Types of business insurance in Australia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the vast and complex world of business, navigating the landscape of insurance can be a daunting task. From protecting your assets to safeguarding your employees, understanding the various types of business insurance available in Australia is crucial for ensuring the smooth operation and long-term success of your enterprise.

This comprehensive guide delves into the diverse spectrum of business insurance options, providing insights into their coverage, key features, and benefits. We will explore the essential insurance types that every Australian business should consider, including public liability, product liability, professional indemnity, workers’ compensation, business property, business interruption, cyber liability, motor vehicle, and management liability insurance. By understanding the nuances of each insurance type, you can make informed decisions to secure your business against potential risks and build a strong foundation for growth and prosperity.

Introduction to Business Insurance in Australia

Running a business in Australia comes with its own set of risks. From unexpected accidents to legal disputes, various unforeseen events can disrupt your operations and impact your financial stability. This is where business insurance plays a crucial role in safeguarding your business and providing peace of mind.

Business insurance offers a safety net against potential financial losses, ensuring you can bounce back from unexpected events and continue operating smoothly. It can also help you avoid significant legal liabilities and protect your assets.

Legal Requirements for Business Insurance in Australia

In Australia, there are no mandatory requirements for all businesses to hold specific types of insurance. However, some industries or specific business activities may have legal obligations to carry certain types of insurance. For instance, if you operate a construction business, you may be required to have public liability insurance to cover potential injuries or damages caused to third parties.

It’s essential to consult with your industry association, professional advisors, or an insurance broker to understand the specific legal requirements for your business. They can help you identify the types of insurance you need to comply with legal obligations and protect your business.

Types of Business Insurance in Australia

In the dynamic landscape of Australian businesses, insurance plays a crucial role in safeguarding against unforeseen risks and financial burdens. A comprehensive understanding of the various types of business insurance available is essential for ensuring the stability and continuity of operations.

Common Types of Business Insurance in Australia

The types of business insurance you need will depend on the specific nature of your business, its size, and the risks it faces. Here’s a breakdown of some of the most common types of business insurance in Australia:

| Insurance Type | Coverage | Key Features | Benefits |

|---|---|---|---|

| Public Liability Insurance | Protects your business from claims arising from injuries or property damage caused by your business activities to third parties. | Covers legal costs, compensation for medical expenses, and other damages. | Provides financial protection against lawsuits and claims, safeguarding your business from significant financial losses. |

| Product Liability Insurance | Covers your business against claims arising from injuries or damages caused by defective products you manufacture or sell. | Covers legal costs, compensation for injuries, and product recalls. | Protects your business from liability related to faulty products, ensuring financial stability in case of product-related claims. |

| Professional Indemnity Insurance | Protects professionals, such as accountants, lawyers, and consultants, against claims arising from negligence or errors in their professional services. | Covers legal costs, compensation for financial losses, and reputational damage. | Provides financial protection for professionals, ensuring they can continue to operate even in the face of malpractice claims. |

| Workers Compensation Insurance | Compulsory insurance that covers employees for injuries or illnesses sustained at work. | Provides medical expenses, lost wages, and rehabilitation costs for injured workers. | Complies with legal requirements, protects your business from liability for work-related injuries, and maintains employee morale. |

| Business Property Insurance | Protects your business property, such as buildings, equipment, and stock, against damage or loss caused by various events, including fire, theft, and natural disasters. | Covers the cost of repairs or replacement of damaged property, including business interruption costs. | Provides financial protection for your business assets, enabling recovery and continuity of operations after a loss. |

| Business Interruption Insurance | Covers lost revenue and ongoing expenses if your business is forced to shut down due to an insured event, such as a fire or natural disaster. | Provides financial support to cover fixed costs, lost profits, and other expenses during the period of interruption. | Ensures business continuity and financial stability during disruptions, minimizing the impact on your operations. |

