- The Australian Business Landscape

- Risks Faced by Small Businesses: The Importance Of Commercial Insurance For Small Businesses In Australia

- The Role of Commercial Insurance

- Benefits of Commercial Insurance for Small Businesses

- Choosing the Right Insurance Policy

- Managing Insurance Costs

- Conclusion

- Expert Answers

The importance of commercial insurance for small businesses in Australia cannot be overstated. In a country where small businesses are the backbone of the economy, it is crucial to understand the vital role that insurance plays in protecting their financial well-being and future success. From natural disasters to cyberattacks, small businesses face a myriad of risks that can threaten their operations and profitability. Commercial insurance provides a safety net, offering financial protection against these unforeseen events and allowing businesses to recover and thrive.

The Australian landscape is dotted with countless small businesses, each contributing to the nation’s economic vitality. While these enterprises bring innovation and employment, they also face unique challenges. Limited resources, fierce competition, and unpredictable market conditions can make it difficult for small businesses to navigate the complexities of running a successful operation. However, one element that can significantly impact their resilience and long-term sustainability is commercial insurance. By understanding the various types of coverage available and the benefits they offer, small business owners can make informed decisions to safeguard their businesses against potential risks.

The Australian Business Landscape

Australia boasts a vibrant and diverse business landscape, with small businesses playing a pivotal role in driving economic growth and creating employment opportunities. These enterprises are the backbone of the Australian economy, contributing significantly to the nation’s overall prosperity.

Prevalence of Small Businesses in Australia

Small businesses are a dominant force in the Australian economy. The Australian Bureau of Statistics (ABS) defines a small business as one with fewer than 200 employees. According to the ABS, there were over 2.4 million small businesses operating in Australia in 2022, representing a substantial portion of the country’s total business population. This signifies the widespread prevalence of small businesses across various industries and sectors.

Contribution of Small Businesses to GDP

Small businesses are not only numerous but also make a significant contribution to Australia’s Gross Domestic Product (GDP). They are estimated to contribute around 33% to Australia’s GDP, highlighting their crucial role in driving economic activity. This substantial contribution underscores the importance of supporting and nurturing small businesses to ensure the continued growth and prosperity of the Australian economy.

Challenges Faced by Small Businesses in Australia

Small businesses in Australia face a range of unique challenges that can impact their growth and sustainability. These challenges include:

- Competition: The Australian market is highly competitive, especially in certain sectors. Small businesses often face intense competition from larger established companies, making it challenging to gain market share and establish a strong foothold.

- Access to Finance: Securing funding can be a significant hurdle for small businesses. Banks and other financial institutions may be reluctant to lend to smaller enterprises due to perceived higher risk. This can limit their ability to invest in growth and expansion.

- Regulatory Compliance: Australia has a complex regulatory environment, with numerous laws and regulations that businesses must comply with. This can be particularly burdensome for small businesses, which may lack the resources to navigate the complexities of regulatory requirements.

- Skills Shortages: The Australian economy is currently experiencing skills shortages in various sectors, making it challenging for small businesses to find and retain qualified employees. This can impact their ability to operate efficiently and meet customer demand.

- Economic Volatility: The Australian economy is subject to fluctuations, with factors such as global economic conditions, commodity prices, and interest rates impacting business performance. Small businesses can be particularly vulnerable to these economic shocks.

Risks Faced by Small Businesses: The Importance Of Commercial Insurance For Small Businesses In Australia

Small businesses in Australia face a range of risks that can significantly impact their operations and financial stability. These risks can arise from various sources, including natural disasters, human error, and criminal activity. It’s crucial for small business owners to understand these risks and implement appropriate measures to mitigate them.

Fire and Natural Disasters

Natural disasters such as bushfires, floods, and storms are a significant risk for businesses in Australia, particularly those located in areas prone to these events. Fire can cause extensive damage to property, equipment, and inventory, disrupting operations and leading to substantial financial losses.

