- Understanding Health Insurance Premiums: What Is A Premium On Health Insurance

- Components of Health Insurance Premiums

- Factors Affecting Premium Variations

- Premium Payment Options

- Understanding Premium Increases

- Impact of Premium Costs on Individuals and Businesses

- Final Thoughts

- Question & Answer Hub

What is a premium on health insurance? It’s the monthly or annual payment you make to your insurance company in exchange for coverage. This payment ensures you have access to healthcare services when you need them, protecting you from potentially high medical bills. Understanding how these premiums are calculated is crucial for making informed decisions about your health insurance.

Several factors contribute to the cost of your health insurance premium, including your age, health status, location, and the type of coverage you choose. For example, a younger and healthier individual may pay a lower premium than an older person with pre-existing health conditions. The location where you live can also influence your premium, as healthcare costs vary across regions.

Understanding Health Insurance Premiums: What Is A Premium On Health Insurance

Health insurance premiums are the monthly or annual payments you make to your insurance company in exchange for coverage. Think of it like a membership fee that gives you access to medical care when you need it.

Factors Influencing Premium Calculation

Several factors determine the cost of your health insurance premium. These factors are used to assess your risk of needing medical care and help determine how much you’ll pay.

- Age: Older individuals tend to have higher premiums because they are more likely to need medical care.

- Health Status: People with pre-existing conditions, such as diabetes or heart disease, may have higher premiums. Insurance companies consider this because they are more likely to file claims.

- Location: Premiums can vary based on your geographic location. Areas with higher costs of living or greater demand for medical services may have higher premiums.

- Coverage Options: The type and amount of coverage you choose will influence your premium. More comprehensive plans with greater benefits typically have higher premiums.

Types of Health Insurance Premiums

There are different types of health insurance premiums, depending on the type of plan and who is covered:

- Individual Plans: These plans cover only the individual policyholder and are typically more expensive than group plans.

- Family Plans: These plans cover a family, including a spouse and children, and typically have higher premiums than individual plans, but are often more cost-effective than buying individual plans for each family member.

- Employer-Sponsored Plans: These plans are offered through an employer and are often more affordable than individual or family plans. The employer may contribute a portion of the premium, making it more accessible to employees.

Components of Health Insurance Premiums

Understanding how health insurance premiums are calculated is crucial for making informed decisions about your coverage. Premiums are the monthly payments you make to maintain your health insurance policy. These payments cover the costs of providing health insurance to you and other policyholders.

Factors Influencing Premium Rates

Several factors influence the cost of health insurance premiums. These factors are used to assess the risk associated with insuring you. Insurers use this information to determine how much they should charge you for coverage.

- Age: Older individuals tend to have higher healthcare costs, so they generally pay higher premiums.

- Location: Premiums vary depending on the cost of healthcare in your area. Places with higher healthcare costs often have higher premiums.

- Health Status: Individuals with pre-existing health conditions may have higher premiums, as they are more likely to need healthcare services.

- Lifestyle Factors: Factors like smoking, weight, and risky hobbies can increase your premium. Insurers consider these factors because they can contribute to higher healthcare costs.

- Family Size: Having a larger family generally means higher premiums, as more people are covered under the policy.

Breakdown of Premium Components

Health insurance premiums are comprised of several key components. These components represent the costs associated with providing health insurance to policyholders.

- Coverage Costs: This is the largest component of your premium. It covers the actual cost of medical care, such as doctor visits, hospital stays, and prescription drugs.

- Administrative Expenses: These costs include the salaries of insurance company employees, marketing expenses, and the costs of processing claims.

- Profit Margins: Insurance companies need to make a profit to stay in business. This profit margin is included in your premium.

Factors Affecting Premium Variations

Health insurance premiums are not fixed and can vary significantly based on a number of factors. Understanding these factors can help you make informed decisions about your health insurance coverage.

Impact of Deductibles, Copayments, and Coinsurance

Deductibles, copayments, and coinsurance are cost-sharing mechanisms that influence the premium amount. These elements directly affect the amount you pay out of pocket for healthcare services.

- Deductibles represent the amount you pay before your insurance plan starts covering healthcare expenses. A higher deductible generally leads to a lower premium. Conversely, a lower deductible usually translates to a higher premium. For example, a plan with a $1,000 deductible might have a lower premium compared to a plan with a $500 deductible.