| Cyber Liability Insurance | Protects your business from financial losses and legal liabilities arising from cyberattacks, data breaches, and other cyber risks. | Covers costs associated with data recovery, regulatory fines, legal defense, and reputational damage. | Safeguards your business from the increasing threat of cybercrime, protecting your data, systems, and reputation. |

| Motor Vehicle Insurance | Covers your business vehicles against damage, theft, and liability for accidents involving other vehicles or pedestrians. | Provides financial protection for repairs, replacement, and legal costs. | Ensures the safety and security of your business vehicles, protecting your assets and drivers from financial hardship. |

| Management Liability Insurance | Protects directors and officers of a company against claims arising from their decisions and actions, such as negligence or breach of duty. | Covers legal costs, compensation for financial losses, and reputational damage. | Provides peace of mind for directors and officers, enabling them to make decisions without fear of personal liability. |

Factors Affecting Business Insurance Premiums

Your business insurance premiums are not set in stone. Several factors influence the cost of your insurance, and understanding these factors can help you make informed decisions about your coverage and potentially reduce your premiums. This section will explore the key factors that affect business insurance premiums in Australia, helping you understand how your specific circumstances can impact your insurance costs.

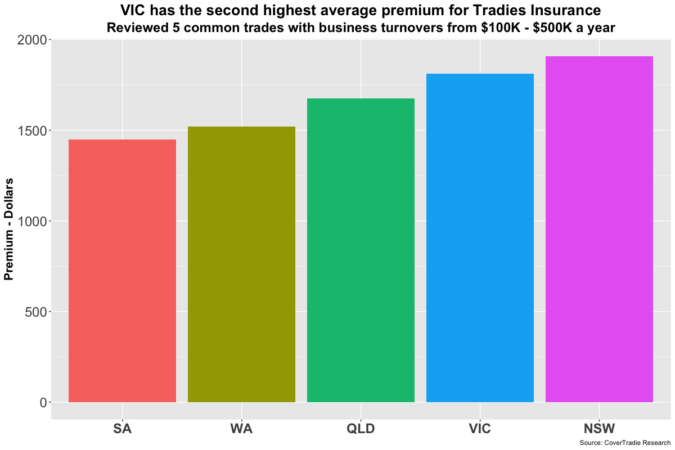

Industry

The industry in which your business operates plays a significant role in determining your insurance premiums. Different industries have varying levels of risk associated with them, which insurance companies take into account when setting premiums. For example, businesses in high-risk industries like construction or manufacturing typically face higher premiums due to the inherent dangers associated with their operations. On the other hand, businesses in lower-risk industries like retail or services may enjoy lower premiums.

Business Size

The size of your business also affects your insurance premiums. Larger businesses generally face higher premiums due to their increased exposure to potential risks. They have more employees, assets, and operations, which can lead to higher potential claims costs. Conversely, smaller businesses may benefit from lower premiums as they typically have fewer employees, assets, and operations, reducing their risk profile.

Location

The location of your business can significantly impact your insurance premiums. Businesses in high-risk areas, such as those prone to natural disasters like floods, earthquakes, or bushfires, may face higher premiums. Additionally, businesses located in areas with high crime rates or traffic congestion may also experience higher premiums due to the increased risk of theft, vandalism, or accidents.

Claims History, Types of business insurance in australia

Your business’s claims history is a critical factor in determining your insurance premiums. A history of frequent or large claims can lead to higher premiums as insurance companies perceive you as a higher risk. Conversely, a clean claims history can result in lower premiums, as you are considered a lower risk. Maintaining a good claims history is essential for managing your insurance costs.

Risk Assessment and Mitigation

Risk assessment and mitigation play a crucial role in determining your business insurance premiums. Insurance companies conduct thorough risk assessments to evaluate the potential hazards and risks associated with your business. They then assess your risk mitigation strategies, such as implementing safety procedures, installing security systems, or taking preventative measures to reduce risks. By demonstrating effective risk management practices, you can potentially lower your insurance premiums.