For example, the Black Summer bushfires of 2019-2020 affected thousands of businesses across Australia, causing billions of dollars in damages.

Theft and Vandalism

Theft and vandalism can also pose significant risks to small businesses. This can include theft of inventory, equipment, or cash, as well as damage to property. The impact of theft and vandalism can be substantial, including lost revenue, repair costs, and increased insurance premiums.

A 2021 study by the Australian Institute of Criminology found that small businesses are disproportionately affected by theft and vandalism, with a higher rate of victimization compared to larger businesses.

Public Liability

Public liability insurance protects businesses from claims arising from injuries or property damage caused to third parties. This risk is particularly relevant for businesses that interact directly with the public, such as retail stores, restaurants, and service providers.

For example, a customer could slip and fall on a wet floor in a retail store, leading to a claim for personal injury. Public liability insurance would cover the costs associated with such claims, including medical expenses, legal fees, and compensation.

Professional Indemnity

Professional indemnity insurance is essential for businesses that provide professional services, such as accountants, lawyers, and consultants. This type of insurance protects businesses from claims arising from negligence or errors in their professional services.

For example, an accountant could make a mistake in preparing a client’s tax return, leading to a claim for financial losses. Professional indemnity insurance would cover the costs associated with such claims, including legal fees and compensation.

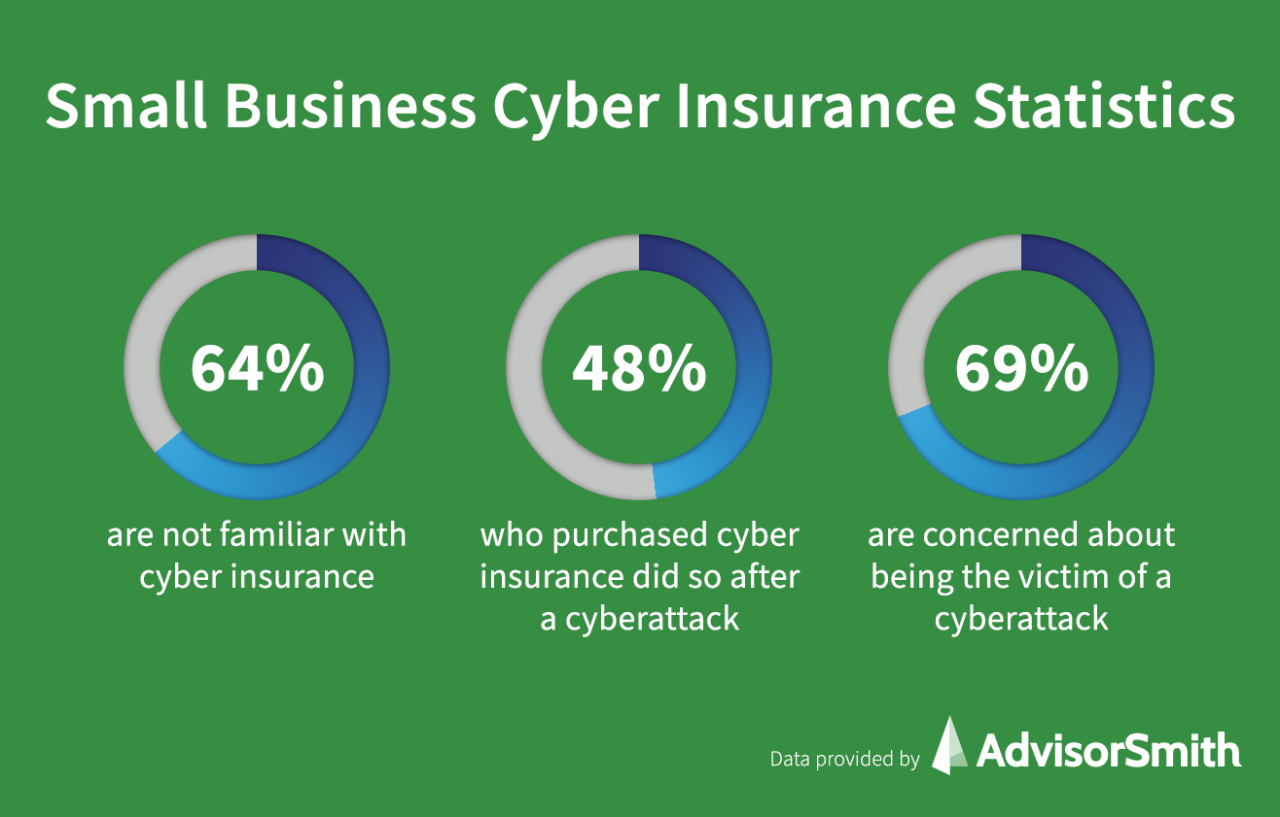

Cyberattacks

Cyberattacks are becoming increasingly common, and small businesses are particularly vulnerable due to their limited resources and IT security infrastructure. Cyberattacks can disrupt operations, damage reputation, and lead to significant financial losses.

A recent report by the Australian Cyber Security Centre found that small businesses are targeted by cybercriminals for their lack of security awareness and resources.

Workers’ Compensation

Workers’ compensation insurance is mandatory for businesses with employees in Australia. This insurance protects businesses from claims arising from injuries or illnesses sustained by employees in the workplace.

For example, an employee could be injured while lifting heavy boxes, leading to a claim for medical expenses and lost wages. Workers’ compensation insurance would cover the costs associated with such claims.

The Role of Commercial Insurance

Commercial insurance plays a crucial role in mitigating the risks faced by small businesses in Australia. It acts as a safety net, providing financial protection against unforeseen events that could threaten a business’s survival. By transferring the risk of potential losses to an insurance company, businesses can focus on their core operations with peace of mind.

