- Understanding Car Insurance Needs in Australia

- Key Factors for Evaluating Car Insurance Companies: The Best Car Insurance Company In Australia

- Comparing Top Car Insurance Companies in Australia

- Factors Influencing Car Insurance Premiums

- Making Informed Decisions about Car Insurance

- Ultimate Conclusion

- Questions and Answers

Finding the best car insurance company in Australia can be a daunting task, especially considering the wide range of options and factors to consider. From comprehensive coverage to third-party options, understanding the nuances of car insurance is crucial for making an informed decision that protects your vehicle and finances.

This guide will delve into the essential aspects of car insurance in Australia, exploring key factors such as pricing, coverage, customer service, and financial stability. We’ll analyze top car insurance companies, providing a comprehensive comparison to help you choose the best fit for your needs and budget.

Understanding Car Insurance Needs in Australia

Car insurance is an essential aspect of responsible car ownership in Australia. Choosing the right policy can be a complex decision, as it depends on various factors, including your individual circumstances, driving habits, and the type of vehicle you own.

Factors Influencing Car Insurance Needs, The best car insurance company in australia

The Australian landscape and driving conditions are diverse, ranging from bustling city streets to vast rural highways. These factors, along with vehicle types and local regulations, influence the need for specific car insurance coverage.

- Driving Conditions: Australia’s diverse road network, from busy urban areas to remote outback roads, presents unique challenges. Factors like traffic density, road conditions, and weather patterns can significantly impact the risk of accidents and therefore influence insurance premiums.

- Vehicle Types: The type of vehicle you own plays a crucial role in determining your insurance needs. For instance, high-performance vehicles or luxury cars typically attract higher premiums due to their greater value and potential repair costs.

- Local Regulations: State and territory regulations regarding compulsory third-party insurance (CTP) vary. Understanding these regulations is essential to ensure you have the appropriate level of coverage.

Types of Car Insurance Coverage in Australia

Understanding the different types of car insurance coverage available in Australia is essential for making informed decisions. Here’s a breakdown of the most common options:

- Comprehensive Car Insurance: This provides the most extensive coverage, protecting you against a wide range of risks, including accidents, theft, fire, and natural disasters. It covers both damage to your vehicle and liability for damage to other vehicles or property.

- Third-Party Fire and Theft: This policy covers damage or theft of your vehicle, but it does not cover damage to other vehicles or property. It’s generally more affordable than comprehensive insurance but offers less protection.

- Third-Party Property Damage: This is the minimum level of car insurance required in Australia. It covers damage to other vehicles or property caused by you, but it does not cover damage to your own vehicle.

Key Considerations for Choosing Car Insurance

Several factors should be considered when choosing the right car insurance policy:

- Your Risk Profile: Factors like your driving history, age, and location can influence your risk profile and, consequently, your insurance premiums.

- Your Budget: Car insurance premiums vary depending on the level of coverage and the insurer. It’s crucial to find a policy that fits your budget while providing adequate protection.

- Your Vehicle’s Value: The value of your vehicle influences the cost of comprehensive insurance. Older vehicles with lower values may not require comprehensive coverage.

- Your Driving Habits: If you frequently drive in high-risk areas or drive long distances, you may need a policy with higher coverage limits.

Key Factors for Evaluating Car Insurance Companies: The Best Car Insurance Company In Australia

Choosing the right car insurance policy is crucial for protecting yourself financially in the event of an accident or other unforeseen circumstances. With numerous insurance providers available, it’s essential to evaluate each company thoroughly to find the best fit for your needs and budget. Several key factors play a significant role in this evaluation process.

Pricing

Understanding the cost of car insurance is essential. Premiums can vary widely depending on factors like your age, driving history, car model, location, and coverage level.

- Compare quotes from multiple insurers to get an idea of average premiums for your specific circumstances.

- Look for discounts offered by insurers, such as no-claims bonuses, safe driver discounts, and multi-policy discounts.

- Consider the overall cost of insurance, including premiums, excess payments, and any additional fees.

Coverage

The level of coverage you need depends on your individual circumstances and risk tolerance.

- Third-party property damage (TPPD) insurance is the minimum legal requirement in Australia, covering damage to other vehicles or property.

- Comprehensive insurance provides more extensive coverage, including damage to your own vehicle, theft, and fire.

- Additional options like personal accident cover, windscreen cover, and roadside assistance can enhance your protection.

Customer Service

Excellent customer service is essential, especially when you need to file a claim or have a query.

- Look for insurers with a strong reputation for responsiveness, helpfulness, and efficiency.

- Read online reviews and testimonials from other customers to gauge their experiences with the insurer’s customer service.

- Consider the availability of various communication channels, such as phone, email, and online chat.

