- Understanding Term Life Insurance

- Benefits of Term Life Insurance

- Factors to Consider When Choosing Term Life Insurance

- How to Apply for Term Life Insurance: Term Life Insurance In Australia

- Understanding the Cost of Term Life Insurance

- Common Questions about Term Life Insurance

- Term Life Insurance and Estate Planning

- Final Wrap-Up

- Clarifying Questions

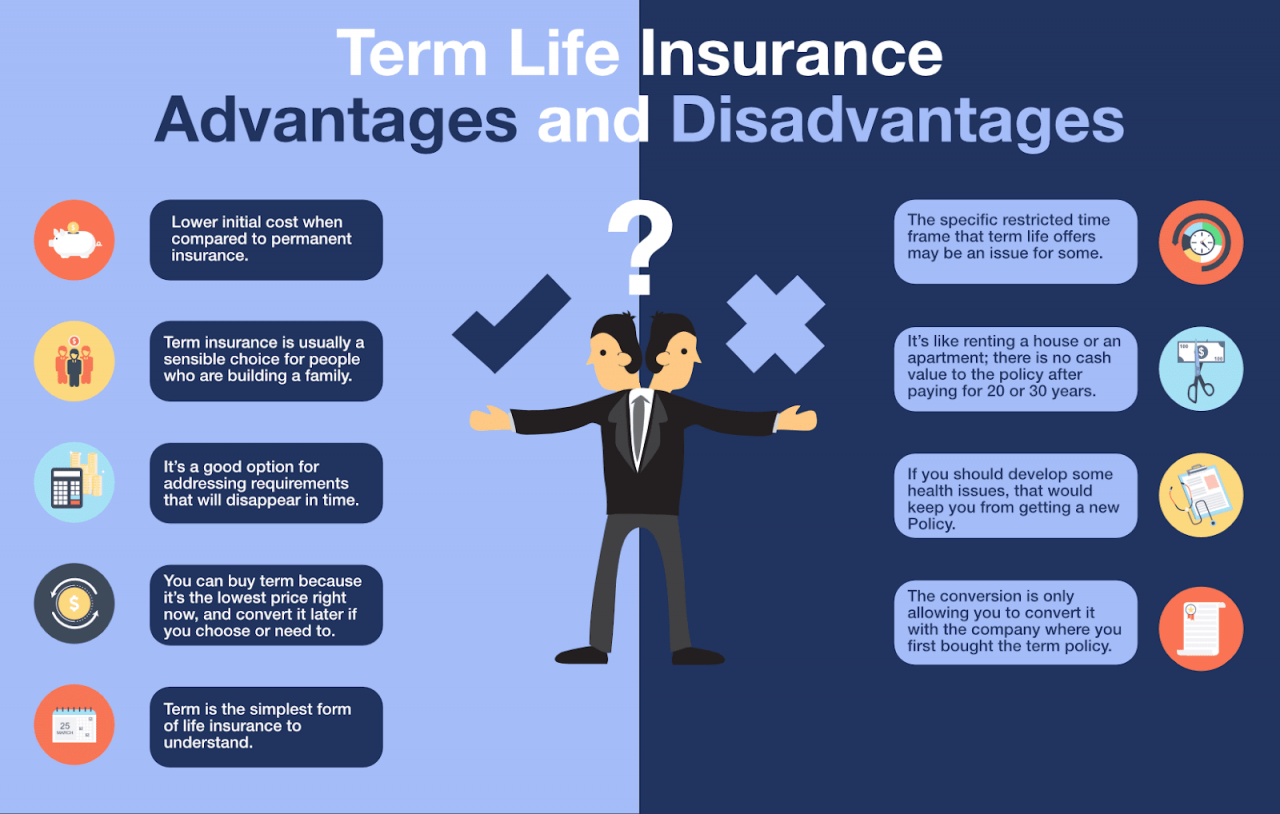

Term life insurance in Australia offers a crucial safety net for families, providing financial security in the event of the policyholder’s passing. It’s a cost-effective way to ensure loved ones are financially protected, particularly when facing significant financial obligations like mortgages, childcare, or a spouse’s reliance on the policyholder’s income.

This type of insurance provides coverage for a specific period, offering peace of mind knowing that your dependents will be taken care of during a challenging time. The premiums are generally lower compared to other life insurance types, making it an accessible option for many Australians.

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the term. If the insured person dies within the term, the beneficiary receives a death benefit. If the insured person survives the term, the policy expires and no death benefit is paid.

Key Features of Term Life Insurance in Australia

Term life insurance policies in Australia offer various features that cater to the needs of individuals and families.