- Copayments are fixed amounts you pay for specific services, such as doctor’s visits or prescriptions. Similar to deductibles, higher copayments often correspond to lower premiums. A plan with a $20 copay for a doctor’s visit might have a lower premium than a plan with a $10 copay.

- Coinsurance is a percentage of the cost you pay after you’ve met your deductible. A higher coinsurance percentage typically means a lower premium. For instance, a plan with a 20% coinsurance might have a lower premium than a plan with a 10% coinsurance.

Impact of Lifestyle Choices, What is a premium on health insurance

Lifestyle choices can significantly impact your health insurance premium.

- Smoking is a major risk factor for various health issues, including heart disease, stroke, and lung cancer. Insurance companies recognize this increased risk and often charge higher premiums to smokers. For instance, a smoker might pay 20% to 30% more in premiums compared to a non-smoker.

- Excessive alcohol consumption can also contribute to health problems like liver disease, high blood pressure, and certain cancers. Insurance companies may consider this factor when determining premiums. A person with a history of excessive alcohol consumption might face higher premiums.

- Body Mass Index (BMI) is another factor that can influence premiums. A high BMI is associated with an increased risk of developing chronic conditions such as diabetes and heart disease. Insurance companies may charge higher premiums to individuals with a high BMI.

Relationship Between Premium Costs and Coverage Level

The level of coverage provided by a health insurance plan directly affects the premium cost.

- Comprehensive plans, which cover a wider range of healthcare services, typically have higher premiums. These plans may offer benefits like extensive coverage for preventive care, hospitalization, and prescription drugs. For example, a platinum plan with low deductibles and comprehensive coverage would likely have a higher premium compared to a bronze plan with higher deductibles and limited coverage.

- Limited coverage plans, on the other hand, have lower premiums but offer less extensive coverage. These plans may have higher deductibles and copayments, and may not cover all services. A bronze plan, for instance, might have a lower premium but offer less coverage for certain services.

Premium Payment Options

Understanding how you can pay your health insurance premiums is essential. Different payment options offer varying levels of convenience and flexibility, which can impact your financial planning and overall budget.

Monthly Installments

Monthly installments are the most common method of paying health insurance premiums. This allows you to spread out the cost of your insurance over the year, making it more manageable.

- Benefits:

- Provides predictable monthly expenses.

- Offers flexibility to adjust your budget.

- Reduces the burden of a large lump sum payment.

- Drawbacks:

- May result in higher overall premiums due to interest charges.

- Requires consistent budgeting and timely payments to avoid late fees.

Annual Payments

Annual payments involve paying the entire year’s premium in one lump sum. This option is often preferred by individuals who have the financial capacity to make a large payment upfront.

- Benefits:

- May qualify for discounts or lower overall premiums.

- Eliminates the need for monthly payments and potential interest charges.

- Drawbacks:

- Requires a significant upfront investment.

- May be challenging for individuals with limited financial resources.

Payroll Deductions

Payroll deductions allow your employer to automatically deduct your health insurance premiums from your paycheck. This method is convenient and ensures timely payments.

- Benefits:

- Provides automatic and hassle-free premium payments.

- Reduces the risk of missed payments and late fees.

- Drawbacks:

- Limited to individuals with employer-sponsored health insurance plans.

- May not be available for all employers or plans.

Common Premium Payment Schedules and Grace Periods

Most health insurance providers offer flexible payment schedules, typically with monthly installments. However, specific payment schedules and grace periods can vary depending on the insurance company and plan.

- Common Payment Schedules:

- Monthly installments: The most common option, typically due on the 1st of each month.

- Quarterly payments: Payments are made every three months.

- Semi-annual payments: Payments are made twice a year.

- Grace Periods:

- A grace period allows you to make your premium payment after the due date without facing immediate policy cancellation.

- Grace periods typically range from 10 to 30 days, but may vary based on the insurer and plan.

- It’s crucial to be aware of your grace period and make timely payments to avoid potential disruptions in your coverage.

Understanding Premium Increases

It’s important to understand why health insurance premiums fluctuate, as this knowledge can help you make informed decisions about your coverage and manage your healthcare costs.

Reasons for Premium Increases

Premium increases are often driven by a combination of factors, including rising healthcare costs, changes in coverage, and market fluctuations.

- Rising healthcare costs: One of the primary drivers of premium increases is the overall increase in healthcare costs. These costs include everything from hospital stays and physician visits to prescription drugs and medical technology. As these costs rise, insurance companies need to charge higher premiums to cover their expenses.

