses, offering access to private healthcare services. Key types of health insurance include:

- Hospital cover: Covers the costs of hospital treatment, including surgery, accommodation, and medical care.

- Extras cover: Covers the costs of non-hospital medical expenses, such as dental, physiotherapy, and optical care.

- Combined cover: Offers both hospital and extras cover in a single policy.

Regulatory Bodies

The Australian insurance industry is regulated by several bodies, ensuring consumer protection and industry stability. Key regulatory bodies include:

- Australian Prudential Regulation Authority (APRA): Oversees the prudential regulation of insurance companies, ensuring their financial stability and solvency.

- Australian Securities and Investments Commission (ASIC): Regulates the financial products and services offered by insurance companies, ensuring fair and ethical conduct.

- Australian Competition and Consumer Commission (ACCC): Promotes competition and fair trading within the insurance industry, addressing issues related to price gouging and misleading advertising.

Top Insurance Companies in Australia

The Australian insurance industry is a significant contributor to the country’s economy, with a wide range of insurance products and services available to individuals and businesses. This section delves into the prominent players in the Australian insurance landscape, providing insights into their operations and contributions.

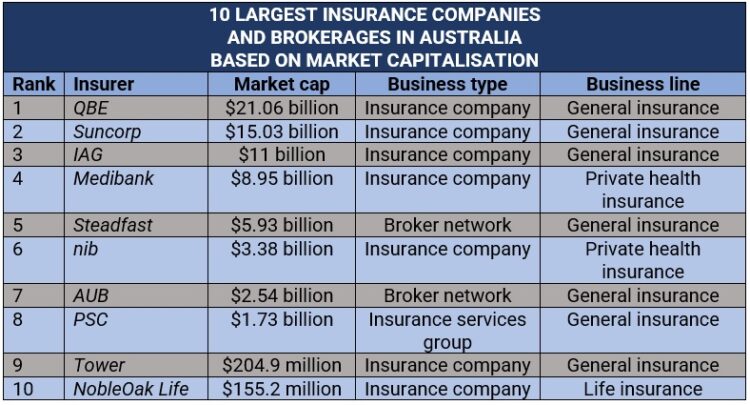

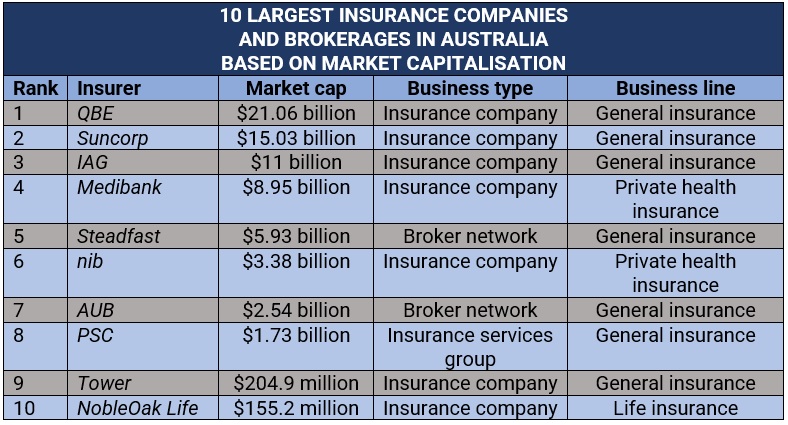

Top 10 Largest Insurance Companies in Australia

This table showcases the top 10 largest insurance companies in Australia based on their market capitalization or revenue, offering a glimpse into their size, reach, and influence within the industry.

| Company Name | Headquarters Location | Key Insurance Products | Notable Achievements |

|---|---|---|---|

| Suncorp Group | Brisbane, Queensland | General insurance (home, car, business), life insurance | Largest general insurer in Australia, known for its strong brand recognition and diverse product offerings. |

| QBE Insurance Group | Sydney, New South Wales | General insurance (commercial, industrial, personal), reinsurance | Global insurance provider with a strong presence in Australia, known for its risk management expertise. |

| IAG | Sydney, New South Wales | General insurance (home, car, business), life insurance | One of the largest insurers in Australia, known for its comprehensive insurance solutions. |

| AMP Limited | Sydney, New South Wales | Life insurance, superannuation, investment products | Leading provider of financial services in Australia, known for its long history and diversified offerings. |

| Medibank Private | Melbourne, Victoria | Private health insurance | Largest private health insurer in Australia, known for its wide range of health insurance plans. |