- Coverage Duration: Term life insurance policies are typically available for terms ranging from 10 to 30 years, allowing you to choose a coverage period that aligns with your specific needs. For example, you might opt for a 20-year term if you have a young family and want to ensure their financial security until your children become financially independent.

- Premiums: Term life insurance premiums are generally lower than other types of life insurance, such as whole life insurance. This is because term life insurance only provides coverage for a specific period and does not accumulate cash value.

- Benefits: The death benefit of a term life insurance policy is paid to the beneficiary upon the insured person’s death within the policy term. The amount of the death benefit is typically determined at the time the policy is purchased and remains fixed throughout the term.

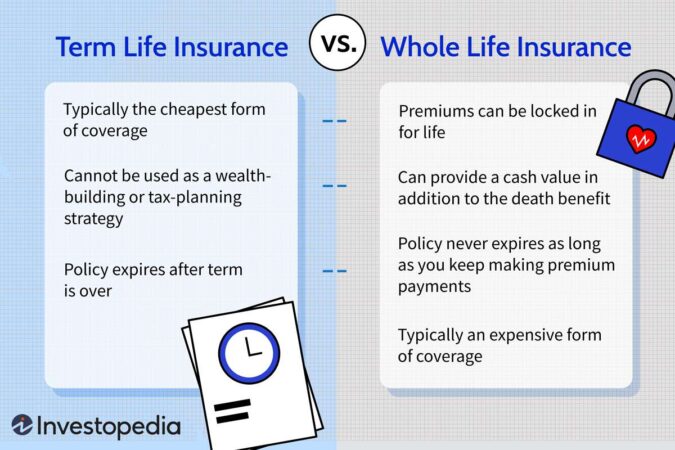

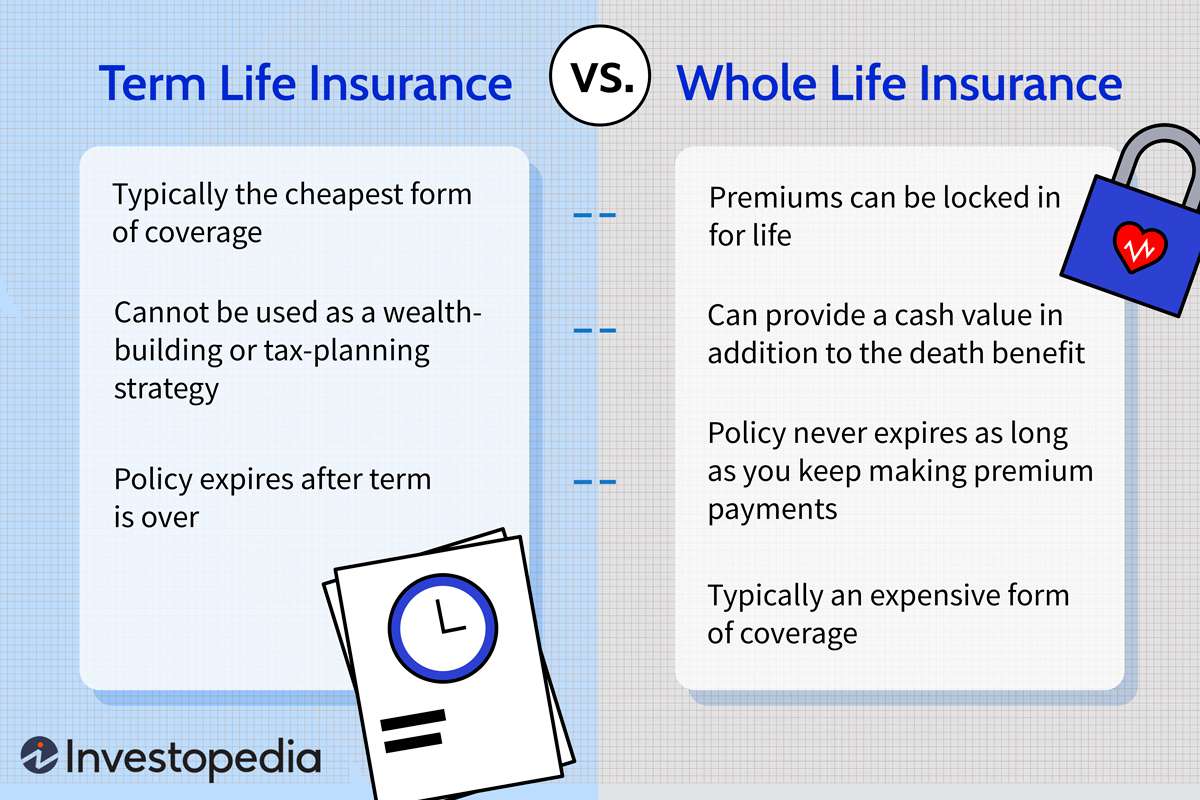

Comparison with Other Types of Life Insurance

Term life insurance is often compared to other types of life insurance, such as whole life insurance and universal life insurance. Here’s a comparison of their key features:

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Coverage Duration | Specific term (e.g., 10-30 years) | Lifetime | Lifetime |

| Premiums | Lower | Higher | Flexible |

| Cash Value | None | Accumulates | Accumulates |

| Death Benefit | Paid only if death occurs within the term | Paid upon death, regardless of when it occurs | Paid upon death, regardless of when it occurs |

Term life insurance is a more affordable option compared to whole life or universal life insurance, making it suitable for individuals seeking temporary coverage for a specific purpose.

Benefits of Term Life Insurance

Term life insurance provides a safety net for your loved ones, ensuring they are financially secure in the event of your passing. It offers peace of mind knowing that your family won’t face overwhelming financial burdens during a difficult time.

Financial Protection for Dependents

Term life insurance offers financial protection for your dependents by providing a lump sum payout upon your death. This payout can help cover various expenses, including:

- Outstanding debts like mortgages, loans, and credit card bills

- Living expenses for your family, including rent, utilities, and groceries

- Education costs for your children

- Funeral and burial expenses

- Loss of income for your spouse or partner

This financial support can help your family maintain their standard of living and avoid financial hardship during a time of grief and adjustment.

Situations Where Term Life Insurance is Beneficial

Term life insurance is particularly beneficial in several situations:

Having a Mortgage

If you have a mortgage, term life insurance can ensure that your family can continue to afford their home in your absence. The payout can be used to cover the outstanding mortgage balance, preventing foreclosure and allowing your family to remain in their home.

Young Children

If you have young children, term life insurance can provide financial support for their upbringing and future education. The payout can help cover childcare costs, school fees, and other expenses until they reach adulthood.

Spouse Who Relies on Your Income

If your spouse or partner relies on your income, term life insurance can provide financial stability for them after your death. The payout can help replace your lost income, allowing them to maintain their lifestyle and financial security.

Factors to Consider When Choosing Term Life Insurance

Choosing the right term life insurance policy is crucial to ensure your loved ones are financially protected in the event of your passing. It’s a significant decision that requires careful consideration of various factors.

Coverage Amount

The coverage amount is the sum your beneficiaries will receive if you pass away during the policy term. It’s crucial to determine the right amount based on your financial obligations and the needs of your dependents. Consider factors such as outstanding debts, mortgage payments, living expenses, children’s education, and future financial goals.

Premium Affordability

Premiums are the regular payments you make for your term life insurance policy. It’s essential to choose a policy with premiums you can comfortably afford throughout the policy term. Factors like your age, health, lifestyle, and the coverage amount will influence your premium.

Policy Duration

The policy duration, also known as the term, is the length of time your coverage remains active. It’s important to choose a term that aligns with your needs and financial goals. For example, if you have a mortgage with a 25-year term, you may consider a term life insurance policy with a similar duration to ensure your family is protected until the mortgage is paid off.

Health Status

Your health status significantly impacts your premium. Individuals with pre-existing health conditions may face higher premiums. It’s crucial to be transparent with your insurance provider about your health history and any ongoing medical conditions.

Reputable Insurance Providers

Choosing a reputable and financially stable insurance provider is essential. Research different providers, compare their policies, and look for factors such as their financial strength, customer reviews, and claims handling process.

How to Apply for Term Life Insurance: Term Life Insurance In Australia

Applying for term life insurance in Australia is a straightforward process. It generally involves getting quotes, completing a health assessment, and receiving your policy documents. This section will guide you through the key steps involved in the application process.

Getting Quotes

Before applying for term life insurance, it’s crucial to get quotes from multiple insurers to compare prices and coverage options. You can use online comparison websites or contact insurers directly.

- Online Comparison Websites: Websites like comparethemarket.com.au and canstar.com.au allow you to compare quotes from various insurers based on your desired coverage amount, term length, and other factors.

- Direct Contact: You can also contact insurers directly through their websites or by phone to request a quote. Provide them with your details and coverage requirements.

When comparing quotes, consider factors such as the premium amount, coverage features, exclusions, and the insurer’s reputation.

