- Factors Influencing Health Insurance Costs

- Average Health Insurance Premiums by Type

- Health Insurance Cost Trends

- Strategies for Reducing Health Insurance Costs

- Government Subsidies and Financial Assistance

- Health Insurance Market Overview

- Importance of Understanding Health Insurance Costs: What Is The Average Price For Health Insurance

- Last Point

- FAQ Overview

What is the average price for health insurance? This is a question on the minds of many individuals and families as they navigate the complex world of healthcare. Understanding the factors that influence health insurance costs, from age and health status to location and coverage options, is crucial for making informed decisions about your healthcare needs. This guide will provide insights into the average premiums for various health insurance plans, explore the trends shaping the market, and offer strategies for reducing your expenses.

By understanding the average prices, the factors that impact them, and the trends shaping the market, individuals and families can make informed decisions about their healthcare coverage. Whether you’re seeking individual or family plans, understanding the cost of health insurance is essential for securing adequate coverage without breaking the bank.

Factors Influencing Health Insurance Costs

The cost of health insurance can vary greatly depending on several factors. Understanding these factors can help you make informed decisions about your health insurance plan.

Age

Age is a significant factor in determining health insurance premiums. As individuals age, they tend to experience more health issues, which can lead to higher healthcare costs. Therefore, older individuals typically pay higher premiums than younger individuals.

Health Status

Your health status also plays a major role in your health insurance premium. Individuals with pre-existing health conditions, such as diabetes, heart disease, or cancer, are likely to have higher premiums. This is because they are more likely to require expensive medical care.