| AIA Australia | Sydney, New South Wales | Life insurance, health insurance, investment products | Part of the AIA Group, a leading pan-Asian life insurance company, known for its innovative products and services. |

| TAL | Sydney, New South Wales | Life insurance, income protection | Specialized in life insurance and income protection, known for its focus on providing financial security. |

| NIB Holdings | Sydney, New South Wales | Private health insurance | Leading provider of private health insurance in Australia, known for its focus on customer service. |

| HCF | Sydney, New South Wales | Private health insurance | Non-profit health insurer, known for its commitment to providing affordable and accessible health insurance. |

| Australian Unity | Melbourne, Victoria | Life insurance, health insurance, superannuation | Mutually owned financial services provider, known for its focus on community and member benefits. |

Market Share and Competitive Landscape

The Australian insurance market is a dynamic landscape, with several key players vying for dominance. This section will explore the distribution of market share amongst the top insurance companies, identify key competitors, and analyze their strategies for market dominance. We will also delve into the competitive advantages and challenges faced by these companies.

Market Share Distribution

The Australian insurance market is dominated by a handful of large players, with the top five companies accounting for a significant share of the market. These companies are:

- Suncorp Group

- IAG (Insurance Australia Group)

- QBE Insurance Group

- AIA Australia

- AMP Limited

These companies compete across a range of insurance products, including general insurance, life insurance, and health insurance. The market share distribution can fluctuate depending on factors such as economic conditions, regulatory changes, and consumer preferences.

Key Competitors and Market Dominance Strategies

The top insurance companies in Australia employ a range of strategies to achieve market dominance, including:

- Product Innovation: Companies are constantly developing new products and services to meet evolving customer needs. For example, Suncorp has introduced innovative products like its “Drive Safe” program, which rewards safe driving habits with discounts.

- Distribution Channels: Companies are expanding their distribution channels to reach a wider customer base. This includes online platforms, mobile apps, and partnerships with brokers and financial advisors.

- Brand Building: Companies invest heavily in branding and marketing to build strong customer loyalty and recognition. IAG, for instance, has established a strong brand presence through its various subsidiaries, such as NRMA, CGU, and Swann.

- Mergers and Acquisitions: Companies are actively pursuing mergers and acquisitions to expand their market share and product offerings. For example, QBE has made several acquisitions in recent years to strengthen its presence in key markets.

Competitive Advantages and Challenges

The Australian insurance market is highly competitive, with companies facing various challenges, including:

- Regulatory Environment: The Australian insurance industry is subject to stringent regulations, which can impact profitability and innovation.

- Economic Conditions: Economic downturns can lead to reduced insurance premiums and claims, impacting company revenues.

- Natural Disasters: Australia is prone to natural disasters such as bushfires and floods, which can result in significant claims payouts for insurance companies.

- Competition from New Entrants: The emergence of new players, particularly in the online insurance space, is increasing competition in the market.

The top insurance companies have developed various competitive advantages to navigate these challenges, including:

- Strong Financial Position: Companies with strong financial reserves are better positioned to withstand economic downturns and natural disasters.

- Sophisticated Risk Management: Effective risk management strategies are crucial for managing claims and minimizing losses.

- Technology and Innovation: Companies are investing in technology to improve efficiency, customer service, and product development.

- Brand Recognition and Trust: Established companies benefit from strong brand recognition and customer trust, which can be difficult for new entrants to overcome.

Financial Performance and Trends

The Australian insurance market is characterized by a mix of large, established players and smaller, niche insurers. These companies operate in a highly competitive landscape, facing pressures from regulatory changes, technological advancements, and evolving customer expectations. Understanding the financial performance of these insurers is crucial for assessing their market position, growth potential, and ability to navigate industry challenges.

Revenue Growth and Profitability

The financial performance of Australian insurance companies is influenced by a number of factors, including premium growth, claims experience, investment returns, and operating expenses. In recent years, the industry has experienced steady revenue growth, driven by factors such as population growth, rising asset values, and increased awareness of insurance products. However, profitability has been more volatile, impacted by factors such as natural disasters, regulatory changes, and competition.

- Premium Growth: The insurance industry has seen consistent premium growth in recent years, driven by factors such as population growth, rising asset values, and increased awareness of insurance products. For example, the Australian Prudential Regulation Authority (APRA) reported that total gross written premiums for general insurance in Australia increased by 4.4% in 2022. This growth is expected to continue in the coming years, driven by factors such as increasing urbanization, rising household incomes, and the growing adoption of digital insurance products.