Types of Commercial Insurance Policies

Understanding the different types of commercial insurance policies available in Australia is essential for businesses to choose the right coverage for their specific needs. Here’s a comparison of key insurance types:

| Insurance Type | Coverage Offered |

|---|---|

| Property Insurance | Covers physical assets of the business, including buildings, equipment, inventory, and furniture, against risks like fire, theft, natural disasters, and vandalism. |

| Liability Insurance | Protects businesses against claims arising from injuries, property damage, or financial losses caused by their operations or products. This includes public liability, product liability, and professional indemnity insurance. |

| Business Interruption Insurance | Provides financial compensation for lost income and ongoing expenses when a business is forced to shut down due to an insured event, such as a fire or natural disaster. |

| Workers’ Compensation Insurance | Mandatory in Australia, this insurance covers employees for injuries or illnesses sustained at work. It provides medical expenses, lost wages, and rehabilitation support. |

| Cyber Insurance | Protects businesses against financial losses resulting from cyberattacks, including data breaches, ransomware attacks, and system failures. This coverage can include data recovery, legal expenses, and business interruption costs. |

Benefits of Commercial Insurance for Small Businesses

Protecting your small business is crucial, and commercial insurance plays a vital role in ensuring its financial stability and peace of mind. It acts as a safety net, providing financial protection against unexpected events that could disrupt your operations and jeopardize your future.

Financial Stability

Commercial insurance safeguards your business from significant financial losses. By providing coverage for various risks, it helps you stay afloat during challenging times. Here are some ways commercial insurance can protect your financial stability:

- Property Damage: Insurance covers damage to your business property, including buildings, equipment, and inventory, due to events like fire, theft, or natural disasters. This prevents substantial financial strain from rebuilding or replacing damaged assets.

- Liability Claims: Commercial liability insurance protects your business from lawsuits arising from injuries or damages caused to third parties. It covers legal fees, settlements, and judgments, preventing devastating financial repercussions.

- Business Interruption: This insurance covers lost income when your business is forced to shut down due to covered events. It helps you maintain operational expenses, pay employees, and keep your business running, minimizing financial disruption.