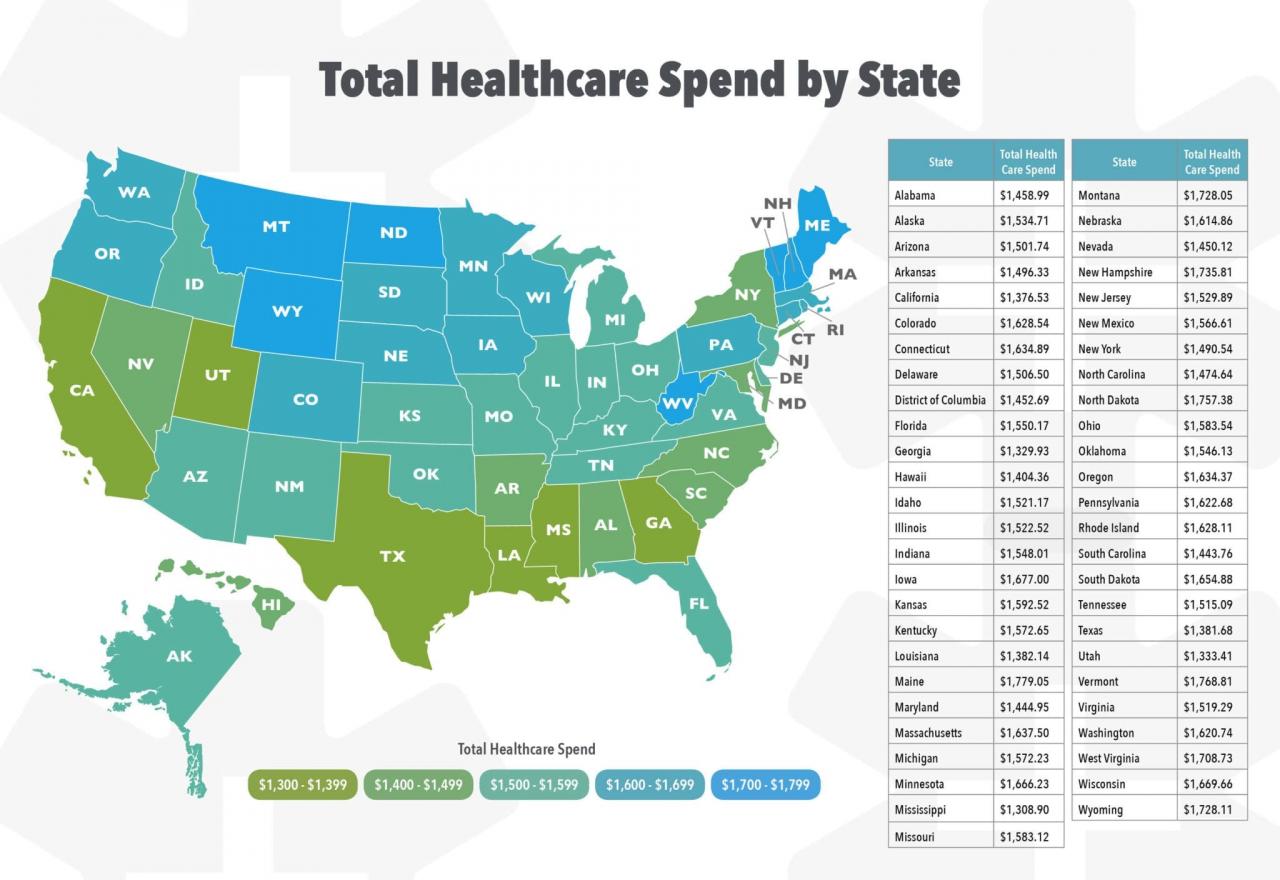

Location

The cost of healthcare varies by location. Areas with higher costs of living, such as major cities, tend to have higher health insurance premiums. The availability of healthcare providers and the competition among insurance companies also influence premium costs.

Coverage Options

The type of coverage you choose can significantly impact your premium. Plans with higher deductibles and copayments typically have lower premiums, but you will pay more out-of-pocket for medical care. Conversely, plans with lower deductibles and copayments generally have higher premiums but offer more comprehensive coverage.

