- Introduction

- Top 10 Travel Insurance Companies in Australia

- Types of Travel Insurance Coverage

- Factors to Consider When Choosing Travel Insurance

- Tips for Saving Money on Travel Insurance

- Common Travel Insurance Claims

- Conclusion

- Final Conclusion: Top 10 Travel Insurance Companies In Australia

- Clarifying Questions

Top 10 travel insurance companies in Australia, securing peace of mind for your adventures abroad. Navigating the world of travel insurance can be daunting, with numerous companies offering a plethora of options. Understanding your needs and choosing the right coverage is paramount, especially when traveling to new destinations. This guide provides a comprehensive overview of the top 10 travel insurance companies in Australia, helping you make an informed decision and embark on your journey with confidence.

From comprehensive medical coverage to baggage protection and cancellation insurance, these companies offer diverse packages tailored to various travel needs. We’ll delve into key features, price ranges, and customer reviews, highlighting strengths and weaknesses to aid your selection process. Whether you’re a seasoned traveler or embarking on your first international adventure, this guide will equip you with the knowledge to choose the perfect travel insurance for your next trip.

Introduction

Travel insurance is a vital component of any travel plan for Australians, providing financial protection against unexpected events that could disrupt your trip and lead to significant expenses. It acts as a safety net, offering peace of mind and financial security during your travels.

Importance of Travel Insurance for Australians

Travel insurance is particularly important for Australians due to the country’s unique geographic location and the potential for unforeseen circumstances. The Australian government strongly recommends travel insurance for all travellers, particularly those planning trips to remote areas or engaging in adventurous activities.

Key Factors to Consider When Choosing Travel Insurance

Choosing the right travel insurance policy is crucial to ensure adequate coverage for your specific needs and travel plans. Here are some key factors to consider:

Types of Coverage

- Medical Expenses: Covers medical costs incurred due to illness or injury while travelling, including emergency medical evacuation and hospitalisation.

- Trip Cancellation and Interruption: Provides reimbursement for non-refundable trip costs if you need to cancel or interrupt your trip due to unforeseen circumstances like illness, injury, or family emergencies.

- Lost or Stolen Luggage: Offers compensation for lost or stolen luggage, including personal belongings and valuables.

- Personal Liability: Protects you from legal claims arising from accidental damage or injury to third parties while travelling.

- Emergency Assistance: Provides 24/7 support and assistance with travel-related emergencies, such as medical emergencies, lost passports, or flight delays.

Destination and Activities

- Destination: Some destinations may have higher risks or specific requirements, such as mandatory health insurance or visa requirements.

- Activities: If you plan to engage in adventurous activities like skiing, scuba diving, or trekking, you may need additional coverage to protect yourself against specific risks.

Age and Health

- Age: Age can affect the cost of travel insurance, with older travellers often facing higher premiums.

- Health: Pre-existing medical conditions may require additional coverage or may be excluded from standard policies.

Budget

- Premium Costs: Travel insurance premiums vary depending on factors such as destination, duration of trip, age, health, and level of coverage.

- Excess: The excess is the amount you pay out of pocket before the insurer covers the remaining costs.

Top 10 Travel Insurance Companies in Australia

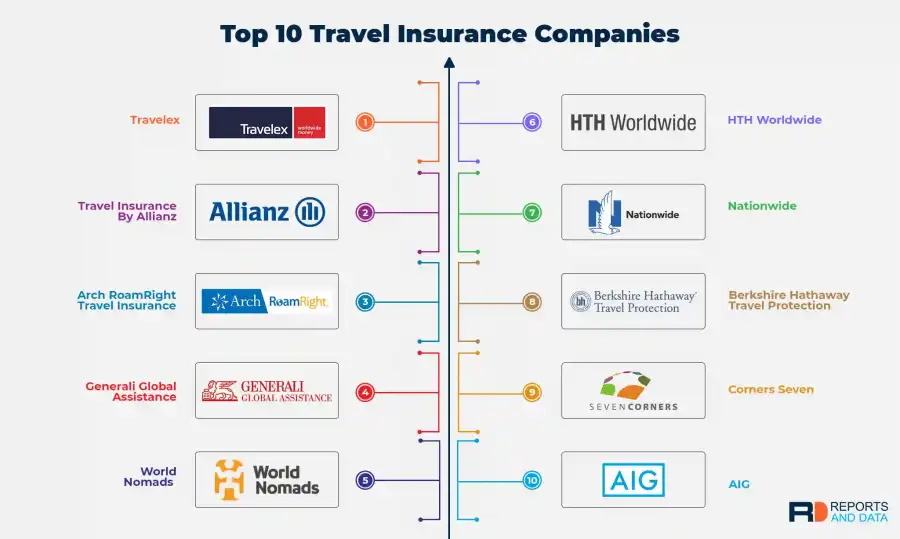

Choosing the right travel insurance can be a daunting task, especially with so many options available. This comprehensive guide will help you navigate the landscape of travel insurance in Australia, providing insights into the top 10 companies, their strengths, weaknesses, and key features.