Completing Health Assessments

Once you’ve chosen an insurer, you’ll need to complete a health assessment. This assessment helps the insurer determine your health risks and assess your eligibility for coverage. The assessment typically involves:

- Health Questionnaire: You’ll be asked to provide information about your medical history, lifestyle habits, and any pre-existing conditions.

- Medical Examination: Depending on your age, health status, and the coverage amount, you may be required to undergo a medical examination by a doctor. This typically involves a physical exam, blood tests, and other assessments.

Be honest and accurate when completing your health assessment. Providing false information could lead to your policy being invalidated or your claim being denied.

Submitting Your Application

After completing the health assessment, you’ll submit your application to the insurer. This usually involves providing personal details, employment information, and any supporting documentation.

- Personal Details: Your full name, address, date of birth, contact information, and occupation.

- Employment Information: Details about your current employment, income, and occupation.

- Supporting Documentation: This may include your driver’s license, passport, proof of address, and medical records.

The insurer will review your application and assess your health risks.

Receiving Your Policy Documents

Once your application is approved, the insurer will issue you a policy document. This document Artikels the terms and conditions of your policy, including:

- Coverage Amount: The amount of money your beneficiaries will receive in the event of your death.

- Term Length: The duration of your policy.

- Premium Amount: The amount you will pay each month or year.

- Exclusions: Specific circumstances or events that are not covered by your policy.

Review your policy document carefully and contact the insurer if you have any questions.

Understanding the Cost of Term Life Insurance

Term life insurance premiums are designed to cover the cost of providing a death benefit to your beneficiaries if you pass away during the policy term. These premiums are calculated based on various factors that assess your risk profile.

How Premiums Are Calculated

The cost of term life insurance is calculated using a complex actuarial model that takes into account several factors. This model is designed to ensure that the premiums collected are sufficient to cover the potential payouts for death benefits. The following are the key factors considered in the calculation:

Your age: Younger individuals generally have lower premiums than older individuals, as they are statistically less likely to pass away during the policy term.

Your health: Individuals with pre-existing health conditions may face higher premiums as they are considered a higher risk.

Your lifestyle: Certain lifestyle factors, such as smoking, can also impact your premium. For instance, smokers typically pay higher premiums than non-smokers due to their increased risk of health issues.

Your coverage amount: The higher the coverage amount you choose, the higher your premium will be. This is because a larger death benefit represents a greater financial risk for the insurance company.

The policy term: The length of the policy term also affects the premium. A longer term generally means a higher premium, as the insurance company is obligated to cover the risk for a longer period.

Factors Influencing the Cost of Term Life Insurance

Several factors can influence the cost of term life insurance, and understanding these factors can help you make informed decisions about your coverage.

Age

Your age is a significant factor in determining your premium. Younger individuals generally have lower premiums than older individuals, as they are statistically less likely to pass away during the policy term. The older you are, the higher your premium will be.

Health

Your health is another crucial factor that insurers consider when calculating your premium. Individuals with pre-existing health conditions, such as diabetes, heart disease, or cancer, may face higher premiums as they are considered a higher risk. Insurers may require you to undergo a medical examination or provide medical records to assess your health status.

Lifestyle

Certain lifestyle factors can also influence your premium. For example, smokers typically pay higher premiums than non-smokers due to their increased risk of health issues. Other lifestyle factors that may impact your premium include your occupation, hobbies, and driving record.

Coverage Amount

The amount of coverage you choose will also affect your premium. The higher the coverage amount, the higher your premium will be. This is because a larger death benefit represents a greater financial risk for the insurance company.

Policy Term

The length of the policy term also affects the premium. A longer term generally means a higher premium, as the insurance company is obligated to cover the risk for a longer period.

Tips for Reducing the Cost of Term Life Insurance

There are several strategies you can employ to potentially reduce the cost of your term life insurance premiums.

- Maintain a healthy lifestyle: By maintaining a healthy lifestyle, including exercising regularly, eating a balanced diet, and avoiding smoking, you can improve your health status and potentially qualify for lower premiums.

- Compare quotes from multiple insurers: It’s essential to compare quotes from multiple insurers before making a decision. Different insurers use different underwriting criteria and pricing models, so you may find significant variations in premiums.

- Consider a shorter policy term: If you only need coverage for a specific period, such as until your children are financially independent, you can opt for a shorter policy term. This can result in lower premiums.

- Choose a higher deductible: If you are comfortable with a higher deductible, you may be able to secure lower premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in.

- Look for discounts: Some insurers offer discounts for various factors, such as being a non-smoker, having a good driving record, or being a member of certain organizations.

Common Questions about Term Life Insurance

Many people have questions about term life insurance, and it’s essential to get clear answers to make informed decisions. This section addresses some common inquiries and provides valuable insights to help you understand this type of insurance better.