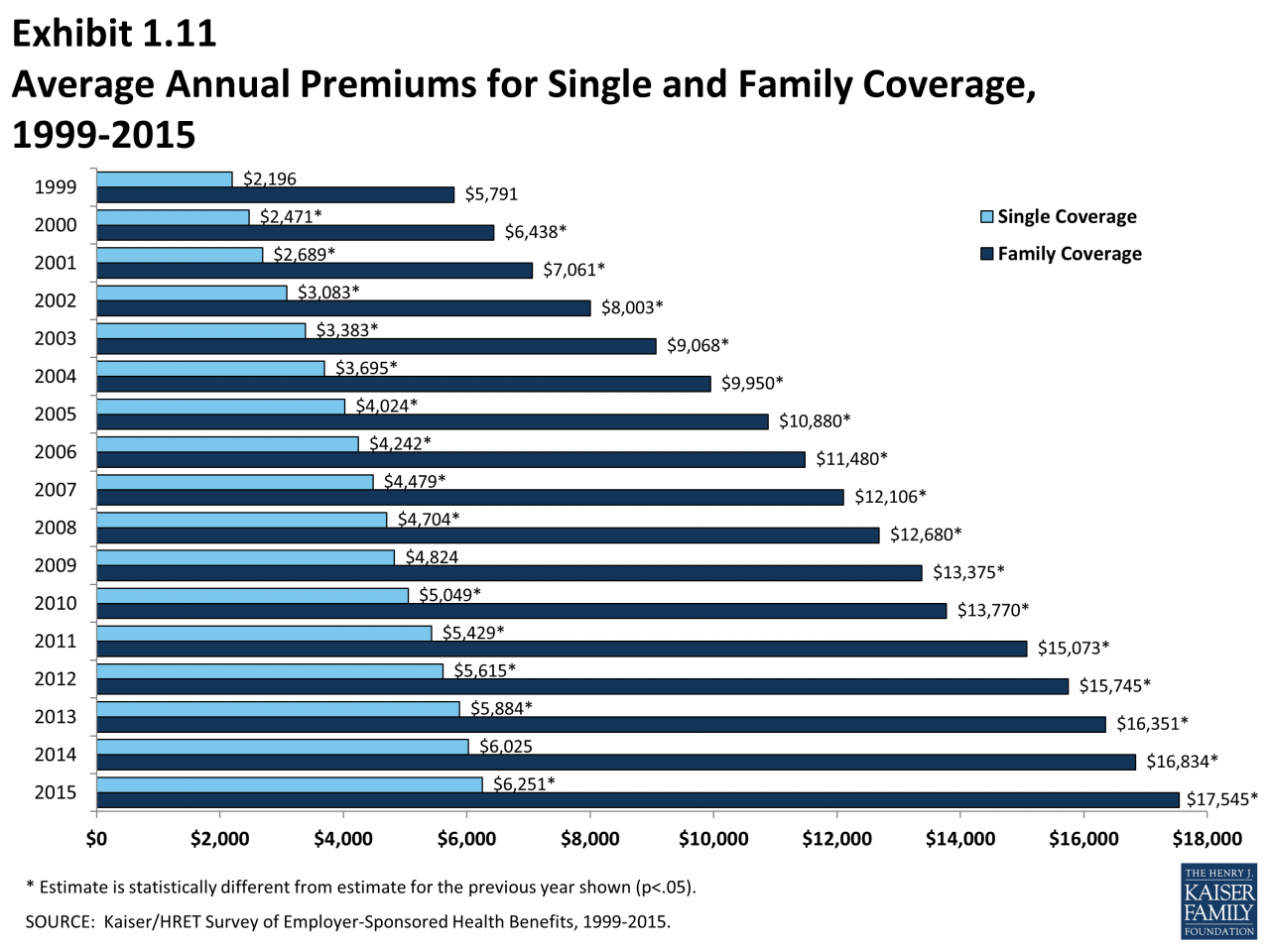

Individual vs. Family Plans

Family health insurance plans typically cost more than individual plans. This is because they cover multiple people, increasing the potential for healthcare costs. However, family plans often offer lower per-person premiums compared to individual plans.

Average Health Insurance Premiums by Type

The average cost of health insurance premiums varies significantly depending on the type of plan you choose. Understanding the different types of plans and their associated costs can help you make an informed decision that aligns with your needs and budget.

Average Premiums by Plan Type

Health insurance plans can be broadly categorized into three main types: HMOs, PPOs, and POS plans. Each type offers a unique combination of coverage, flexibility, and cost. Let’s take a closer look at the average premiums for each plan type.

| Plan Type | Coverage Level | Average Monthly Premium | Notes |

|---|---|---|---|

| HMO (Health Maintenance Organization) | Bronze | $350 | Typically the lowest-cost option with limited network choices. |

| HMO | Silver | $450 | Offers a balance between cost and coverage. |

| HMO | Gold | $550 | Provides comprehensive coverage with higher premiums. |

| HMO | Platinum | $650 | The most comprehensive plan with the highest premiums. |

| PPO (Preferred Provider Organization) | Bronze | $400 | Offers more network flexibility than HMOs but with higher premiums. |

| PPO | Silver | $500 | Provides a good balance between cost and flexibility. |

| PPO | Gold | $600 | Offers comprehensive coverage with a wider network. |

| PPO | Platinum | $700 | The most comprehensive plan with the highest premiums. |

| POS (Point of Service) | Bronze | $375 | Combines elements of HMOs and PPOs, offering flexibility with a primary care physician. |

| POS | Silver | $475 | Provides a balance between cost and flexibility. |

| POS | Gold | $575 | Offers comprehensive coverage with a wider network. |

| POS | Platinum | $675 | The most comprehensive plan with the highest premiums. |