- Claims Experience: Claims experience is a significant driver of profitability for insurers. Natural disasters, such as bushfires and floods, can have a significant impact on claims costs. In recent years, Australia has experienced a number of severe natural disasters, which have put pressure on insurers’ profitability. However, insurers have also been able to manage their claims costs through improved risk management practices and the use of technology.

- Investment Returns: Investment returns are another important source of revenue for insurers. Insurers invest premiums collected from policyholders in a variety of assets, such as bonds, equities, and property. The returns on these investments can have a significant impact on profitability. In recent years, interest rates have been low, which has put pressure on insurers’ investment returns. However, insurers have been able to offset this by investing in alternative assets, such as infrastructure and private equity.

- Operating Expenses: Operating expenses, such as salaries, marketing, and technology, can also impact profitability. Insurers are under pressure to reduce operating expenses, particularly in a competitive market. They are doing this by streamlining operations, automating processes, and adopting new technologies. For example, the use of artificial intelligence (AI) is becoming increasingly common in the insurance industry, as insurers look to automate tasks such as claims processing and fraud detection.

Key Financial Ratios and Metrics

Financial ratios and metrics provide insights into the financial health and performance of insurance companies.

- Combined Ratio: The combined ratio is a key measure of profitability for insurers. It is calculated as the sum of the loss ratio and the expense ratio. The loss ratio represents the percentage of premiums paid out in claims, while the expense ratio represents the percentage of premiums spent on operating expenses. A combined ratio below 100% indicates that an insurer is profitable, while a ratio above 100% indicates that the insurer is losing money. For example, a combined ratio of 95% means that for every $100 in premiums collected, the insurer paid out $95 in claims and expenses, leaving $5 in profit.

- Return on Equity (ROE): ROE measures the profitability of a company relative to its shareholders’ equity. It is calculated as net income divided by shareholders’ equity. A higher ROE indicates that a company is generating a higher return on its investments. For example, an ROE of 15% means that for every $100 of shareholders’ equity, the company generated $15 in net income.

- Solvency Ratio: The solvency ratio measures an insurer’s ability to meet its financial obligations. It is calculated as the insurer’s capital and surplus divided by its liabilities. A higher solvency ratio indicates that an insurer has a stronger financial position and is less likely to face financial distress. For example, a solvency ratio of 200% means that the insurer has $2 in capital and surplus for every $1 in liabilities.

Emerging Trends and their Impact on Financial Performance

The Australian insurance industry is undergoing a period of significant change, driven by factors such as technological advancements, regulatory changes, and evolving customer expectations. These trends are having a profound impact on the financial performance of insurance companies.

- Digital Transformation: The insurance industry is increasingly embracing digital technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT). These technologies are enabling insurers to automate processes, improve customer experiences, and develop new products and services. For example, AI is being used to automate claims processing, fraud detection, and risk assessment. Blockchain is being used to create secure and transparent record-keeping systems. And the IoT is being used to collect data on customer behavior and assets, which can be used to improve risk management and pricing.

- Insurtech: The emergence of insurtech companies, which are using technology to disrupt the traditional insurance industry, is another key trend. Insurtech companies are offering innovative products and services, such as on-demand insurance, micro-insurance, and personalized insurance. They are also using technology to streamline operations and reduce costs. This competition from insurtech companies is putting pressure on traditional insurers to innovate and adapt. Insurers are responding by investing in technology, developing new products and services, and partnering with insurtech companies.

- Climate Change: Climate change is having a significant impact on the insurance industry, as it is leading to more frequent and severe natural disasters. This is increasing claims costs and making it more difficult for insurers to price risk. Insurers are responding to climate change by developing new products and services that address climate risks, such as flood insurance and climate-resilient building standards. They are also advocating for government policies that promote climate change mitigation and adaptation.

Customer Experience and Service

In the highly competitive Australian insurance market, customer experience and service are crucial differentiators for insurance companies. A positive customer experience can lead to increased customer loyalty, retention, and positive word-of-mouth referrals. Conversely, negative experiences can result in customer churn and reputational damage.

Customer Satisfaction Ratings and Reviews

Customer satisfaction ratings and reviews provide valuable insights into the performance of insurance companies. These ratings are often based on factors such as ease of claims processing, communication, responsiveness, and overall customer support. Several independent organizations, such as Roy Morgan and Canstar, conduct regular surveys and publish customer satisfaction ratings for various insurance products and services. These ratings can be used by consumers to compare different insurance companies and make informed decisions.

