- Introduction to Insurance in Australia

- Types of Insurance in Australia

- Health Insurance in Australia

- Home and Contents Insurance in Australia

- Motor Vehicle Insurance in Australia

- Life Insurance in Australia

- Travel Insurance in Australia

- Business Insurance in Australia

- Workers’ Compensation Insurance in Australia

- Liability Insurance in Australia

- Pet Insurance in Australia

- Choosing the Right Insurance in Australia

- Tips for Managing Insurance in Australia

- Closure

- Frequently Asked Questions

Types of insurance in Australia sets the stage for this enthralling narrative, offering readers a glimpse into a world of financial protection and peace of mind. Australia boasts a diverse and comprehensive insurance landscape, catering to the unique needs of its citizens. From safeguarding your health to securing your assets, insurance plays a crucial role in the lives of Australians, providing a safety net against unforeseen circumstances.

This guide explores the various types of insurance available in Australia, providing insights into their coverage, benefits, and considerations. Whether you’re a homeowner seeking protection for your property, a traveler venturing abroad, or a business owner seeking to mitigate risks, this comprehensive overview will equip you with the knowledge to make informed decisions about your insurance needs.

Introduction to Insurance in Australia

Insurance plays a crucial role in the lives of Australians, providing financial protection against unexpected events and risks. It is a fundamental concept that helps individuals and businesses mitigate potential losses and maintain financial stability.

The Australian insurance industry is a significant contributor to the country’s economy, encompassing a wide range of insurance products and services.