- Changes in coverage: Premiums can also be affected by changes in the coverage offered by an insurance plan. For example, if a plan expands its coverage to include more benefits, or if it changes its coverage to include more expensive treatments, premiums may increase to reflect these changes.

- Market fluctuations: The health insurance market is also subject to fluctuations, such as changes in the number of people enrolled in plans or changes in the overall health of the insured population. These fluctuations can impact premiums, as insurance companies adjust their pricing to reflect the changing risk pool.

Strategies for Managing Premium Increases

While you can’t always control the factors that drive premium increases, you can take steps to manage their impact on your budget.

- Shop for alternative plans: One way to potentially reduce your premiums is to shop for alternative plans offered by other insurance companies. Compare plans based on coverage, costs, and deductibles to find the best value for your needs.

- Negotiate with your insurer: If you’re unhappy with a premium increase, consider negotiating with your insurer. Explain your situation and see if they’re willing to work with you to find a solution. For example, you might be able to lower your premium by increasing your deductible or switching to a plan with a higher copay.

Tips for Minimizing Premium Costs

By adopting a proactive approach to your health and healthcare, you can potentially reduce your premium costs in the long run.

- Preventive care: Getting regular checkups, screenings, and vaccinations can help prevent health problems from developing in the first place. This can lead to lower healthcare costs over time, which may be reflected in lower premiums.

- Healthy lifestyle choices: Making healthy lifestyle choices, such as eating a balanced diet, exercising regularly, and avoiding smoking, can also help you stay healthy and potentially lower your healthcare costs.

Impact of Premium Costs on Individuals and Businesses

Health insurance premiums are a significant financial commitment for individuals, families, and businesses. The cost of these premiums can significantly impact personal finances and business operations. This section will delve into the impact of premium costs on individuals and businesses, exploring the financial burden, the role of premiums in employer-sponsored plans, and the broader economic implications of rising premiums.

Financial Burden on Individuals and Families

Health insurance premiums can place a substantial financial burden on individuals and families, especially those with limited income. The cost of premiums can vary significantly based on factors like age, health status, location, and the type of coverage chosen. For individuals and families struggling to make ends meet, high premiums can make it challenging to afford essential healthcare services. This financial strain can lead to delayed or forgone medical care, potentially impacting overall health and well-being.

For example, a family with a median income of $60,000 per year might find it difficult to afford a monthly premium of $500 or more, especially if they also have other financial obligations such as rent, utilities, and transportation.