Comparison of Top 10 Travel Insurance Companies

Here’s a table comparing the top 10 travel insurance companies in Australia, covering essential aspects like price range, key features, and customer reviews.

| Company Name | Website | Key Features | Price Range | Customer Reviews |

|---|---|---|---|---|

| 1. Cover-More | www.covermore.com.au | Comprehensive coverage, including medical expenses, cancellation, and lost luggage; 24/7 assistance; wide range of optional extras | $40 – $200+ per trip | 4.5/5 stars (based on independent reviews) |

| 2. Allianz Global Assistance | www.allianz.com.au | Strong reputation for international coverage; extensive medical benefits; flexible policy options | $50 – $250+ per trip | 4.3/5 stars (based on independent reviews) |

| 3. Travel Insurance Direct | www.travelinsurancedirect.com.au | Competitive pricing; straightforward policies; easy online quote and purchase process | $30 – $150+ per trip | 4.2/5 stars (based on independent reviews) |

| 4. RACQ Travel Insurance | www.racq.com.au | Good value for money; tailored policies for different travel needs; strong customer service | $45 – $200+ per trip | 4.1/5 stars (based on independent reviews) |

| 5. Budget Direct Travel Insurance | www.budgetdirect.com.au | Affordable premiums; simple policy options; quick and easy online application | $25 – $100+ per trip | 3.9/5 stars (based on independent reviews) |

| 6. Qantas Travel Insurance | www.qantas.com/travelinsurance | Exclusive benefits for Qantas frequent flyers; good value for money; 24/7 emergency assistance | $40 – $180+ per trip | 4.0/5 stars (based on independent reviews) |

| 7. World Nomads | www.worldnomads.com | Popular choice for backpackers and long-term travelers; flexible policies; comprehensive coverage | $50 – $250+ per trip | 4.4/5 stars (based on independent reviews) |

| 8. Insurance House | www.insurancehouse.com.au | Wide range of policies to choose from; competitive pricing; strong customer service | $35 – $150+ per trip | 4.0/5 stars (based on independent reviews) |

| 9. nib Travel Insurance | www.nib.com.au | Comprehensive coverage for various travel needs; 24/7 emergency assistance; good value for money | $45 – $200+ per trip | 3.8/5 stars (based on independent reviews) |

| 10. HBF Travel Insurance | www.hbf.com.au | Tailored policies for families and individuals; strong customer service; competitive pricing | $40 – $180+ per trip | 3.9/5 stars (based on independent reviews) |

Types of Travel Insurance Coverage

Travel insurance in Australia provides financial protection against unexpected events that may occur during your trip. Understanding the different types of coverage is crucial to ensure you have the right protection for your specific needs and travel plans.

Types of Travel Insurance Coverage

Travel insurance policies in Australia typically offer a range of coverage options, categorized into various types. These types of coverage are designed to protect you against a wide array of travel-related risks.

- Medical Expenses: This coverage is essential for travelers, as it helps cover medical costs incurred due to illness or injury while abroad. It can include expenses such as hospital stays, doctor consultations, emergency medical evacuation, and repatriation.

- Cancellation and Interruption: This coverage protects you against financial losses resulting from the cancellation or interruption of your trip due to unforeseen circumstances. These circumstances can include illness, injury, death of a family member, or natural disasters.

- Lost or Stolen Luggage: This coverage provides compensation for lost or stolen luggage during your travels. It typically covers the cost of replacing essential items and personal belongings.

- Personal Liability: This coverage protects you against legal liabilities arising from accidents or injuries caused to others during your travels. It can cover legal fees and compensation for damages.

- Emergency Assistance: This coverage provides 24/7 access to emergency assistance services, including medical advice, translation services, and assistance with travel arrangements.

Benefits and Limitations of Each Coverage Type

Each type of travel insurance coverage offers specific benefits and limitations. It’s important to understand these aspects before choosing a policy.