Claims Process

The claims process can be stressful, so it’s crucial to choose an insurer with a straightforward and efficient system.

- Inquire about the insurer’s claims handling procedures, including the timeframes for processing claims and the availability of 24/7 support.

- Look for insurers with a high claims approval rate and a reputation for fair and transparent settlements.

- Consider the insurer’s online claims portal and its ease of use.

Financial Stability

Financial stability is essential to ensure the insurer can meet its obligations to you in the event of a significant claim.

- Check the insurer’s financial strength ratings from independent agencies like Standard & Poor’s or Moody’s.

- Look for insurers with a history of strong financial performance and a track record of paying claims promptly.

- Consider the insurer’s size and market share, as larger insurers tend to have greater financial resources.

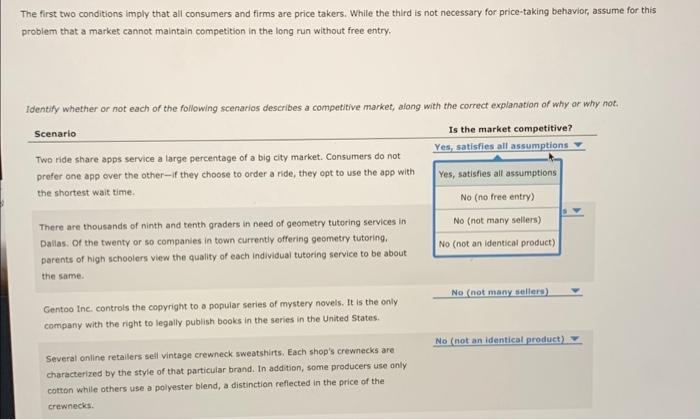

Top 5 Car Insurance Companies in Australia

| Company | Average Premium Cost | Customer Satisfaction Rating | Claims Settlement Timeframe | Financial Strength Rating |

|---|---|---|---|---|

| Company A | $1,200 | 4.5/5 | 10 days | A+ |

| Company B | $1,100 | 4.2/5 | 12 days | A |

| Company C | $1,000 | 4.0/5 | 15 days | A- |

| Company D | $900 | 3.8/5 | 18 days | BBB+ |

| Company E | $800 | 3.5/5 | 20 days | BBB |

Comparing Top Car Insurance Companies in Australia

Choosing the right car insurance can be a daunting task, given the wide range of options available. To simplify your search, we’ve compiled a comprehensive list of top car insurance companies in Australia, highlighting their key features and benefits. This comparison will empower you to make an informed decision that best suits your individual needs and budget.

Top Car Insurance Companies in Australia

To help you navigate the diverse landscape of car insurance providers, we’ve curated a table comparing some of the leading companies in Australia.

| Company | Key Features | Benefits |

|---|---|---|

| AAMI | – Comprehensive and third-party car insurance options – Optional add-ons like roadside assistance and new car replacement – Online quote and policy management |

– Competitive premiums – Strong customer service reputation – Flexible payment options |

| NRMA Insurance | – Comprehensive and third-party car insurance options – Optional add-ons like windscreen cover and legal expenses – Discounts for safe driving and multiple policies |

– Wide network of repairers – 24/7 roadside assistance – Strong claims handling process |

| RACQ Insurance | – Comprehensive and third-party car insurance options – Optional add-ons like hire car cover and personal accident insurance – Discounts for members and long-term customers |

– Competitive premiums for Queensland residents – Strong financial stability – Dedicated customer support |

| GIO | – Comprehensive and third-party car insurance options – Optional add-ons like excess reduction and car rental cover – Online quote and policy management |

– Competitive premiums – Fast claims processing – Flexible payment options |

| Suncorp | – Comprehensive and third-party car insurance options – Optional add-ons like roadside assistance and new car replacement – Discounts for safe driving and multiple policies |

– Wide network of repairers – 24/7 claims support – Strong financial stability |

Factors Influencing Car Insurance Premiums

Car insurance premiums are calculated based on a complex assessment of risk factors associated with each individual driver. Several factors contribute to the final premium, and understanding these factors can help you make informed decisions to potentially lower your costs.

Age and Driving Experience

Your age and driving experience significantly influence your car insurance premium. Younger drivers, especially those with less experience behind the wheel, are statistically more likely to be involved in accidents. This increased risk translates into higher premiums for younger drivers. As you gain more driving experience and reach a certain age, your premium generally decreases. This is because insurance companies recognize that drivers with a longer and safer driving history pose a lower risk.

Driving History

Your driving history is a crucial factor in determining your car insurance premium. A clean driving record with no accidents, traffic violations, or claims is essential for securing lower premiums. Conversely, having a history of accidents, speeding tickets, or other driving offenses will increase your premium. Insurance companies view these incidents as indicators of a higher risk of future claims.