Role of Premiums in Employer-Sponsored Health Insurance Plans

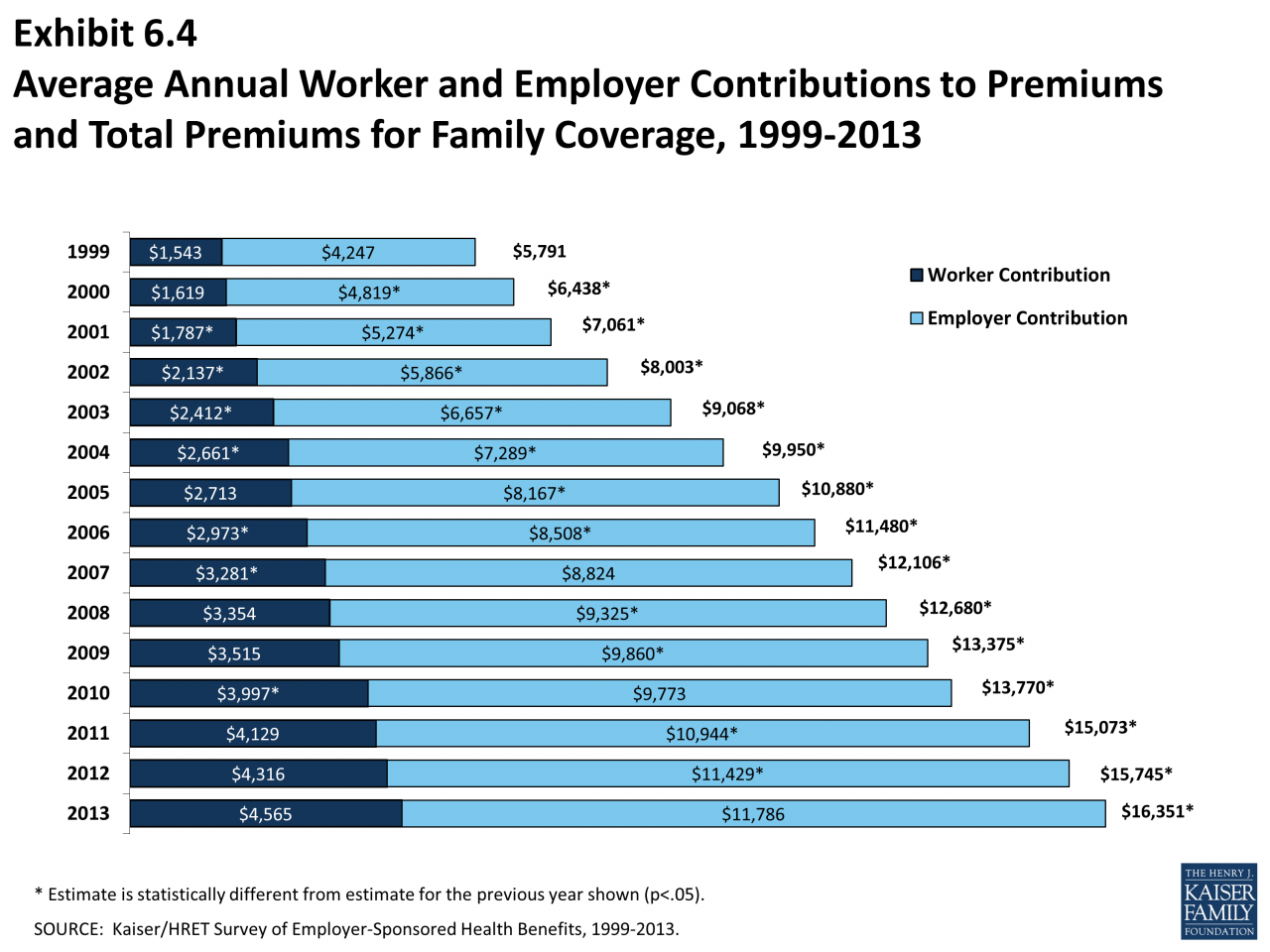

Employer-sponsored health insurance plans are a common way for individuals to obtain health coverage in the United States. Employers often contribute a portion of the premium costs for their employees, while employees pay the remaining balance. The premium costs associated with these plans can impact employee compensation and overall benefits packages.

Employers may consider premium costs when determining employee wages and benefits, as high premiums can reduce the amount of money available for other benefits or salary increases. This can impact employee morale and retention, as employees may seek employment opportunities with more affordable health insurance plans.

Economic Implications of Rising Health Insurance Premiums

Rising health insurance premiums have broader economic implications, impacting individuals, businesses, and the overall economy. As premiums increase, individuals and families may have less disposable income available for other spending, potentially slowing down economic growth. Businesses may face higher costs associated with providing health insurance to their employees, leading to reduced profitability and potentially hindering investment and job creation.