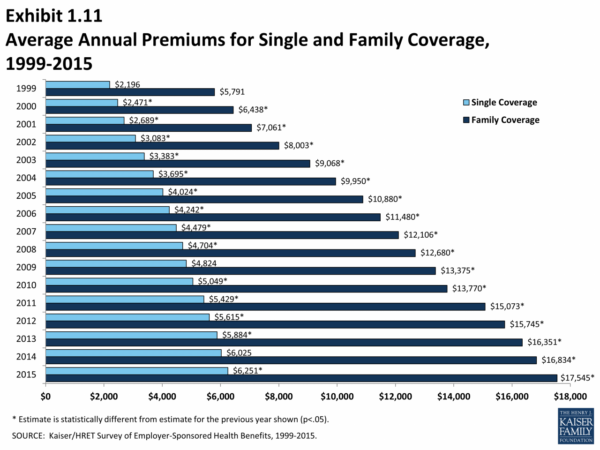

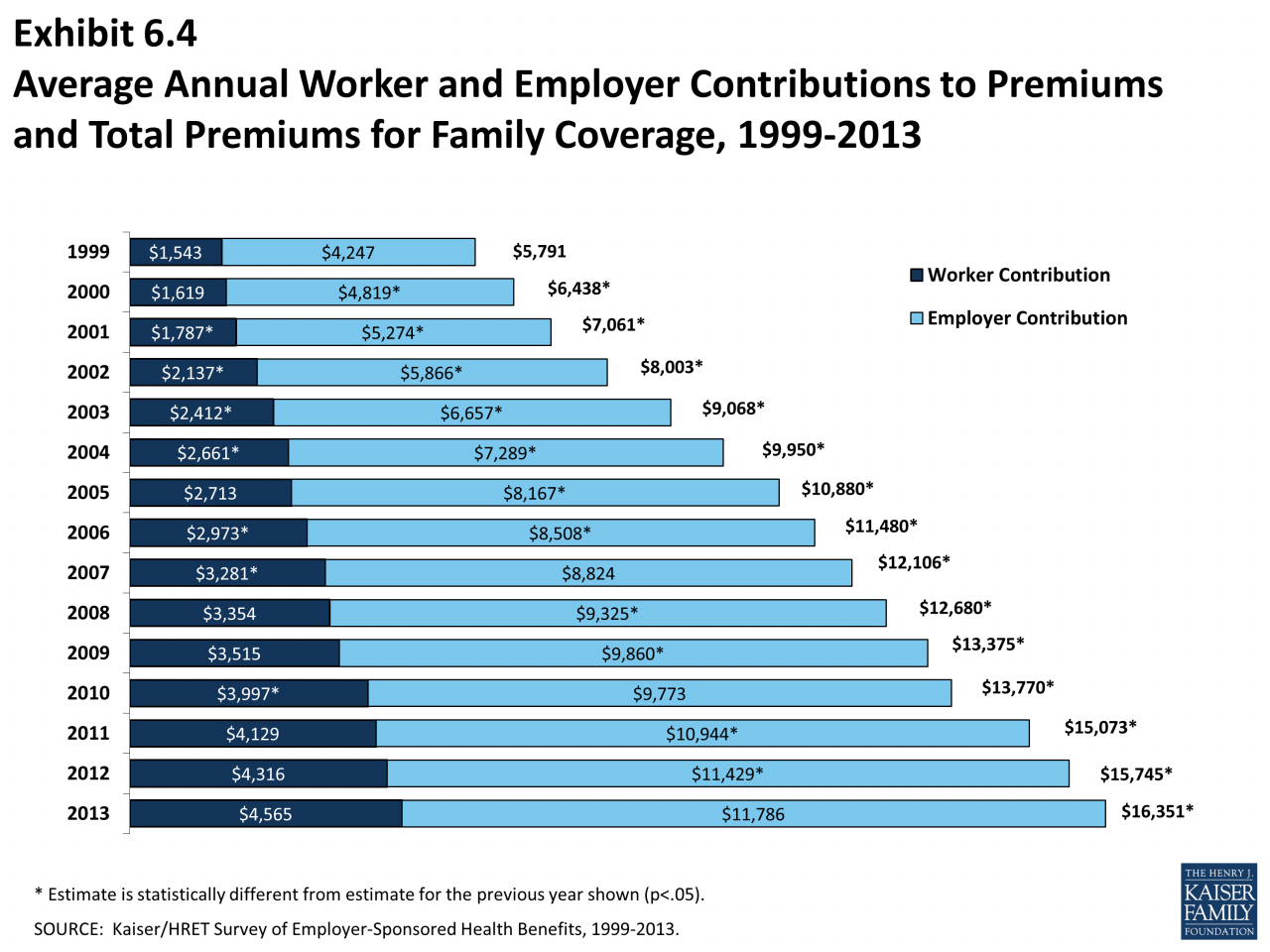

Health Insurance Cost Trends

Health insurance premiums have been steadily rising for several decades, driven by a combination of factors that impact the overall cost of healthcare in the United States. Understanding these trends is crucial for individuals and families seeking affordable coverage and for policymakers aiming to create a more sustainable healthcare system.

Rising Healthcare Costs

Rising healthcare costs are the primary driver of increasing health insurance premiums. Several factors contribute to this trend, including:

- Advancements in Medical Technology: New technologies, while often beneficial, can be expensive to develop and implement. For example, advanced imaging techniques and complex surgical procedures contribute to higher healthcare costs.

- Aging Population: As the population ages, the demand for healthcare services increases, putting pressure on healthcare providers and insurance companies.

- Chronic Diseases: The prevalence of chronic diseases like diabetes, heart disease, and cancer is rising, leading to increased healthcare utilization and higher costs.

- Administrative Costs: The complex administrative processes involved in managing health insurance and healthcare delivery contribute to higher costs.

Inflation

Inflation, the general increase in prices over time, also contributes to rising health insurance premiums. As the cost of goods and services increases, healthcare providers and insurance companies need to adjust their prices accordingly to maintain profitability.

Government Regulations

Changes in government regulations can also impact health insurance costs. For example, the Affordable Care Act (ACA) aimed to expand health insurance coverage and regulate the insurance market. While the ACA has led to significant improvements in access to healthcare, some regulations have contributed to higher premiums for certain individuals and families.

Projected Future Trends

Predicting future health insurance cost trends is challenging, but several factors suggest continued upward pressure on premiums:

- Continued Technological Advancements: Innovation in medical technology is expected to continue, driving further increases in healthcare costs.