Vehicle Type

The type of vehicle you drive plays a significant role in your car insurance premium. High-performance vehicles, luxury cars, and expensive vehicles are typically associated with higher repair costs in case of an accident. This increased risk of financial loss translates into higher premiums. Conversely, basic, economical cars with lower repair costs generally have lower premiums.

Location

Your location can also affect your car insurance premium. Insurance companies consider the geographic location of your residence and the associated risk of theft, accidents, and other incidents. Urban areas with higher population density and traffic congestion often have higher premiums compared to rural areas with lower traffic volumes.

Driving Habits

Your driving habits significantly influence your car insurance premium. Drivers who frequently commute long distances, drive in high-risk areas, or engage in risky driving behaviors, such as speeding or driving under the influence, are more likely to be involved in accidents. These factors can lead to higher premiums.

Other Factors

Other factors can also influence your car insurance premium, such as your occupation, credit score, and the type of coverage you choose. Certain occupations, such as those involving frequent travel or hazardous work environments, may increase your premium due to a higher risk of accidents. Similarly, a good credit score may indicate financial responsibility and potentially lower your premium, while a poor credit score may suggest a higher risk of financial instability and lead to higher premiums. The type of coverage you choose, such as comprehensive or collision coverage, will also affect your premium.

Tips to Lower Your Car Insurance Premium

Here are some practical tips to potentially lower your car insurance premium:

- Maintain a clean driving record by driving safely and avoiding traffic violations.

- Consider a vehicle with lower repair costs and a good safety rating.

- Improve your credit score by managing your finances responsibly.

- Explore discounts offered by insurance companies, such as good student discounts, safe driver discounts, and multi-car discounts.

- Increase your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. This can lower your premium but increases your out-of-pocket expenses in case of an accident.

- Shop around and compare quotes from different insurance companies to find the best rates.

Risk Assessment Models

Insurance companies utilize sophisticated risk assessment models to determine individual premiums. These models analyze various factors, including your age, driving history, vehicle type, location, and driving habits, to calculate the likelihood of you being involved in an accident. The higher your risk score, the higher your premium.

Insurance companies use data and algorithms to assess your risk, and the resulting premium reflects their assessment of your likelihood of making a claim.

Making Informed Decisions about Car Insurance

Making informed decisions about car insurance is crucial to ensure you have adequate coverage at a reasonable price. While comparing quotes online can be helpful, it’s essential to go beyond the surface and delve deeper into the details of each policy.

Understanding Policy Documents

Reading and understanding your policy documents before purchasing car insurance is paramount. It allows you to grasp the scope of coverage, exclusions, and conditions. This comprehensive understanding helps you make informed decisions about the policy that best suits your needs and circumstances. For example, understanding the difference between comprehensive and third-party property damage insurance can help you choose the right level of coverage for your car.

Asking Relevant Questions

To ensure you have a comprehensive understanding of a car insurance company’s offerings, it’s vital to ask relevant questions before committing to a policy.

- What are the specific coverages included in the policy?

- What are the exclusions and limitations of the policy?

- What is the process for making a claim?

- What are the customer service options available?

- What are the renewal terms and conditions?

By asking these questions, you can gain valuable insights into the insurer’s offerings and ensure that the policy meets your specific requirements.

Seeking Professional Advice

When making car insurance decisions, seeking professional advice from insurance brokers or financial advisors can be highly beneficial. They can provide unbiased guidance based on your individual circumstances and help you navigate the complexities of the insurance market. They can also assist you in comparing different policies and finding the best option that balances cost and coverage.

“Insurance brokers and financial advisors can provide valuable insights and help you make informed decisions about your car insurance.”

Ultimate Conclusion

Ultimately, finding the best car insurance company in Australia requires a personalized approach. By carefully evaluating your needs, comparing quotes, and considering the factors discussed in this guide, you can make an informed decision that ensures peace of mind on the road. Remember, insurance is about protecting yourself and your assets, so choose wisely and drive with confidence.

Questions and Answers

What are the most common types of car insurance in Australia?

The most common types of car insurance in Australia include comprehensive, third-party fire and theft, and third-party property damage. Comprehensive insurance provides the broadest coverage, while third-party options offer varying levels of protection.

How do I get a car insurance quote?

You can obtain a car insurance quote online, over the phone, or through an insurance broker. Be sure to provide accurate information about your vehicle, driving history, and desired coverage.

What are some tips for lowering my car insurance premiums?

To potentially lower your premiums, consider factors like increasing your excess, choosing a safe vehicle, maintaining a clean driving record, and bundling your car insurance with other policies.

What should I do if I need to make a claim?

Contact your insurance company immediately after an accident. Follow their instructions carefully and provide all necessary documentation to facilitate the claims process.