Choosing the Right Business Insurance

Choosing the right business insurance is crucial for safeguarding your company’s financial well-being and protecting it from unforeseen events. By understanding your unique needs and risks, you can select policies that provide the appropriate coverage at a competitive price.

Assessing Individual Business Needs and Risks

It’s essential to conduct a thorough assessment of your business’s specific needs and potential risks before selecting insurance policies. This involves identifying the areas most vulnerable to loss or disruption and determining the level of protection required.

- Identify Key Assets: Start by listing your most valuable assets, including physical property, equipment, inventory, intellectual property, and financial records. This will help you determine the extent of coverage needed for each asset.

- Analyze Potential Risks: Consider the specific risks your business faces, such as fire, theft, natural disasters, accidents, product liability, professional negligence, and cyberattacks.

- Evaluate Legal Liabilities: Assess your potential legal liabilities, including claims from employees, customers, or third parties. This helps determine the appropriate level of liability insurance.

- Review Business Operations: Examine your business operations and identify any potential areas of vulnerability. This might include your supply chain, customer data security, or employee safety protocols.

Comparing Quotes and Selecting the Most Suitable Insurance Provider

Once you’ve assessed your needs and risks, it’s time to compare quotes from different insurance providers. This involves gathering information about various policies, understanding their coverage details, and considering the overall value proposition.

- Request Quotes: Contact several insurance providers and request quotes for the specific types of insurance you need. Be sure to provide accurate and complete information about your business and its operations.

- Compare Coverage Details: Carefully review the coverage details of each policy. Pay attention to the policy limits, deductibles, exclusions, and any specific conditions.

- Consider Premiums and Value Proposition: Compare the premiums of different policies, taking into account the coverage provided. Choose a provider that offers the best value for your money, balancing premium costs with the level of protection offered.

- Read Reviews and Testimonials: Research the reputation of each insurance provider by reading online reviews, customer testimonials, and industry ratings. This can provide valuable insights into their claims handling processes and overall customer satisfaction.

- Seek Professional Advice: If you’re unsure about which insurance policies to choose, consider consulting with an independent insurance broker. They can provide impartial advice and help you navigate the complex world of business insurance.

Making a Claim with Business Insurance

Making a claim with your business insurance is a crucial process that can help you recover from unexpected events and minimize financial losses. The process is generally straightforward, but understanding the steps involved and adhering to your policy terms and conditions can significantly improve your chances of a successful claim.

Understanding the Claims Process

The claims process typically involves several steps:

- Report the Incident: Immediately notify your insurer about the incident. You can usually do this by phone, email, or through their online portal. Make sure to provide all relevant details about the incident, including the date, time, location, and any witnesses.

- Document the Incident: Thoroughly document the incident, including taking photographs or videos, gathering witness statements, and preserving any damaged property. This documentation will be crucial for supporting your claim.

- Submit the Claim: Your insurer will provide you with a claim form. Complete the form accurately and submit it with all supporting documentation.

- Claim Investigation: The insurer will investigate your claim to verify the details and assess the extent of the damage. They may request additional information or conduct an inspection.

- Claim Settlement: Once the investigation is complete, the insurer will make a decision on your claim. If approved, they will pay out the claim amount according to your policy terms and conditions.

Tips for Documenting and Reporting Incidents Effectively

Effective documentation and reporting are crucial for a successful claim. Here are some tips:

- Be Prompt: Report the incident to your insurer as soon as possible. This demonstrates your commitment to transparency and helps the insurer start the investigation promptly.

- Be Thorough: Provide detailed information about the incident, including the date, time, location, and any witnesses.

- Be Accurate: Ensure all information you provide is accurate and truthful. False or misleading information can jeopardize your claim.

- Preserve Evidence: Take photographs or videos of the damaged property and the scene of the incident. Gather witness statements and keep any relevant documents, such as invoices or receipts.

- Keep Records: Maintain a detailed record of all communication with your insurer, including dates, times, and the content of conversations.