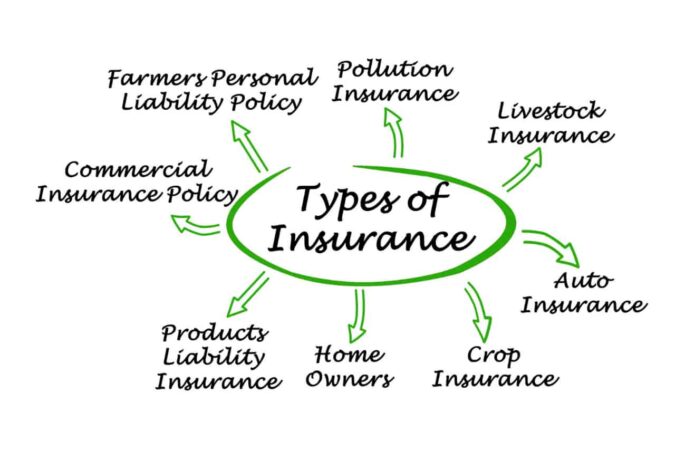

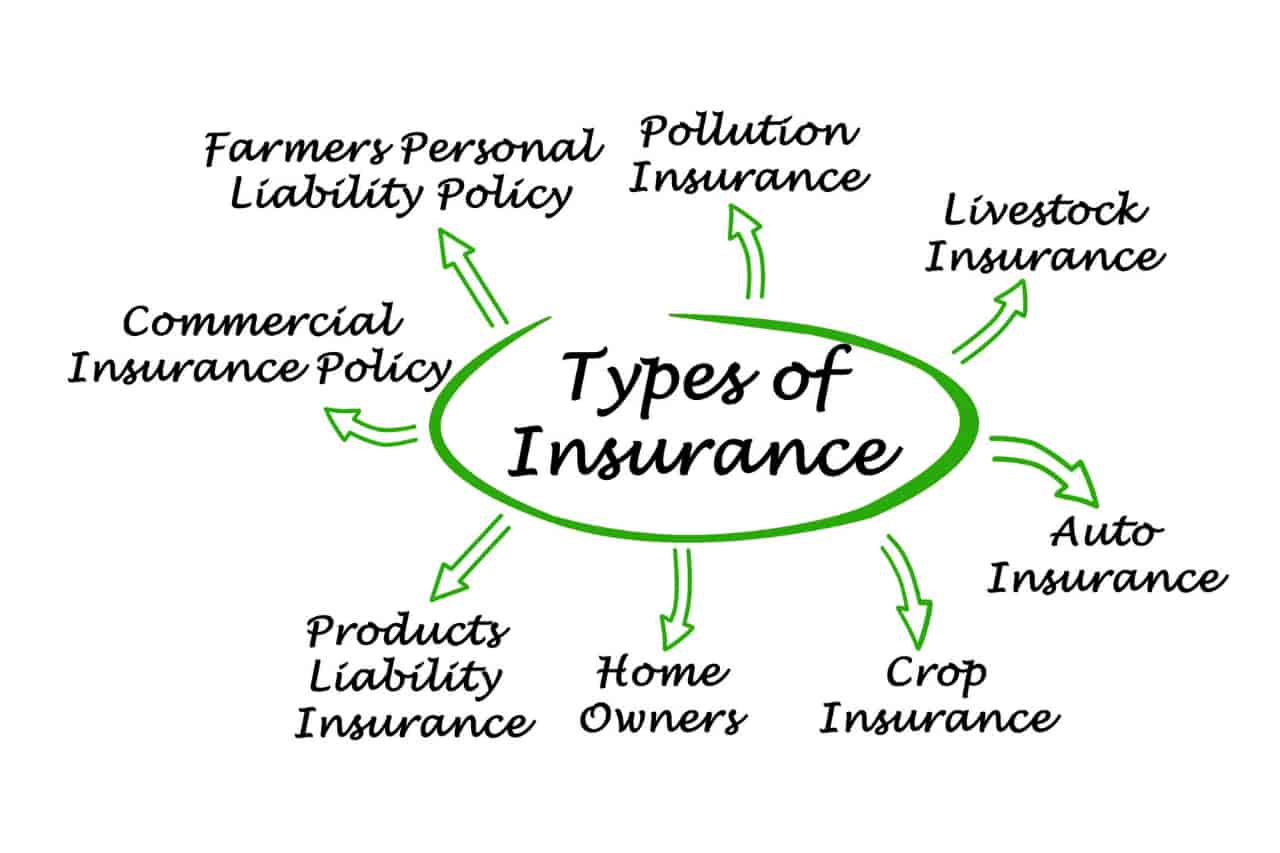

Types of Insurance in Australia

Insurance in Australia can be broadly categorized into several types, each addressing specific risks and needs. These types include:

- General Insurance: This category encompasses insurance products that cover a wide range of risks, such as property damage, liability, and accidents. Examples include home insurance, car insurance, and business insurance.

- Life Insurance: This type of insurance provides financial protection to beneficiaries in the event of the insured person’s death. It can include term life insurance, whole life insurance, and other variations.

- Health Insurance: Health insurance policies cover medical expenses and provide access to private healthcare services. It can include hospital cover, extras cover, and ambulance cover.

- Travel Insurance: Travel insurance offers financial protection against unexpected events while traveling, such as medical emergencies, flight cancellations, and lost luggage.

The Importance of Insurance in Australia

Insurance is essential for Australians due to several reasons:

- Financial Protection: Insurance provides a financial safety net by covering potential losses from unexpected events. For example, home insurance protects homeowners from financial hardship in the event of a fire or natural disaster.

- Peace of Mind: Knowing that you are insured can provide peace of mind and reduce stress in the face of uncertainty. For example, having car insurance can alleviate worries about the financial consequences of an accident.

- Legal Compliance: Some types of insurance, such as workers’ compensation insurance, are mandatory by law in Australia. These policies protect employers from liability in case of workplace accidents.

- Access to Healthcare: Health insurance provides Australians with access to private healthcare services, which can complement the public healthcare system.

Types of Insurance in Australia

Insurance is an essential part of life in Australia, providing financial protection against unexpected events and risks. Understanding the different types of insurance available can help you make informed decisions about your financial security.

Types of Insurance in Australia

This section will explore the diverse range of insurance types available in Australia, categorizing them based on their primary purpose and coverage.

| Insurance Type | Description | Coverage | Examples |

|---|---|---|---|

| Health Insurance | Private health insurance provides coverage for medical expenses not covered by Medicare, the public health system. | Hospital and/or ancillary benefits, such as dental, physiotherapy, and optical. | Private hospital cover, extras cover, ambulance cover. |

| Home and Contents Insurance | Protects your home and its contents against damage or loss caused by various events, such as fire, theft, and natural disasters. | Building structure, contents, and personal liability. | House insurance, apartment insurance, renters insurance. |

| Motor Vehicle Insurance | Provides financial protection against damage or loss to your vehicle, and liability for injuries or damage caused to others. | Third-party property damage, third-party injury, comprehensive cover, and fire and theft. | Compulsory third-party insurance (CTP), comprehensive car insurance, third-party property damage insurance. |

| Life Insurance | Provides a financial payout to your beneficiaries upon your death. | Death benefit, terminal illness benefit, and total and permanent disability (TPD) benefit. | Term life insurance, whole life insurance, and endowment insurance. |

| Travel Insurance | Covers unexpected events while you’re traveling, such as medical emergencies, lost luggage, and trip cancellations. | Medical expenses, travel delays, lost or stolen belongings, and trip cancellation. | Single-trip travel insurance, multi-trip travel insurance, and backpacker insurance. |

| Business Insurance | Protects businesses against various risks, such as property damage, liability claims, and business interruption. | Public liability, product liability, professional indemnity, and business interruption insurance. | General liability insurance, professional indemnity insurance, workers’ compensation insurance. |

| Workers’ Compensation Insurance | Provides financial benefits to employees injured or become ill at work. | Medical expenses, lost wages, and rehabilitation costs. | Compulsory workers’ compensation insurance for employers in most industries. |

| Liability Insurance | Protects individuals and businesses from financial losses due to claims of negligence or wrongdoing. | Legal defense costs, compensation for injuries or property damage. | Public liability insurance, product liability insurance, professional indemnity insurance. |

| Pet Insurance | Covers veterinary expenses for your pet in case of illness or injury. | Medical expenses, surgery, hospitalization, and ongoing care. | Accident-only pet insurance, comprehensive pet insurance. |

| Other Specialized Insurance Types | These include various insurance products designed to meet specific needs. | Coverage varies depending on the specific insurance type. | Income protection insurance, cyber insurance, landlord insurance, strata insurance. |

Health Insurance in Australia

Australia has a unique healthcare system that combines public and private health insurance. The government provides universal healthcare through Medicare, while private health insurance offers additional coverage and benefits. Understanding the different types of health insurance available in Australia is crucial for making informed decisions about your healthcare needs and financial planning.