Peace of Mind

Having adequate commercial insurance provides valuable peace of mind, allowing you to focus on running your business without constant worry about unforeseen risks.

- Reduced Stress: Knowing that your business is protected financially from unexpected events reduces stress and anxiety, enabling you to focus on growth and development.

- Enhanced Confidence: With insurance coverage in place, you can confidently take calculated risks, knowing that you have a safety net to fall back on if things don’t go as planned.

- Improved Business Relationships: Insurance can strengthen your business relationships with clients, suppliers, and employees, as it demonstrates your commitment to their safety and well-being.

Real-Life Examples

Numerous small businesses have successfully navigated challenging situations thanks to commercial insurance. Here are a few examples:

- A café in Sydney suffered a fire that destroyed its kitchen equipment. Their business interruption insurance covered lost income and the cost of replacing the equipment, allowing them to reopen within a few weeks.

- A small construction company in Melbourne was sued by a client who claimed injury on their worksite. Their liability insurance covered legal fees and the settlement amount, preventing a financial catastrophe.

- A retail store in Brisbane experienced a major flood that damaged their inventory. Their property insurance covered the cost of replacing the damaged goods, enabling them to resume operations quickly.

Choosing the Right Insurance Policy

Selecting the right commercial insurance policy is crucial for any small business in Australia. It’s not just about ticking a box on your to-do list; it’s about safeguarding your business against unexpected risks and ensuring its long-term sustainability.

Factors to Consider

Choosing the right commercial insurance policy involves careful consideration of several factors. These factors help you determine the specific coverage you need and ensure that your policy aligns with your business’s unique requirements.

- Type of Business: Different industries face different risks. For example, a retail store might require product liability insurance, while a construction company might need workers’ compensation insurance.

- Size of Business: The size of your business can impact the level of coverage you need. A larger business with more employees and assets might require more extensive insurance than a smaller one.

- Location: Geographic location can influence risk factors. For example, businesses in areas prone to natural disasters might require additional coverage for flood or earthquake damage.

- Assets: Identify and assess the value of your business assets, including equipment, inventory, and property. This helps you determine the appropriate level of coverage for each asset.

- Employees: If you have employees, you’ll need to consider workers’ compensation insurance to protect them from work-related injuries or illnesses.

- Budget: Insurance premiums can vary significantly based on coverage levels and risk factors. Consider your budget and allocate a reasonable amount for insurance.

- Existing Policies: Review any existing insurance policies you have, such as home or car insurance, to see if they offer any relevant coverage for your business.

Consulting with an Insurance Broker or Agent

Seeking advice from an insurance broker or agent can be incredibly valuable. These professionals possess expertise in the insurance industry and can help you navigate the complexities of choosing the right policy.

- Expert Guidance: They can explain different policy options, assess your specific needs, and recommend the most suitable coverage for your business.

- Negotiation Skills: Brokers and agents can negotiate with insurance providers on your behalf to secure the best possible rates and coverage.

- Claims Assistance: They can guide you through the claims process if you need to file a claim, ensuring you receive the maximum benefits.

Obtaining Multiple Quotes

Getting quotes from multiple insurance providers is essential for comparing prices and coverage options. This allows you to find the best value for your money and ensure you’re not overpaying for insurance.

- Competitive Pricing: Comparing quotes from different insurers can help you identify the most competitive prices for the coverage you need.

- Diverse Coverage Options: Different insurers may offer unique coverage options or benefits, so comparing quotes can help you find the policy that best suits your specific requirements.

- Negotiation Power: Having multiple quotes in hand can give you more bargaining power when negotiating with insurers.

Managing Insurance Costs

While commercial insurance is crucial for protecting your small business, it’s also essential to manage costs effectively. Finding the right balance between adequate coverage and affordability is key. Here are some strategies to help you minimize premiums without compromising the protection your business needs.