- Growing Demand for Healthcare: The aging population and rising prevalence of chronic diseases will likely lead to continued growth in healthcare utilization.

- Inflationary Pressures: Inflation is expected to remain a factor, impacting the cost of healthcare services and insurance premiums.

- Potential Policy Changes: Changes in government policies, such as modifications to the ACA or new regulations, could have a significant impact on health insurance costs.

It’s important to note that the specific impact of these trends on health insurance premiums can vary depending on individual circumstances, such as age, health status, location, and chosen plan.

Strategies for Reducing Health Insurance Costs

Health insurance is a necessity for most Americans, but the costs can be a significant burden. Fortunately, there are several strategies you can employ to reduce your health insurance premiums and out-of-pocket expenses. Understanding these strategies can help you make informed decisions about your health insurance coverage and save money in the process.

Shop Around for Different Plans

Comparing plans from different insurers is crucial to finding the best value for your needs. Insurance companies offer a wide range of plans with varying coverage and premiums. By shopping around, you can identify plans that offer the most comprehensive coverage at the most affordable price.

- Use online comparison tools: Websites like Healthcare.gov and eHealth allow you to compare plans side-by-side based on your location, age, and other factors.

- Contact insurance brokers: Brokers can help you navigate the complex world of health insurance and find plans that meet your specific needs.

- Check with your employer: If you’re employed, your employer may offer group health insurance plans with negotiated rates that could be more affordable than individual plans.

Strategies for Individuals and Families

- Choose a higher deductible plan: A higher deductible plan typically has a lower monthly premium, but you’ll pay more out-of-pocket for medical services before your insurance kicks in. This strategy can be effective if you’re generally healthy and don’t anticipate frequent medical expenses.