Medicare

Medicare is Australia’s universal healthcare system, providing essential medical services to all Australian citizens and permanent residents. It is funded through taxes and provides access to a wide range of services, including:

- Hospital treatment, including surgery and intensive care

- General practitioner (GP) consultations

- Some specialist consultations

- Diagnostic tests, such as X-rays and blood tests

- Some medications, such as vaccines and some prescription drugs

Medicare is a valuable resource, but it has limitations. It does not cover all medical expenses, such as:

- Private hospital rooms

- Dental care (except for some basic services for children)

- Physiotherapy and other allied health services

- Most medications

- Cosmetic surgery

Waiting times for elective surgery and specialist consultations can also be long under Medicare.

Private Health Insurance

Private health insurance provides supplementary coverage to Medicare, offering a wider range of benefits and faster access to healthcare. Private health insurance policies vary widely in their coverage and costs, depending on the provider, the level of cover, and the individual’s age and health status.

- Hospital cover: Covers private hospital room, choice of doctor, and shorter waiting times for elective surgery. It can also include extras such as private hospital accommodation, private hospital beds, and other benefits.

- Extras cover: Covers a range of services not covered by Medicare, such as dental, optical, physiotherapy, and chiropractor services. The level of coverage varies depending on the policy and the provider.

Government Incentives for Private Health Insurance

The Australian government provides incentives to encourage Australians to take out private health insurance. These incentives include:

- Medicare Levy Surcharge: A penalty for high-income earners who do not have private health insurance.

- Lifetime Health Cover (LHC): A loading on premiums for people who take out private health insurance after the age of 31.

- Private Health Insurance Rebate: A government subsidy that reduces the cost of private health insurance premiums for eligible individuals.

Comparing Private Health Insurance Policies

When choosing a private health insurance policy, it is important to compare different providers and policies to find the best value for your needs. Consider factors such as:

- Coverage: What services are covered by the policy?

- Premiums: How much does the policy cost?

- Excesses: How much do you have to pay out-of-pocket before the insurance kicks in?

- Waiting periods: How long do you have to wait before you can claim certain benefits?

- Provider network: Which hospitals and doctors are covered by the policy?

Key Considerations

When choosing between Medicare and private health insurance, it is important to consider your individual circumstances and needs. Factors to consider include:

- Your health status: If you have pre-existing health conditions, you may need to consider private health insurance to ensure you have access to the care you need.

- Your income: If you earn a high income, you may be subject to the Medicare Levy Surcharge.

- Your lifestyle: If you are a young, healthy individual with no pre-existing conditions, you may be able to rely on Medicare.

- Your financial situation: Private health insurance can be expensive, so you need to consider whether you can afford the premiums.

Home and Contents Insurance in Australia

Owning a home is a significant investment for many Australians. It’s a place where memories are made, families grow, and lives are lived. Protecting this investment from unexpected events is crucial, and that’s where home and contents insurance comes in. This type of insurance provides financial protection against various risks that could damage your home or belongings.

Importance of Home and Contents Insurance

Home and contents insurance plays a vital role in safeguarding your financial well-being in the event of unforeseen circumstances. It acts as a safety net, helping you rebuild your life and recover from losses. Here are some key reasons why it’s essential:

- Protection against natural disasters: Australia is prone to natural disasters like bushfires, floods, cyclones, and earthquakes. Home and contents insurance can help you cover the costs of repairs or replacement if your home or belongings are damaged.

- Coverage for theft and vandalism: Your home and its contents are vulnerable to theft and vandalism. Insurance can provide financial assistance to repair or replace stolen or damaged items.

- Peace of mind: Knowing you have insurance can give you peace of mind, knowing that you’re protected in case of an unexpected event.

- Financial security: Home and contents insurance can help you avoid significant financial hardship in the event of a major loss. It can cover the costs of repairs, replacement, and temporary accommodation, ensuring you can get back on your feet.

Factors Influencing Home Insurance Premiums

Several factors determine the cost of your home insurance premiums. Understanding these factors can help you make informed decisions about your policy:

- Location: The risk of natural disasters and crime varies depending on your location. Areas prone to bushfires, floods, or high crime rates generally have higher premiums.

- Property value: The higher the value of your home and its contents, the higher your premium will be. This is because the insurer needs to cover the cost of replacing or repairing more expensive items.

- Building materials: Homes built with more expensive materials, such as brick or stone, may have higher premiums than those built with cheaper materials.

- Security features: Homes with security features like alarms, security doors, and motion sensors are considered less risky and may qualify for lower premiums.

- Your claims history: If you have made previous claims on your home insurance, your premiums may be higher. Insurers consider your claims history to assess your risk profile.

Coverage Options in Home and Contents Insurance Policies

Home and contents insurance policies offer various coverage options to suit different needs. Here are some common coverages included:

- Building cover: This covers damage to the structure of your home, including the walls, roof, and foundation. It can also cover repairs or replacement for damage caused by natural disasters, fire, theft, or vandalism.

- Contents cover: This covers your personal belongings, such as furniture, appliances, electronics, clothing, and jewelry. It can provide financial assistance to replace or repair these items if they are damaged or stolen.