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the term. If the policyholder dies during the term, the beneficiary receives a death benefit. If the policyholder survives the term, the policy expires without any payout.

| Question | Answer | Example | Further Information |

|---|---|---|---|

| What is term life insurance? | Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. If the policyholder dies during the term, the beneficiary receives a death benefit. If the policyholder survives the term, the policy expires without any payout. | A 30-year-old individual purchases a 20-year term life insurance policy with a death benefit of $500,000. If the individual dies within the 20-year term, the beneficiary receives $500,000. If the individual survives the 20-year term, the policy expires, and no payout is made. | Moneysmart |

| What are the benefits of term life insurance? | Term life insurance offers several benefits, including:

|

A young couple with a mortgage and young children might choose a 30-year term life insurance policy to provide financial security for their family if one of them passes away. | Canstar |

| How much term life insurance do I need? | The amount of term life insurance you need depends on your individual circumstances, including your age, income, dependents, debts, and financial goals. | A 35-year-old individual with a mortgage of $500,000, outstanding debts of $100,000, and two young children might need a term life insurance policy with a death benefit of $750,000 to cover these financial obligations. | Finder |

| What are the factors to consider when choosing term life insurance? | When choosing term life insurance, it’s important to consider factors such as:

|

A 40-year-old individual with a 15-year mortgage might choose a 15-year term life insurance policy with a death benefit of $500,000 to cover the mortgage and provide financial security for their family. | Compare the Market |

| How do I apply for term life insurance? | Applying for term life insurance typically involves the following steps:

|

An individual applying for term life insurance might contact an insurer online, provide their personal information, complete a health questionnaire, and undergo a medical examination. After the application is approved, they will receive a policy offer with details of their coverage and premiums. | Life Insurance |

| How much does term life insurance cost? | The cost of term life insurance varies depending on several factors, including:

|

A 25-year-old healthy individual with a 20-year term life insurance policy with a death benefit of $500,000 might pay a monthly premium of $50. A 50-year-old individual with a health condition and a 30-year term life insurance policy with a death benefit of $1,000,000 might pay a monthly premium of $150. | Choice |

Term Life Insurance and Estate Planning

Term life insurance can play a vital role in estate planning, ensuring your loved ones are financially protected after your passing. It can provide a crucial financial safety net, offering peace of mind knowing your beneficiaries will be taken care of.

Financial Security for Beneficiaries, Term life insurance in australia

Term life insurance acts as a financial safety net for your beneficiaries, providing a lump sum payment upon your death. This payment can help cover various expenses and ensure their financial stability during a difficult time.

- Funeral Expenses: Covering funeral costs, including burial arrangements, memorial services, and associated expenses, can be a significant burden for surviving family members. Term life insurance can help alleviate this financial strain.

- Outstanding Debts: If you have outstanding debts, such as mortgages, loans, or credit card balances, term life insurance can be used to pay them off, preventing your loved ones from inheriting these obligations.

- Living Expenses: Term life insurance can provide financial support for surviving family members to cover living expenses, such as rent or mortgage payments, utilities, groceries, and other essential needs.

- Education Expenses: If you have children, term life insurance can help fund their education, ensuring they can pursue their educational goals without financial hardship.

- Business Expenses: For business owners, term life insurance can provide financial support to cover business debts or ensure the continuity of the business in the event of the owner’s death.

Final Wrap-Up

Navigating the world of term life insurance in Australia can seem daunting, but understanding its benefits, key considerations, and the application process can empower you to make informed decisions. Remember, choosing the right policy involves carefully assessing your needs, comparing quotes from reputable providers, and ensuring the coverage amount is sufficient to protect your family’s future. By taking these steps, you can secure a valuable safety net that provides peace of mind and financial security for your loved ones.

Clarifying Questions

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period, usually 10-30 years, and pays a death benefit only if you pass away within that term. Whole life insurance offers lifetime coverage and builds cash value that you can borrow against or withdraw from.

How much term life insurance do I need?

The amount of term life insurance you need depends on your individual circumstances, including your dependents, outstanding debts, and desired lifestyle for your family. It’s recommended to consult with a financial advisor to determine the appropriate coverage amount.

Can I get term life insurance if I have a pre-existing health condition?

Yes, but you may face higher premiums or have your coverage restricted depending on the severity of your condition. It’s crucial to disclose all health information to the insurance provider during the application process.

Can I increase my term life insurance coverage later?

You may be able to increase your coverage later, but you’ll need to undergo a new health assessment and may face higher premiums depending on your age and health status.