- Consider a health savings account (HSA): HSAs are tax-advantaged savings accounts that can be used for healthcare expenses. You can contribute pre-tax dollars to an HSA, which can lower your taxable income and reduce your overall healthcare costs.

- Negotiate with your healthcare providers: In some cases, you may be able to negotiate lower prices for medical services, especially if you pay in full at the time of service.

- Use generic medications: Generic medications are often significantly cheaper than brand-name medications and offer the same therapeutic benefits. Ask your doctor if a generic alternative is available for any prescription medications you need.

- Take advantage of preventive care: Many health insurance plans cover preventive care services like screenings and vaccinations at no cost. Getting these services can help you stay healthy and avoid costly medical issues down the line.

- Practice healthy habits: Maintaining a healthy lifestyle through regular exercise, a balanced diet, and stress management can help reduce your risk of developing chronic health conditions that can lead to higher healthcare costs.

Government Subsidies and Financial Assistance

The Affordable Care Act (ACA) has made health insurance more accessible and affordable for millions of Americans through government subsidies and financial assistance. These programs aim to reduce the cost of health insurance premiums and out-of-pocket expenses, making coverage more attainable for individuals and families.

Eligibility Criteria and Application Process

Eligibility for government subsidies and financial assistance for health insurance is determined by factors such as income, household size, and location. Individuals and families with incomes below certain thresholds may qualify for subsidies to reduce their monthly premiums. The application process involves providing personal and financial information through the Health Insurance Marketplace website or by contacting a certified enrollment assister.

Types of Financial Assistance, What is the average price for health insurance

There are several types of financial assistance available through the ACA, including:

- Premium Tax Credits: These credits are available to individuals and families with incomes between 100% and 400% of the federal poverty level. The amount of the tax credit depends on income and the cost of health insurance plans in the individual’s area. The tax credit is applied directly to the monthly premium, reducing the out-of-pocket cost.

- Cost-Sharing Reductions: These reductions help lower out-of-pocket costs, such as deductibles, copayments, and coinsurance. Individuals with incomes between 100% and 250% of the federal poverty level are eligible for cost-sharing reductions. The amount of the reduction varies depending on income level and the type of health insurance plan chosen.

- Medicaid Expansion: The ACA expanded Medicaid eligibility to individuals with incomes up to 138% of the federal poverty level. Medicaid is a state-run health insurance program for low-income individuals and families. It provides comprehensive health coverage, including preventive services, hospitalizations, and prescription drugs.

Potential Cost Savings

The potential cost savings available through government subsidies and financial assistance can be substantial. For example, a family of four with an income of $50,000 per year may qualify for a premium tax credit that reduces their monthly premium by hundreds of dollars. Cost-sharing reductions can also significantly lower out-of-pocket costs, making health insurance more affordable.

“The average premium tax credit for Marketplace enrollees in 2022 was $600 per month, which is a significant reduction in the cost of health insurance.” – Kaiser Family Foundation

Health Insurance Market Overview

The health insurance market in the United States is a complex and dynamic landscape, shaped by numerous factors including government regulations, consumer demand, and competition among insurance providers. Understanding the key players, competitive dynamics, and current trends in this market is essential for both individuals and businesses seeking health insurance coverage.

Major Health Insurance Providers

The health insurance market in the United States is dominated by a few large, national insurance companies, with regional and local providers also playing significant roles.

- UnitedHealth Group: The largest health insurer in the United States, UnitedHealth Group offers a wide range of health insurance products, including individual, employer-sponsored, and Medicare Advantage plans.

- Anthem: Another major national player, Anthem provides health insurance coverage through its Blue Cross Blue Shield affiliates, serving millions of Americans.

- Cigna: Cigna offers health insurance plans for individuals, families, and employers, as well as specialized coverage for specific groups like seniors and military personnel.