- Liability cover: This protects you from financial claims made by others if they are injured on your property. It can cover legal fees and compensation payments.

- Loss of rent cover: This provides financial assistance if you are unable to live in your home due to damage or repairs. It can cover the cost of temporary accommodation while your home is being fixed.

- Optional extras: Many insurers offer optional extras, such as cover for valuable items, legal expenses, and temporary accommodation.

Claiming Insurance in Case of Damage or Loss

If you need to make a claim on your home and contents insurance, it’s important to follow the insurer’s procedures:

- Report the claim: Contact your insurer immediately after the damage or loss occurs. Provide details about the event, the extent of the damage, and any relevant information.

- Gather evidence: Take photos or videos of the damage, and keep any receipts or invoices for repairs or replacements. This will help you support your claim.

- Cooperate with the insurer: Provide the insurer with all the necessary information and documents, and follow their instructions for the claim process.

- Consider professional assistance: If you have significant damage, you may need to hire a builder or other professionals to assess and repair the damage. Make sure to keep receipts and invoices for these services.

- Negotiate a settlement: Once the insurer has assessed your claim, they will offer a settlement. You have the right to negotiate the settlement amount if you believe it’s not fair.

Motor Vehicle Insurance in Australia

Motor vehicle insurance is a crucial aspect of owning and operating a vehicle in Australia. It protects you financially in case of accidents, theft, or damage to your vehicle. Understanding the different types of motor vehicle insurance available and the legal requirements is essential for responsible vehicle ownership.

Types of Motor Vehicle Insurance in Australia

There are several types of motor vehicle insurance available in Australia, each offering varying levels of coverage and protection.

- Compulsory Third-Party Insurance (CTP): This type of insurance is mandatory in all Australian states and territories. It provides coverage for injuries or death caused to other people in an accident, including passengers in your vehicle, pedestrians, and other road users. CTP insurance does not cover damage to your own vehicle or any property damage caused by you.

- Third-Party Property Damage Insurance: This type of insurance covers damage to other people’s property caused by you in an accident. It does not cover damage to your own vehicle or personal injuries.

- Comprehensive Insurance: This is the most comprehensive type of motor vehicle insurance, offering coverage for damage to your own vehicle, regardless of who is at fault, as well as third-party liability and property damage. It also includes coverage for theft, fire, and natural disasters.

- Third-Party Fire and Theft Insurance: This type of insurance covers damage to your own vehicle caused by fire or theft, but not damage caused by accidents.

Legal Requirements for Motor Vehicle Insurance in Australia

In Australia, it is a legal requirement to have CTP insurance for all registered vehicles. This requirement applies to all states and territories. Failing to have CTP insurance can result in significant fines and penalties. Other types of motor vehicle insurance, such as comprehensive insurance, are not mandatory but are highly recommended for financial protection.

Benefits and Limitations of Different Motor Vehicle Insurance Policies

Each type of motor vehicle insurance policy has its own benefits and limitations.

Compulsory Third-Party Insurance (CTP)

- Benefits: Provides essential coverage for injuries or death caused to other people in an accident.

- Limitations: Does not cover damage to your own vehicle or property damage caused by you.

Third-Party Property Damage Insurance

- Benefits: Covers damage to other people’s property caused by you in an accident.

- Limitations: Does not cover damage to your own vehicle or personal injuries.

Comprehensive Insurance

- Benefits: Provides the most comprehensive coverage, including damage to your own vehicle, third-party liability, and property damage. It also covers theft, fire, and natural disasters.

- Limitations: Can be more expensive than other types of insurance.

Third-Party Fire and Theft Insurance

- Benefits: Covers damage to your own vehicle caused by fire or theft.

- Limitations: Does not cover damage caused by accidents.

Key Factors to Consider When Choosing Motor Vehicle Insurance

Choosing the right motor vehicle insurance policy is crucial for ensuring adequate financial protection. Here are some key factors to consider:

- Your budget: The cost of insurance varies depending on the type of policy, your vehicle, and your driving history. Consider your budget and choose a policy that you can afford.

- Your vehicle: The type, age, and value of your vehicle will affect the cost of insurance. Older and more expensive vehicles typically have higher insurance premiums.

- Your driving history: Your driving history, including any accidents or traffic violations, can impact your insurance premiums. A clean driving record can result in lower premiums.

- Your driving habits: Your driving habits, such as the distance you drive, the time of day you drive, and your driving style, can influence your insurance premiums.

- Your personal circumstances: Your personal circumstances, such as your age, occupation, and family situation, can also affect your insurance premiums.

Life Insurance in Australia

Life insurance in Australia provides financial protection to your loved ones in the unfortunate event of your passing. It offers a lump sum payment, known as a death benefit, to help cover expenses like funeral costs, outstanding debts, and ongoing living costs for your dependents.

Types of Life Insurance

There are different types of life insurance policies available in Australia, each with its own features and benefits.

- Term Life Insurance: This type of policy provides coverage for a specific period, typically 10, 20, or 30 years. It offers a lower premium than permanent life insurance, but it does not accumulate cash value. If you die within the term of the policy, your beneficiaries will receive the death benefit. If you outlive the term, the policy expires, and you receive nothing.