- Roy Morgan: Roy Morgan’s Customer Satisfaction ratings are based on regular surveys of Australian consumers, covering a wide range of industries, including insurance. The ratings are based on a scale of 0 to 100, with higher scores indicating greater customer satisfaction.

- Canstar: Canstar is a leading financial comparison website that provides independent ratings and reviews for various financial products and services, including insurance. Canstar’s insurance ratings are based on a star rating system, with five stars being the highest.

Best Practices and Innovative Approaches to Customer Service

Insurance companies are increasingly adopting best practices and innovative approaches to enhance customer service. These include:

- Digital Transformation: Insurance companies are leveraging digital technologies to provide seamless and convenient customer experiences. This includes online portals, mobile apps, and chatbots for policy management, claims filing, and customer support.

- Personalized Customer Service: Using data analytics, insurance companies can personalize customer interactions and provide tailored solutions based on individual needs and preferences. This includes offering customized policies, targeted communication, and proactive support.

- Customer-Centric Culture: Building a customer-centric culture within the organization is essential for delivering exceptional customer service. This involves empowering employees to resolve customer issues quickly and efficiently, fostering a culture of empathy and understanding, and providing ongoing training and development opportunities.

Technological Advancements and Innovation

The Australian insurance industry is undergoing a rapid transformation driven by technological advancements. Digitalization, artificial intelligence (AI), and data analytics are revolutionizing how insurance companies operate and interact with their customers.

Impact of Digitalization

Digitalization has significantly reshaped the insurance landscape in Australia. Insurance companies are increasingly adopting digital platforms and tools to streamline their operations, enhance customer experiences, and develop innovative products and services.

- Online Insurance Sales: Digital platforms have made it easier for customers to purchase insurance policies online, eliminating the need for physical interactions. This has led to increased convenience and accessibility for customers, as well as cost savings for insurers.

- Automated Underwriting: AI-powered underwriting systems are being used to automate the process of assessing risk and determining premiums. This improves efficiency and accuracy, reducing the time it takes to process applications and providing more personalized pricing.

- Digital Claims Management: Insurance companies are leveraging digital tools to streamline the claims process, enabling customers to report claims online, track their progress, and receive faster payouts. This enhances customer satisfaction and reduces processing costs.

Artificial Intelligence in Insurance

AI is playing a growing role in the insurance industry, enabling insurers to analyze large datasets, automate processes, and personalize customer interactions.

- Risk Assessment: AI algorithms can analyze vast amounts of data to identify patterns and predict potential risks. This helps insurers develop more accurate pricing models and make better decisions about underwriting.

- Fraud Detection: AI can be used to detect fraudulent claims by identifying anomalies in data patterns. This helps insurers reduce losses and protect their bottom line.

- Personalized Customer Experiences: AI-powered chatbots and virtual assistants are being used to provide 24/7 customer support, answer questions, and assist with policy management. This allows insurers to offer more personalized and efficient customer service.

Data Analytics and Insights

Data analytics is crucial for insurers to understand customer behavior, identify trends, and develop innovative products and services.

- Customer Segmentation: Insurance companies can use data analytics to segment their customer base into different groups based on factors such as age, location, and risk profile. This allows them to develop targeted marketing campaigns and offer more personalized insurance products.

- Product Development: Data analytics can help insurers identify emerging trends and customer needs, enabling them to develop new products and services that meet those needs.

- Risk Management: By analyzing data on past claims and other relevant factors, insurers can identify areas where they can improve risk management practices and reduce losses.

Examples of Innovative Insurance Products and Services

Technology is driving the development of innovative insurance products and services, such as:

- Usage-Based Insurance: This type of insurance uses telematics data to track driving behavior and adjust premiums based on actual driving habits. This allows drivers who are safe and responsible to pay lower premiums.

- On-Demand Insurance: This allows customers to purchase insurance for specific periods or activities, such as short-term rentals or weekend trips. This provides flexibility and affordability for customers who need insurance only occasionally.

- Wearable Technology: Some insurers are offering discounts to customers who wear fitness trackers or other wearable devices, as this data can be used to assess their health and lifestyle choices.

Social Responsibility and Sustainability

Australia’s largest insurance companies are increasingly recognizing their role in promoting social responsibility and environmental sustainability. These companies are not only committed to providing financial protection but also to contributing to the well-being of their customers and communities.

Social Responsibility Initiatives

The largest insurance companies in Australia are actively engaged in various social responsibility initiatives. They are committed to promoting financial inclusion, supporting vulnerable communities, and contributing to social causes.