Medical Expenses

- Benefits: Medical expenses coverage can provide financial protection against significant medical costs incurred while traveling abroad. It can help alleviate financial burdens and ensure access to necessary medical treatment.

- Limitations: The coverage amount may be limited, and some policies may have exclusions for pre-existing conditions or certain activities. It’s crucial to carefully review the policy terms and conditions to understand the specific limitations.

Cancellation and Interruption

- Benefits: Cancellation and interruption coverage can protect you against financial losses resulting from unexpected events that force you to cancel or interrupt your trip. It can provide reimbursement for non-refundable travel expenses.

- Limitations: The coverage may not apply to all cancellation or interruption reasons. It’s essential to review the policy terms and conditions to understand the specific circumstances covered.

Lost or Stolen Luggage

- Benefits: Lost or stolen luggage coverage can provide compensation for lost or stolen luggage, helping to replace essential items and personal belongings.

- Limitations: The coverage amount may be limited, and some policies may have exclusions for certain types of items, such as valuables or electronics. It’s crucial to understand the specific limitations and consider additional coverage for valuable items.

Personal Liability

- Benefits: Personal liability coverage provides financial protection against legal liabilities arising from accidents or injuries caused to others during your travels. It can help cover legal fees and compensation for damages.

- Limitations: The coverage amount may be limited, and some policies may have exclusions for specific types of accidents or injuries. It’s essential to review the policy terms and conditions to understand the specific limitations.

Emergency Assistance

- Benefits: Emergency assistance coverage provides 24/7 access to emergency assistance services, providing support and assistance in unforeseen situations. It can help navigate emergencies and ensure your safety and well-being.

- Limitations: The services provided may vary depending on the policy. It’s essential to review the policy terms and conditions to understand the specific services included and the limitations.

Examples of Situations Where Each Coverage Type Would Be Most Suitable

Understanding the specific situations where each type of coverage is most suitable can help you make informed decisions when choosing a travel insurance policy.

Medical Expenses

- Example: A traveler experiencing a sudden illness or injury requiring hospitalization and medical treatment while abroad.

Cancellation and Interruption

- Example: A traveler needing to cancel or interrupt their trip due to a family emergency, illness, or natural disaster.

Lost or Stolen Luggage

- Example: A traveler whose luggage is lost or stolen during their travels, requiring the replacement of essential items and personal belongings.

Personal Liability

- Example: A traveler accidentally causing injury or damage to property belonging to others during their travels, resulting in legal liability.

Emergency Assistance

- Example: A traveler requiring medical advice, translation services, or assistance with travel arrangements due to an unforeseen event or emergency.

Factors to Consider When Choosing Travel Insurance

Choosing the right travel insurance policy is crucial for protecting yourself from unexpected events while traveling. It’s important to consider several factors to ensure you have adequate coverage for your specific needs.

Destination, Top 10 travel insurance companies in australia

The destination you’re traveling to significantly influences the type of travel insurance you need. For instance, if you’re traveling to a high-risk destination, you might require more comprehensive coverage, including medical evacuation and political unrest insurance. Conversely, if you’re traveling to a low-risk destination, you might only need basic coverage.

Trip Duration

The length of your trip is another crucial factor. Longer trips generally require more extensive coverage as the risk of something happening increases with time. Consider the duration of your trip when choosing your policy and ensure it covers the entire period.

Age and Health

Your age and health status play a vital role in determining your travel insurance needs. If you have pre-existing medical conditions, you’ll need to disclose them to the insurer and ensure your policy covers them. Additionally, some insurers may have age limits or exclusions for certain activities.

Budget

Travel insurance policies come in various price ranges, and it’s important to find one that fits your budget. However, don’t solely focus on the cheapest option. Consider the coverage offered and ensure it meets your needs. It’s better to pay a little extra for comprehensive coverage than regret it later.

Activity Level

Your planned activities while traveling also influence the type of insurance you need. If you’re engaging in high-risk activities like skiing, scuba diving, or trekking, you’ll need a policy that covers these activities. Some insurers may have additional premiums or exclusions for such activities.

Tips for Saving Money on Travel Insurance

Travel insurance can be a significant expense, but it’s essential for protecting yourself against unexpected events while traveling. Fortunately, there are several strategies you can use to save money on travel insurance without compromising coverage.

Bundling Travel Insurance with Other Products

Bundling your travel insurance with other products, such as your home or car insurance, can often result in significant savings. This is because insurance companies often offer discounts for multiple policies.