- Whole Life Insurance: This type of policy provides lifetime coverage, meaning it will remain in effect as long as you pay the premiums. It accumulates cash value that you can borrow against or withdraw from. Whole life insurance is more expensive than term life insurance, but it provides permanent coverage and offers a cash value component.

- Permanent Life Insurance: This is a broad category that includes whole life insurance, universal life insurance, and variable life insurance. These policies offer permanent coverage and have a cash value component.

Benefits and Drawbacks of Life Insurance Policies

- Term Life Insurance:

- Benefits: Lower premiums, provides coverage for a specific period, ideal for temporary needs like covering a mortgage or young children.

- Drawbacks: No cash value accumulation, coverage expires after the term, may not be suitable for long-term financial needs.

- Whole Life Insurance:

- Benefits: Lifetime coverage, accumulates cash value, can be used for long-term financial planning.

- Drawbacks: Higher premiums than term life insurance, may not be affordable for everyone.

Factors to Consider When Choosing a Life Insurance Policy

- Your financial situation: Consider your income, expenses, and outstanding debts.

- Your dependents: Determine the financial needs of your spouse, children, or other dependents.

- Your health: Your health status will affect your premiums.

- Your lifestyle: Consider your hobbies and activities, as they can impact your insurance premiums.

- Your budget: Choose a policy that fits your budget and provides the coverage you need.

Insurance Payout Process

In the event of death, the insurance payout process involves the following steps:

- Notification of Death: Your beneficiaries must notify the insurance company of your death, usually by providing a death certificate.

- Claim Filing: The beneficiaries will need to file a claim with the insurance company, providing all necessary documentation, including the death certificate, policy details, and beneficiary information.

- Claim Review: The insurance company will review the claim and verify the information provided.

- Payout: Once the claim is approved, the insurance company will issue the death benefit payment to the designated beneficiaries.

Travel Insurance in Australia

Travel insurance is an essential consideration for Australian travelers, providing financial protection against unexpected events that could disrupt or even derail your trip. It offers peace of mind, knowing that you have a safety net in place if the unexpected occurs.

Key Coverage Options

Travel insurance policies typically include a range of coverage options to protect you against various risks. These options can vary depending on the insurer and the specific policy you choose. Here are some common coverage components:

- Medical Expenses: Covers the cost of medical treatment, including hospital stays, doctor’s fees, and emergency medical evacuation, if you fall ill or are injured while traveling.

- Trip Cancellation or Interruption: Provides reimbursement for non-refundable trip costs if you need to cancel or interrupt your trip due to unforeseen circumstances, such as illness, injury, or family emergencies.

- Lost or Stolen Luggage: Covers the cost of replacing lost or stolen luggage and personal belongings, up to a specified limit.

- Personal Liability: Protects you against claims of accidental damage or injury caused to others during your trip.

- Emergency Assistance: Provides 24/7 support services, including assistance with medical emergencies, legal issues, and lost or stolen travel documents.

- Natural Disasters: Offers coverage for trip cancellations or interruptions caused by natural disasters, such as earthquakes, volcanic eruptions, or floods.

- Terrorism and Political Unrest: May provide coverage for trip cancellations or interruptions due to terrorism or political unrest in your destination country.

Factors to Consider When Choosing Travel Insurance

Choosing the right travel insurance policy is crucial to ensure you have adequate protection. Here are some factors to consider:

- Destination: The type of coverage you need will depend on your destination. For example, if you’re traveling to a remote or high-risk area, you may need more comprehensive coverage.

- Duration of Trip: Longer trips typically require more extensive coverage than shorter trips.

- Activities: If you plan to engage in high-risk activities, such as skiing, scuba diving, or extreme sports, you’ll need a policy that covers those activities.

- Age and Health: Your age and health status can affect the cost and availability of travel insurance.

- Pre-existing Medical Conditions: If you have any pre-existing medical conditions, you may need to disclose them to the insurer and obtain specific coverage for them.

- Budget: Travel insurance premiums vary depending on the level of coverage and the insurer. It’s important to find a policy that fits your budget while providing adequate protection.

Scenarios Where Travel Insurance Might Be Beneficial

Travel insurance can be a lifesaver in various situations. Here are some examples:

- Medical Emergency: If you fall ill or are injured while traveling, travel insurance can cover the cost of medical treatment, including hospital stays and emergency medical evacuation. For instance, imagine you’re on a hiking trip in the Australian outback and you break your leg. Travel insurance could cover the cost of helicopter rescue and medical treatment at a nearby hospital.

- Trip Cancellation: Travel insurance can reimburse you for non-refundable trip costs if you need to cancel your trip due to unforeseen circumstances. For example, if you have to cancel your trip due to a family emergency or illness, travel insurance could help you recover some of your lost expenses.

- Lost or Stolen Luggage: Travel insurance can help you replace lost or stolen luggage and personal belongings. Imagine you’re traveling to Europe and your luggage is lost during transit. Travel insurance could help you purchase new clothes and essential items until your luggage is recovered.

- Natural Disaster: Travel insurance can provide coverage for trip cancellations or interruptions caused by natural disasters. If a volcanic eruption disrupts your travel plans, travel insurance could help you recover some of your lost expenses.