- Supporting Vulnerable Communities: Many companies are involved in programs that provide financial assistance and support to individuals and families facing hardship. For example, Suncorp Group has partnered with various charities to provide disaster relief and support to communities affected by natural disasters.

- Promoting Financial Literacy: Several insurance companies are running programs to educate the public about financial planning and insurance. For instance, Allianz Australia has developed online resources and workshops to help customers understand insurance products and make informed decisions.

- Diversity and Inclusion: The insurance industry is increasingly recognizing the importance of diversity and inclusion in the workplace. Companies are implementing initiatives to promote equal opportunities and create a more inclusive work environment. For example, QBE Insurance has set targets for gender diversity in leadership positions.

Environmental Sustainability Practices

The insurance industry is facing increasing pressure to address environmental sustainability concerns. Many Australian insurance companies have implemented initiatives to reduce their carbon footprint and promote sustainable practices.

- Reducing Operational Emissions: Companies are taking steps to reduce their energy consumption and greenhouse gas emissions. For example, IAG has set targets to reduce its operational emissions by 50% by 2030.

- Investing in Renewable Energy: Some insurance companies are investing in renewable energy projects to reduce their reliance on fossil fuels. For example, Suncorp Group has invested in solar farms to generate clean energy.

- Promoting Sustainable Investments: Several insurance companies are incorporating environmental, social, and governance (ESG) factors into their investment decisions. For example, AMP has committed to investing in companies that are committed to sustainable practices.

Future Outlook and Trends

The Australian insurance industry is poised for significant transformation in the coming years, driven by evolving customer expectations, technological advancements, and a changing regulatory landscape.

Key Trends and Challenges, Largest insurance companies in australia

The industry will face a number of key trends and challenges that will shape its future.

- Increased competition: The insurance market is becoming increasingly competitive, with the emergence of new players and the growth of digital insurers. This will put pressure on traditional insurers to innovate and offer more competitive products and services.

- Changing customer expectations: Consumers are becoming more demanding and tech-savvy, expecting personalized experiences, instant gratification, and seamless digital interactions. Insurers will need to adapt to these expectations to remain competitive.

- Technological advancements: The rapid pace of technological advancement is transforming the insurance industry. Insurers are using data analytics, artificial intelligence (AI), and other technologies to improve efficiency, personalize customer experiences, and develop new products and services.

- Regulatory changes: The regulatory landscape is evolving, with new rules and regulations being introduced to address issues such as climate change, cyber security, and data privacy. Insurers will need to adapt to these changes to ensure compliance and maintain their licenses.

- Economic uncertainty: The global economy is facing a period of uncertainty, with rising inflation and interest rates. This could impact insurance premiums and claims, as well as the overall profitability of the industry.

Opportunities for Growth and Innovation

Despite the challenges, the Australian insurance industry has significant opportunities for growth and innovation.

- Growth in niche markets: There is increasing demand for specialized insurance products, such as cyber insurance, pet insurance, and travel insurance. Insurers can capitalize on this growth by developing innovative products and services tailored to specific customer needs.

- Digital transformation: Insurers can leverage digital technologies to improve efficiency, enhance customer experiences, and develop new products and services. For example, they can use AI-powered chatbots to provide 24/7 customer support, or use data analytics to identify and mitigate risks.

- Sustainable insurance: There is growing demand for sustainable insurance products that address environmental and social issues. Insurers can develop products that promote green initiatives, such as renewable energy insurance, or that offer discounts for environmentally friendly practices.

Summary

As the Australian insurance industry continues to evolve, the largest insurance companies are at the forefront of innovation, leveraging technology and data analytics to enhance customer experience and develop new products and services. By embracing social responsibility and sustainability initiatives, these companies are also demonstrating their commitment to the well-being of their customers and communities. This comprehensive overview provides valuable insights into the Australian insurance market, highlighting the key players, their strategies, and the future outlook for the industry.

FAQ Overview: Largest Insurance Companies In Australia

What are the main types of insurance offered in Australia?

The main types of insurance offered in Australia include general insurance (covering property, motor vehicles, and liability), life insurance (covering death and critical illness), and health insurance (covering medical expenses).

How do I choose the right insurance company for my needs?

It’s important to compare quotes from different insurance companies, consider the coverage options, and read reviews before making a decision. You should also ensure that the company is reputable and financially sound.

What are the key factors driving growth in the Australian insurance market?

Key factors driving growth in the Australian insurance market include population growth, rising disposable incomes, increasing awareness of insurance benefits, and technological advancements that are improving efficiency and customer experience.