Understanding Policy Terms and Conditions

Thoroughly understanding your policy terms and conditions is essential for a successful claim. Here are some key points to consider:

- Covered Risks: Ensure that the incident you are claiming for is covered by your policy. Some policies have specific exclusions or limitations.

- Claim Limits: Your policy will specify the maximum amount you can claim for each covered risk.

- Deductibles: Most policies have deductibles, which are the amount you need to pay out-of-pocket before the insurer covers the remaining costs.

- Time Limits: Your policy will specify a time limit for reporting claims. Failing to meet this deadline can result in your claim being denied.

Resources and Further Information

Navigating the world of business insurance can be complex. To help you make informed decisions, we’ve compiled a list of valuable resources. These resources can provide further insights, tools, and guidance to ensure you choose the right insurance coverage for your specific business needs.

Government Websites

Government websites offer a wealth of information on business insurance regulations, requirements, and support programs.

- Australian Securities and Investments Commission (ASIC): ASIC provides comprehensive information on insurance products, including business insurance, and consumer protection regulations. You can find guides, fact sheets, and resources on various insurance topics.

- Australian Prudential Regulation Authority (APRA): APRA regulates the insurance industry in Australia. Their website provides information on insurance company solvency, financial reporting, and industry standards.

- Australian Taxation Office (ATO): The ATO provides information on tax implications of business insurance premiums and claims. You can find guidance on deductibility of premiums and how to report insurance income.

Industry Associations

Industry associations represent specific business sectors and provide valuable resources and support for their members, including information on relevant insurance policies.

- Australian Chamber of Commerce and Industry (ACCI): The ACCI provides resources and advocacy on business issues, including insurance. They offer information on insurance policies, risk management, and legal advice.

- National Insurance Brokers Association (NIBA): NIBA represents insurance brokers in Australia. Their website offers information on insurance products, industry trends, and consumer rights.

- Insurance Council of Australia (ICA): The ICA is the peak body for the Australian insurance industry. They provide information on insurance products, industry statistics, and consumer advocacy.

Professional Insurance Brokers and Advisors

Engaging a professional insurance broker or advisor can be highly beneficial. They can provide personalized advice, help you understand your insurance needs, and compare quotes from different insurers.

- NIBA Member Directory: You can search for NIBA-member brokers in your area on their website. These brokers are required to adhere to professional standards and ethical conduct.

- Financial Planning Association of Australia (FPA): The FPA provides a directory of certified financial planners who can assist you with insurance needs as part of your overall financial planning.

- Your Accountant or Business Advisor: Your existing accountant or business advisor may have relationships with reputable insurance brokers and can provide recommendations based on your specific needs.

Conclusion

As you navigate the complex world of business insurance in Australia, remember that seeking professional advice from a qualified insurance broker is essential. They can provide personalized guidance, help you identify your specific needs, and recommend the most suitable insurance policies to protect your business. By taking the time to understand the intricacies of business insurance, you can empower yourself to make informed decisions that safeguard your company’s future and ensure its continued success.

FAQ Summary

What are the legal requirements for business insurance in Australia?

While there is no universal requirement for all businesses to have insurance, specific industries or activities may have mandatory insurance requirements. For example, businesses operating in construction, mining, or transportation often have legal obligations to hold certain types of insurance. It’s essential to consult with your industry association or relevant government agencies to understand any specific insurance requirements that apply to your business.

How do I choose the right insurance provider for my business?

Selecting the right insurance provider is crucial. Research different providers, compare quotes, and consider factors like their reputation, customer service, and claims handling processes. It’s also advisable to seek recommendations from other businesses or industry experts.

What is the process for making a claim with business insurance?

When you need to make a claim, contact your insurance provider immediately. They will guide you through the process, which typically involves providing details about the incident, supporting documentation, and completing necessary forms. It’s essential to follow the insurer’s instructions carefully and keep thorough records of all communications and documentation.