- Contact your existing insurance provider to inquire about bundling options and potential discounts.

- Compare quotes from different insurance companies to see if bundling is a more cost-effective option for you.

Negotiating Travel Insurance Premiums

While it might seem daunting, you can sometimes negotiate your travel insurance premiums. Insurance companies are often willing to work with customers to find a price that works for both parties.

- Shop around and compare quotes from multiple insurance providers. This gives you a better understanding of the market and helps you identify potential areas for negotiation.

- Highlight your good risk profile. If you have a clean driving record, a good credit score, and no prior insurance claims, you might be able to negotiate a lower premium.

- Be prepared to explain your specific needs and why you require certain types of coverage. This can help the insurance company understand your situation and tailor a policy that meets your requirements at a reasonable price.

- Don’t be afraid to ask for a discount. Many insurance companies offer discounts for various factors, such as paying your premium upfront, signing up for automatic payments, or being a loyal customer.

Common Travel Insurance Claims

Travel insurance claims are a common occurrence, with many travellers seeking compensation for unexpected events that disrupt their trips. Understanding the most common types of claims and the process involved can help you navigate this process effectively.

Types of Travel Insurance Claims

Travel insurance policies typically cover a wide range of events, and the most common claims are often related to:

- Medical Expenses: This includes medical treatment for illness or injury, hospital stays, and emergency medical evacuations.

- Trip Cancellation or Interruption: This covers situations where you need to cancel your trip or cut it short due to unforeseen circumstances like illness, injury, or a natural disaster.

- Lost or Stolen Luggage: If your luggage is lost or stolen during your trip, travel insurance can help cover the cost of replacing essential items.

- Delayed Flights or Luggage: If your flight or luggage is delayed, travel insurance may reimburse you for expenses like accommodation, meals, and essential items.

- Personal Liability: This covers you if you accidentally cause damage to property or injury to someone else while travelling.

The Claims Process

Making a claim with your travel insurance provider is generally straightforward. You will typically need to:

- Contact your insurer: Inform them about the incident as soon as possible, ideally within 24 hours.

- Provide necessary documentation: This might include medical reports, flight details, police reports, receipts for expenses, and other relevant documents.

- Complete a claims form: Your insurer will provide you with a form to complete, outlining the details of your claim.

Examples of Successful Travel Insurance Claims

- Medical Expenses: A traveller who experienced a serious illness while overseas was able to claim for their medical treatment, hospital stay, and repatriation to Australia.

- Trip Cancellation: A traveller who had to cancel their trip due to a sudden family emergency was reimbursed for their non-refundable flights and accommodation costs.

- Lost Luggage: A traveller whose luggage was lost during a flight was able to claim for the cost of replacing essential items like clothing and toiletries.

Conclusion

Choosing the right travel insurance is crucial for protecting yourself and your finances while traveling. This article has provided a comprehensive guide to understanding the different types of travel insurance, key factors to consider, and tips for saving money. It has also Artikeld the top 10 travel insurance companies in Australia based on factors like coverage, price, and customer service.

Importance of Travel Insurance

Travel insurance is a vital investment for any traveler, offering peace of mind and financial protection against unexpected events. It can cover a wide range of situations, including medical emergencies, trip cancellations, lost luggage, and more. By understanding your travel needs and comparing different insurance plans, you can find the best coverage for your specific requirements.

Final Conclusion: Top 10 Travel Insurance Companies In Australia

With a thorough understanding of the top 10 travel insurance companies in Australia, you’re well-equipped to make an informed decision. Remember to consider your destination, trip duration, budget, and individual needs when selecting a policy. Don’t let unforeseen events dampen your travel experience. Secure your peace of mind with the right travel insurance, and enjoy your journey with confidence.

Clarifying Questions

What is the difference between single trip and multi-trip travel insurance?

Single trip insurance covers a single trip, while multi-trip insurance provides coverage for multiple trips within a specified period, often a year.

What are the most common travel insurance claims?

Common claims include medical expenses, flight cancellations, lost luggage, and emergency evacuation.

How do I make a travel insurance claim?

Contact your insurance provider immediately after an incident, provide necessary documentation, and follow their claims process.

Is it worth getting travel insurance if I’m only traveling within Australia?

While domestic travel may seem less risky, travel insurance can still provide valuable coverage for unexpected events like medical emergencies, natural disasters, and flight disruptions.