Business Insurance in Australia

Business insurance is a vital component of any successful business in Australia. It provides financial protection against various risks that could potentially disrupt operations, damage assets, or lead to legal liabilities.

Types of Business Insurance

Business insurance encompasses a wide range of policies designed to address specific risks faced by businesses. Some common types include:

- Public Liability Insurance: This policy protects businesses from financial losses arising from claims of injury or property damage caused by their operations or employees. It is essential for businesses that interact with the public, such as retailers, restaurants, and service providers.

- Professional Indemnity Insurance: Also known as errors and omissions insurance, this policy safeguards professionals against financial losses resulting from negligent advice, errors, or omissions in their services. It is crucial for professionals such as accountants, lawyers, architects, and consultants.

- Product Liability Insurance: This policy covers businesses against claims arising from defective products that cause injury or damage. It is particularly important for manufacturers, distributors, and retailers.

- Property Insurance: This policy provides financial protection against damage or loss to a business’s physical assets, such as buildings, equipment, and inventory. It can cover risks like fire, flood, theft, and vandalism.

- Business Interruption Insurance: This policy helps businesses cover lost income and ongoing expenses during a period of disruption caused by an insured event, such as a fire or natural disaster. It helps ensure the business can continue operating and recover from the incident.

- Cyber Liability Insurance: In today’s digital age, this policy is crucial for businesses to protect against financial losses caused by cyberattacks, data breaches, and other cyber risks. It can cover expenses related to data recovery, legal defense, and reputational damage.

- Workers’ Compensation Insurance: This policy is mandatory in Australia and covers employees for injuries or illnesses sustained at work. It provides medical expenses, lost wages, and rehabilitation benefits.

Importance of Business Insurance

Business insurance plays a critical role in protecting a business’s assets and mitigating risks.

- Financial Protection: Business insurance provides financial protection against unexpected events that could lead to significant financial losses, such as lawsuits, property damage, or business interruption.

- Risk Management: By having appropriate insurance coverage, businesses can effectively manage their risks and minimize potential financial consequences. This allows them to focus on their core operations and growth.

- Legal Compliance: Some types of business insurance are mandatory in Australia, such as workers’ compensation insurance. Failure to comply with these requirements can result in fines and penalties.

- Peace of Mind: Knowing that a business is adequately insured provides peace of mind to business owners, employees, and stakeholders, allowing them to focus on their work and operations.

Factors to Consider When Choosing Business Insurance Policies

When selecting business insurance policies, it is essential to consider several factors:

- Industry and Business Type: The type of business and its specific risks will determine the types of insurance needed. For example, a construction company will require different coverage than a retail store.

- Assets and Liabilities: The value of a business’s assets and liabilities will influence the amount of coverage required. For example, a business with significant property assets will need higher property insurance coverage.

- Risk Tolerance: The level of risk a business is willing to accept will impact its insurance choices. Businesses with a high risk tolerance may choose lower coverage levels, while those with a low risk tolerance may opt for more comprehensive coverage.

- Budget: The cost of insurance premiums should be factored into the business’s budget. It is important to find a balance between adequate coverage and affordability.

- Insurance Provider: Different insurance providers offer varying coverage options, premiums, and customer service. It is essential to compare quotes and research different providers to find the best fit for the business’s needs.

Examples of Situations Where Business Insurance Might Be Crucial

Business insurance can be crucial in a wide range of situations. Some examples include:

- A customer is injured on business premises: Public liability insurance would cover the costs associated with the injury, such as medical expenses and legal fees.

- A professional provides incorrect advice that results in financial loss for a client: Professional indemnity insurance would protect the professional from financial claims arising from the negligent advice.

- A fire damages a business’s property: Property insurance would cover the cost of repairs or replacement of the damaged property.

- A cyberattack disrupts a business’s operations: Cyber liability insurance would cover the costs associated with the attack, such as data recovery, legal defense, and reputational damage.

- An employee is injured at work: Workers’ compensation insurance would cover the employee’s medical expenses, lost wages, and rehabilitation benefits.

Workers’ Compensation Insurance in Australia

Workers’ compensation insurance is a crucial aspect of the Australian workplace, designed to protect employees from the financial and social consequences of work-related injuries or illnesses. It ensures that workers who experience these unfortunate events receive necessary medical treatment, income support, and rehabilitation services.

Legal Requirements for Workers’ Compensation Insurance

In Australia, employers are legally obligated to provide workers’ compensation insurance for their employees. This obligation is enforced by state and territory legislation, which varies slightly across jurisdictions. The primary purpose of these laws is to ensure that employees have access to the necessary support and benefits in the event of a workplace injury or illness.

Benefits Available to Employees

Workers’ compensation insurance offers a range of benefits to employees who suffer work-related injuries or illnesses. These benefits are designed to provide financial security and support during the recovery process. The benefits typically include:

- Medical expenses: This covers the cost of treatment, including consultations, medications, physiotherapy, and other necessary medical services.

- Weekly payments: These payments provide income support while the employee is unable to work due to their injury or illness.

- Lump sum payments: In some cases, lump sum payments may be awarded for permanent impairments or for pain and suffering.

- Rehabilitation services: These services aim to help the employee return to work or adjust to a new role if their previous job is no longer suitable.