Strategies for Minimizing Insurance Premiums

Minimizing insurance premiums is a balancing act. You want to make sure you’re getting the right coverage, but you also want to keep costs down. Here are a few strategies to help you achieve this balance:

- Shop Around: Get quotes from multiple insurers. Different companies have varying rates and coverage options. Compare prices and features carefully to find the best deal.

- Improve Risk Management: Implementing robust risk management practices can significantly reduce your premiums. By minimizing the likelihood of claims, you become a more attractive customer to insurers.

- Increase Deductibles: A higher deductible typically translates to a lower premium. Consider raising your deductible if you’re comfortable assuming a larger financial responsibility in the event of a claim.

- Bundle Policies: Combining multiple insurance policies with the same insurer, such as property, liability, and workers’ compensation, can often result in discounts.

- Maintain a Good Claims History: A clean claims history is a significant factor in determining premiums. By minimizing claims, you demonstrate a lower risk profile to insurers.

- Consider Payment Options: Some insurers offer discounts for paying premiums annually or semi-annually. Explore these options to potentially save on costs.

Reducing the Risk of Claims

Proactive risk management is a crucial step in controlling insurance costs. By taking measures to reduce the likelihood of claims, you can significantly impact your premiums and overall financial well-being. Here are some practical tips:

- Implement Safety Procedures: Establishing clear safety protocols for your workplace can significantly reduce the risk of accidents and injuries, minimizing the potential for workers’ compensation claims.

- Maintain Proper Security: Invest in security measures to protect your business property from theft, vandalism, and other risks. This includes robust alarm systems, security cameras, and adequate lighting.

- Conduct Regular Maintenance: Ensure regular maintenance of equipment and facilities to prevent breakdowns, accidents, and potential liability issues.

- Train Employees: Provide thorough training to employees on safety procedures, risk awareness, and customer service to minimize the potential for accidents and customer disputes.

- Review Contracts: Carefully review contracts with suppliers, contractors, and other parties to ensure adequate protection and minimize potential liability.

Maintaining Accurate Records and Documentation, The importance of commercial insurance for small businesses in australia

Accurate records and documentation are essential for managing your insurance costs effectively. They play a vital role in supporting claims, demonstrating your risk management practices, and negotiating favorable premiums. Here’s why they are crucial:

- Supporting Claims: Detailed records can help you quickly and efficiently file claims, ensuring timely and accurate compensation.

- Demonstrating Risk Management: Well-maintained records can showcase your proactive approach to safety and risk management, influencing insurers to offer more competitive premiums.

- Negotiating Premiums: By providing comprehensive documentation of your risk management practices, you can strengthen your position when negotiating premiums with insurers.

- Audits and Reviews: Accurate records are essential for meeting insurance company audits and reviews, ensuring compliance and maintaining your coverage.

Conclusion

Navigating the world of commercial insurance can feel overwhelming, but with careful planning and the right guidance, small businesses in Australia can secure the protection they need to weather any storm. By understanding the risks they face, choosing the appropriate coverage, and managing insurance costs effectively, small businesses can not only mitigate potential financial losses but also foster a sense of peace of mind, knowing that they are prepared for the unexpected. This proactive approach empowers them to focus on their core business operations, confident that they have a strong foundation for long-term growth and success.

Expert Answers

What are the most common types of commercial insurance for small businesses in Australia?

Common types of commercial insurance for small businesses in Australia include property insurance, liability insurance, business interruption insurance, workers’ compensation insurance, and cyber insurance.

How much does commercial insurance cost for small businesses in Australia?

The cost of commercial insurance for small businesses in Australia varies depending on factors such as the industry, business size, location, and coverage level. It’s best to get quotes from multiple insurance providers to compare prices and find the most suitable policy.

What are the benefits of working with an insurance broker?

Insurance brokers have expertise in the insurance market and can help small businesses find the best coverage at competitive prices. They can also provide guidance on policy terms and conditions, ensuring businesses are adequately protected.