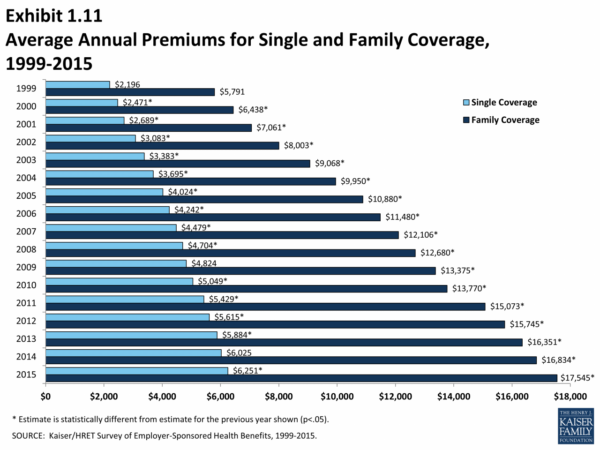

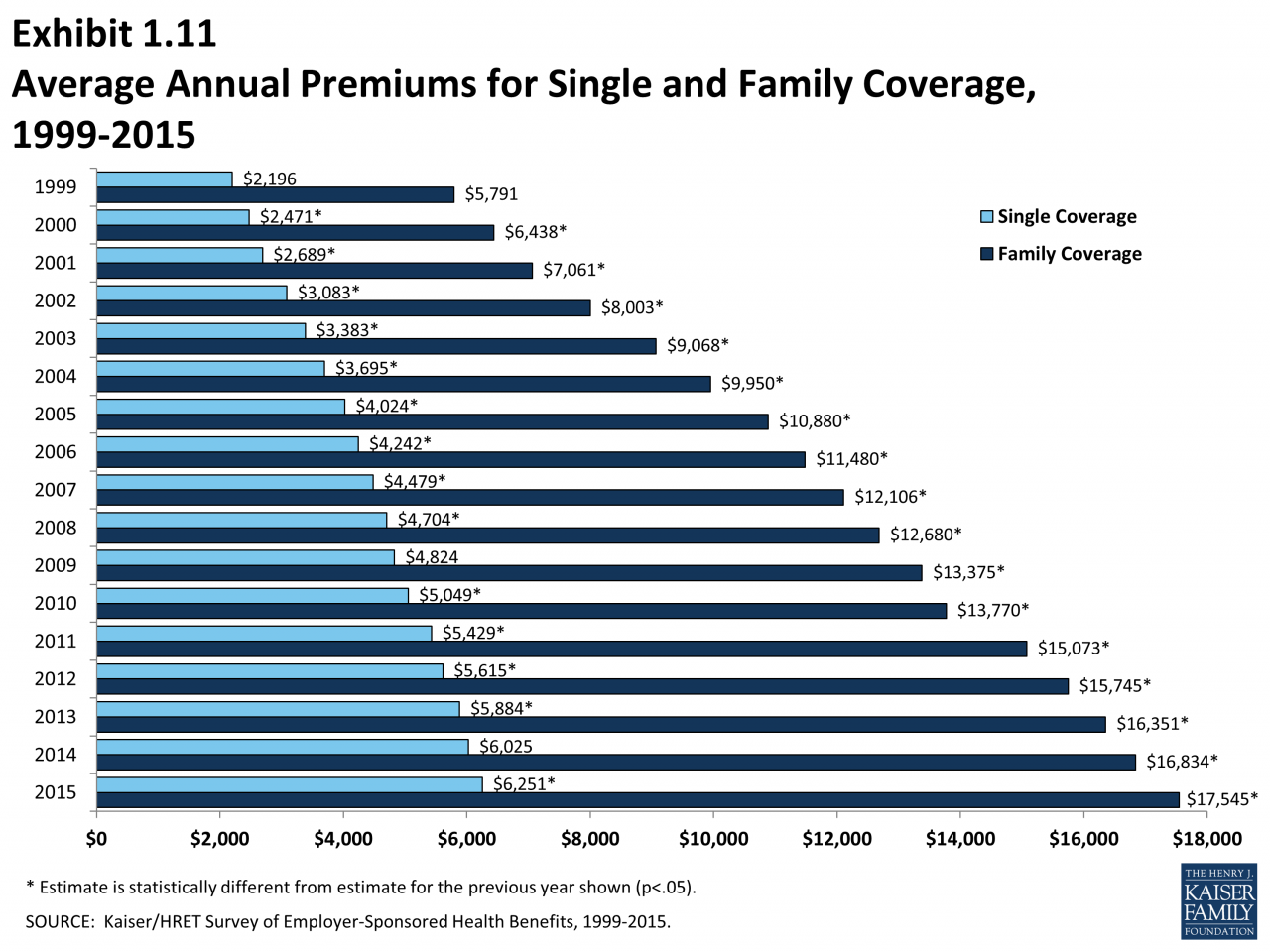

For instance, a study by the Kaiser Family Foundation found that the average annual premium for employer-sponsored health insurance plans increased by 5% in 2022, exceeding the rate of inflation. This trend of rising premiums can put pressure on businesses to reduce costs or pass them on to consumers in the form of higher prices.

Final Thoughts

In essence, health insurance premiums are the price you pay for peace of mind. They act as a financial safety net, ensuring you can access necessary medical care without facing overwhelming financial burdens. By understanding how premiums are calculated and the factors that influence their cost, you can make informed choices about your health insurance plan and manage your healthcare expenses effectively.

Question & Answer Hub

How often do health insurance premiums typically increase?

Health insurance premiums can increase annually, often due to rising healthcare costs, changes in coverage, or market fluctuations.

What are some ways to reduce my health insurance premium?

You can explore options like choosing a higher deductible, enrolling in a health savings account (HSA), or considering a different health insurance plan with lower coverage.

What happens if I miss a health insurance premium payment?

Missing a premium payment can lead to your coverage being canceled or suspended. It’s essential to contact your insurance company and work out a payment plan if you’re unable to make your payment on time.

Can I negotiate my health insurance premium?

While it’s not always possible, you can try negotiating your premium by shopping around for different plans, comparing rates, and exploring options for discounts or incentives.