Claiming Workers’ Compensation Benefits

The process of claiming workers’ compensation benefits typically involves the following steps:

- Notification: The employee must notify their employer of the injury or illness as soon as possible.

- Medical assessment: The employee will be required to undergo a medical assessment by a doctor or other qualified healthcare professional.

- Claim lodgement: The employee will need to lodge a claim with their employer’s insurer.

- Assessment and decision: The insurer will assess the claim and make a decision on whether the injury or illness is work-related and eligible for benefits.

- Payment of benefits: If the claim is approved, the insurer will begin paying the relevant benefits.

Liability Insurance in Australia

Liability insurance is crucial in Australia, offering financial protection against legal claims arising from injuries, property damage, or other incidents caused by you or your business. This type of insurance safeguards you from potential financial losses, legal fees, and court judgments, providing peace of mind in various situations.

Types of Liability Insurance

Different types of liability insurance cater to specific needs and situations. Some common types include:

- Public Liability Insurance: This type covers claims arising from injuries or property damage caused by you or your business to third parties. It is essential for businesses operating in public spaces, such as restaurants, retail stores, and construction companies. For example, if a customer slips and falls in your store, public liability insurance can cover the costs associated with their injuries and legal expenses.

- Product Liability Insurance: This insurance protects manufacturers, distributors, and retailers from claims arising from defective products. It covers costs related to injuries, property damage, and legal expenses resulting from faulty products. For instance, if a faulty appliance causes a fire, product liability insurance can cover the costs of repairs, replacements, and legal settlements.

- Professional Indemnity Insurance: Also known as errors and omissions insurance, this type covers professionals like doctors, lawyers, and accountants against claims arising from negligence or errors in their professional services. This insurance is crucial for professionals whose mistakes can lead to significant financial losses for their clients.

Situations Where Liability Insurance is Essential

Liability insurance is essential in various situations, including:

- Businesses: Businesses operating in public spaces, manufacturing products, or providing professional services are at risk of liability claims. Liability insurance is crucial for managing these risks and protecting the business from financial ruin.

- Property Owners: Homeowners and landlords can face liability claims from visitors who suffer injuries on their property. Liability insurance protects them from financial losses arising from such incidents.

- Event Organizers: Organizers of events, such as concerts, festivals, and conferences, are responsible for the safety of attendees. Liability insurance is crucial for covering claims arising from injuries or property damage during these events.

- Volunteers: Volunteers participating in community organizations or events can be held liable for accidents or injuries. Liability insurance protects volunteers and the organization from financial losses in such situations.

Coverage Provided by Liability Insurance Policies

Liability insurance policies typically provide coverage for:

- Legal Defense Costs: The policy covers legal fees incurred in defending against liability claims, including court costs, expert witness fees, and attorney fees.

- Compensation Payments: If the insured is found liable, the policy covers compensation payments to the injured party or property owner. This includes medical expenses, lost wages, and property damage costs.

- Settlement Negotiations: The insurer can assist with negotiating settlements with the claimant to avoid costly court proceedings.

- Crisis Management: The insurer may provide support and guidance in handling a liability claim, including public relations advice and crisis management strategies.

Pet Insurance in Australia

Pet insurance is gaining popularity in Australia as pet owners become increasingly aware of the potential high costs associated with veterinary care. With rising vet fees and advancements in medical technology, pet insurance provides financial protection for unexpected health issues, offering peace of mind for pet owners.

Types of Coverage in Pet Insurance Policies

Pet insurance policies in Australia typically offer various levels of coverage, tailored to different needs and budgets.

- Accident and Illness Coverage: This is the most common type of pet insurance, covering expenses related to accidents and illnesses, including surgery, hospitalization, and medication.

- Routine Care Coverage: Some policies may include coverage for routine vet visits, vaccinations, and preventative care, such as dental cleanings and parasite control.

- Third-Party Liability Coverage: This coverage protects pet owners against financial liability if their pet causes damage to property or injury to another person.

- Death and Euthanasia Coverage: Some policies offer a payout upon the death or euthanasia of the pet, covering expenses related to cremation or burial.

Factors to Consider When Choosing Pet Insurance

- Breed and Age: Certain breeds are predisposed to specific health conditions, influencing premium costs. Age also plays a role, as older pets are more likely to require veterinary care.

- Coverage Levels and Exclusions: Policies vary in coverage levels, with some offering comprehensive protection while others have specific exclusions. Carefully review the policy document to understand what is covered and what is not.

- Premium Costs and Excesses: Premiums can vary depending on the insurer, coverage level, and pet’s age and breed. Consider the cost of the policy in relation to your budget and the potential savings it could provide.

- Claims Process and Customer Service: Research the insurer’s claims process and customer service reputation. Look for a provider with a straightforward claims process and responsive customer support.

Situations Where Pet Insurance Might Be Beneficial

- Unexpected Accidents: Accidents can happen at any time, resulting in costly vet bills. Pet insurance can provide financial assistance for emergency treatment, such as surgery, hospitalization, and rehabilitation.

- Chronic Illnesses: Pets can develop chronic illnesses, requiring ongoing medication and vet visits. Pet insurance can help cover these costs, ensuring your pet receives the necessary care without financial strain.