- Humana: Humana is a leading provider of Medicare Advantage and Prescription Drug Plans, with a strong focus on serving seniors and individuals with chronic health conditions.

- Aetna: Aetna, a subsidiary of CVS Health, offers a range of health insurance plans, including individual, employer-sponsored, and Medicare Advantage plans.

In addition to these national giants, there are numerous regional and local health insurance providers that operate in specific geographic areas, often offering specialized plans or focusing on niche markets.

Competitive Landscape

The health insurance market is highly competitive, with companies vying for market share through various strategies, including:

- Product Innovation: Insurers are constantly developing new health insurance plans and benefits to attract customers and meet evolving needs.

- Price Competition: Insurance companies compete on price, offering different premium rates and cost-sharing arrangements to appeal to different segments of the market.

- Network Expansion: Expanding provider networks, particularly to include high-quality hospitals and doctors, is a key strategy for insurers to attract customers.

- Customer Service: Providing excellent customer service, including prompt claims processing and easy access to information, is crucial for retaining customers and building brand loyalty.

- Marketing and Advertising: Insurers invest heavily in marketing and advertising to reach potential customers and raise awareness of their products and services.

Current State of the Market

The health insurance market is constantly evolving, influenced by factors such as:

- Healthcare Reform: The Affordable Care Act (ACA) has significantly reshaped the health insurance market, expanding coverage and creating new regulations for insurers.

- Technological Advancements: Technological advancements are transforming the health insurance industry, enabling new ways to manage care, process claims, and interact with customers.

- Changing Demographics: The aging population and the increasing prevalence of chronic diseases are putting pressure on the health insurance system.

- Economic Conditions: Economic fluctuations can impact consumer demand for health insurance, as well as the financial performance of insurance companies.

Importance of Understanding Health Insurance Costs: What Is The Average Price For Health Insurance

Health insurance is an essential component of financial planning, and understanding its costs is crucial for making informed decisions. Choosing the right health insurance plan can significantly impact your financial well-being, while selecting an inadequate or overly expensive plan can lead to unexpected financial burdens.

Financial Implications of Inadequate or Overly Expensive Plans

Choosing an inadequate health insurance plan can result in significant out-of-pocket expenses for medical care. This could include high deductibles, copayments, and coinsurance, leaving you vulnerable to unexpected financial strain during a health crisis. On the other hand, an overly expensive plan might provide extensive coverage that you may not need, leading to unnecessary premium payments.

Importance of Researching and Comparing Health Insurance Options

To ensure you choose a health insurance plan that meets your needs and budget, it is essential to actively research and compare available options. This involves considering factors such as your individual health needs, budget, and coverage preferences.

Last Point

The cost of health insurance is a significant factor in the financial well-being of individuals and families. By understanding the average prices, the factors that influence them, and the strategies for reducing costs, you can make informed decisions about your healthcare coverage. Remember to shop around, explore government subsidies, and stay informed about market trends to ensure you have the best possible protection for your health and finances.

FAQ Overview

What are the main factors that influence health insurance premiums?

Health insurance premiums are influenced by a variety of factors, including age, health status, location, coverage options, and the type of plan you choose. For example, older individuals typically pay higher premiums due to their increased risk of health issues. Similarly, individuals with pre-existing conditions may face higher premiums compared to those with healthier profiles.

How can I find the best health insurance plan for my needs?

Finding the best health insurance plan requires careful consideration of your individual needs and circumstances. Start by assessing your healthcare needs, including any pre-existing conditions or anticipated healthcare expenses. Then, compare plans from different providers, taking into account factors such as premiums, deductibles, co-pays, and coverage options. You can use online comparison tools or consult with an insurance broker to help you navigate this process.

What are some common health insurance terms I should know?

Some common health insurance terms include:

- Premium: The monthly payment you make for your health insurance coverage.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Co-pay: A fixed amount you pay for specific healthcare services, such as doctor’s visits or prescriptions.

- Co-insurance: A percentage of the cost of healthcare services that you pay after your deductible is met.