- Age-Related Health Issues: As pets age, they are more susceptible to health problems. Pet insurance can help cover the costs of managing these conditions, such as arthritis, diabetes, and heart disease.

- High-Risk Breeds: Certain breeds are prone to specific health issues, potentially leading to high vet bills. Pet insurance can provide financial protection for these potential expenses.

Choosing the Right Insurance in Australia

Navigating the world of insurance in Australia can be overwhelming, with numerous options available. Choosing the right insurance policy is crucial to ensure you have adequate protection when you need it. This guide will help you understand the factors to consider and strategies to employ when selecting the best insurance policies for your individual needs.

Understanding Your Needs

It’s essential to assess your specific requirements and circumstances before exploring insurance options. This involves considering various factors that influence your insurance needs.

Age

- Younger individuals may prioritize insurance policies that cover unexpected events, such as accidents or health issues, while older individuals might focus on policies that address long-term care or end-of-life planning.

Lifestyle

- An active lifestyle may require comprehensive travel insurance, while a sedentary lifestyle might necessitate health insurance for chronic conditions.

Health

- Individuals with pre-existing health conditions should consider policies that provide adequate coverage for their specific needs.

Financial Situation

- Your financial situation determines your ability to afford insurance premiums and coverage levels.

Risk Tolerance

- Your risk tolerance influences your decision to opt for higher coverage with higher premiums or lower coverage with lower premiums.

Comparing Quotes and Policies

Once you understand your needs, it’s time to compare different insurance quotes and policies to find the best fit.

Gather Quotes

- Obtain quotes from multiple insurers to compare premiums, coverage, and policy terms.

Review Policy Documents

- Thoroughly review the policy documents to understand the terms and conditions, including exclusions and limitations.

Consider Additional Features

- Compare additional features such as discounts, benefits, and customer service options offered by different insurers.

Seek Expert Advice

- Consult with a financial advisor or insurance broker to get personalized recommendations and assistance in choosing the right insurance policy.

Making an Informed Decision

By carefully considering your needs and comparing quotes, you can make an informed decision about your insurance coverage.

Prioritize Your Needs

- Identify your top priorities and choose a policy that adequately addresses them.

Balance Coverage and Cost

- Strike a balance between comprehensive coverage and affordable premiums.

Review Regularly

- Review your insurance policies regularly to ensure they continue to meet your changing needs and circumstances.

Tips for Managing Insurance in Australia

Insurance is an essential part of life in Australia, providing financial protection against unexpected events. Effectively managing your insurance policies can save you money, ensure you have the right coverage, and help you navigate the claims process smoothly.

Minimizing Insurance Premiums, Types of insurance in australia

Lowering your insurance premiums requires a proactive approach.

- Compare Quotes Regularly: Shop around and compare quotes from different insurers to find the best deals. Use online comparison websites or contact insurers directly.

- Increase Your Excess: Consider increasing your excess, the amount you pay upfront in case of a claim. This can lower your premium but means you’ll have to pay more out of pocket if you make a claim.

- Improve Your Home Security: Installing security systems, alarms, and smoke detectors can reduce your home and contents insurance premium.

- Maintain a Good Driving Record: For car insurance, avoid speeding, driving under the influence, or accumulating traffic violations. This can significantly impact your premium.

- Bundle Your Policies: Many insurers offer discounts if you bundle multiple policies, such as home, contents, and car insurance, with them.

Understanding Policy Terms and Conditions

Thoroughly understanding your policy terms and conditions is crucial.

- Read Your Policy Carefully: Take the time to read your policy document, paying attention to the coverage details, exclusions, and limits.

- Ask Questions: If you have any questions or don’t understand something, don’t hesitate to contact your insurer.

- Keep Your Policy Up-to-Date: Inform your insurer about any changes to your circumstances, such as a new address, renovations, or changes to your vehicle.

Making Successful Insurance Claims

Navigating the claims process can be stressful, but following these tips can increase your chances of a successful outcome.

- Report Claims Promptly: Contact your insurer as soon as possible after an incident.

- Gather Evidence: Collect all relevant evidence, such as photographs, witness statements, and repair quotes.

- Be Honest and Accurate: Provide accurate information about the incident and your claim.

- Follow the Process: Cooperate with your insurer and follow their instructions throughout the claims process.

Closure

Navigating the world of insurance in Australia can be a complex endeavor. However, by understanding the different types of insurance available and their respective benefits, you can make informed choices that align with your individual circumstances. Remember, insurance is a powerful tool for safeguarding your financial well-being and ensuring peace of mind. By taking the time to explore your options and selecting the right coverage, you can navigate life’s uncertainties with confidence.

Frequently Asked Questions

What is the difference between private health insurance and Medicare?

Medicare is Australia’s universal healthcare system, providing subsidized access to essential medical services. Private health insurance offers additional coverage for services not covered by Medicare, such as private hospitals, dental, and optical care.

How do I know if I need life insurance?

Life insurance is crucial if you have dependents who rely on your income. It provides financial support to your loved ones in the event of your death, helping them cover expenses like mortgages, debts, and living costs.

What are the main types of business insurance?

Common types of business insurance include public liability, professional indemnity, product liability, and workers’ compensation. These policies protect your business from financial losses arising from accidents, negligence, or legal claims.