- Understanding Georgia’s Health Insurance Landscape: What Is The Best Health Insurance In Georgia

- Major Health Insurance Providers in Georgia

- Essential Considerations for Choosing Health Insurance

- Resources for Finding and Comparing Plans

- Understanding Health Insurance Terminology

- Closing Notes

- Essential FAQs

What is the best health insurance in Georgia sets the stage for this exploration, guiding you through the complex landscape of health insurance options available in the Peach State. Navigating the world of health insurance can be overwhelming, but understanding the different plans, providers, and factors that influence costs is crucial for making informed decisions about your health and finances.

From individual and employer-sponsored plans to government programs like Medicaid and Medicare, Georgia offers a range of options to suit diverse needs and budgets. This guide aims to shed light on the key considerations for choosing the right health insurance plan, empowering you to make the best choice for your unique circumstances.

Understanding Georgia’s Health Insurance Landscape: What Is The Best Health Insurance In Georgia

Navigating the world of health insurance in Georgia can be complex, with various plan options and factors influencing costs. This guide will help you understand the different types of health insurance plans available, the key factors that determine your premiums, and the impact of the Affordable Care Act (ACA).

Types of Health Insurance Plans in Georgia

Georgia offers a range of health insurance plans to meet diverse needs and budgets. Here’s a breakdown of the common types:

- Individual Health Insurance: Purchased directly from an insurance company, this option provides coverage for individuals and families. It’s ideal for self-employed individuals, those not covered by employer plans, or those seeking more control over their coverage.

- Employer-Sponsored Health Insurance: Offered by employers as a benefit, this type of insurance is often more affordable due to group rates. Employers typically contribute to the premium costs, making it a popular choice for many employees.

- Medicaid: A government-funded program for low-income individuals and families, Medicaid provides comprehensive health coverage. Eligibility requirements vary based on income and other factors.

- Medicare: A federal health insurance program for individuals aged 65 and older or those with certain disabilities. Medicare offers different parts, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D).

Factors Influencing Health Insurance Costs in Georgia

Several factors contribute to the cost of health insurance in Georgia, including:

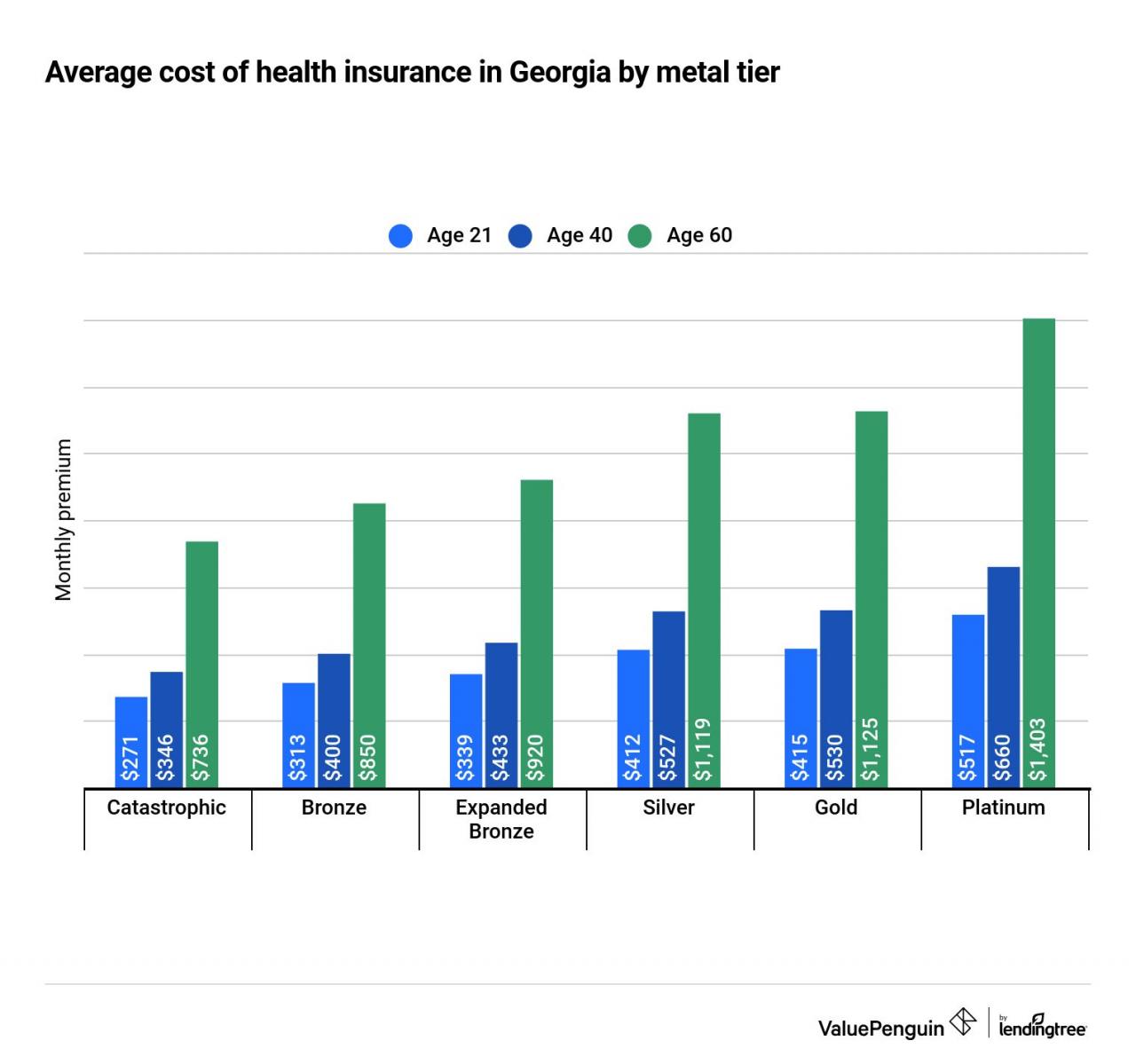

- Age: Generally, older individuals tend to have higher health insurance premiums due to a greater likelihood of needing healthcare services.

- Location: The cost of healthcare varies across Georgia. Urban areas often have higher premiums due to higher healthcare provider costs and greater demand for services.

- Health Status: Individuals with pre-existing conditions or those who anticipate needing more healthcare services may face higher premiums.

- Plan Coverage: The level of coverage you choose, such as the deductible, co-pays, and out-of-pocket maximum, significantly impacts your premium. More comprehensive plans typically come with higher premiums.

The Affordable Care Act (ACA) and its Impact on Georgia

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted health insurance in Georgia. Key provisions include:

- Health Insurance Marketplace: The ACA created health insurance marketplaces, online platforms where individuals can compare and purchase health insurance plans from different insurers. These marketplaces offer subsidies to help eligible individuals afford coverage.

- Essential Health Benefits: The ACA mandates that all health insurance plans offered in the marketplace must cover essential health benefits, such as preventive care, hospitalization, and prescription drugs.

- Pre-Existing Condition Protections: The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

Major Health Insurance Providers in Georgia

Georgia’s health insurance market is diverse, offering a wide range of plans and providers to cater to different needs and budgets. Understanding the major players and their offerings is crucial for making informed decisions about your health insurance.

Leading Health Insurance Companies in Georgia

This section will delve into the prominent health insurance companies operating in Georgia, providing insights into their market presence, network size, and reputation.

- Blue Cross Blue Shield of Georgia (BCBSGA): BCBSGA is the largest health insurer in Georgia, holding a significant market share. Its extensive network includes a vast majority of healthcare providers in the state. BCBSGA is known for its comprehensive plans and strong customer service.

- UnitedHealthcare: UnitedHealthcare is another major player in Georgia’s health insurance market. It offers a wide range of plans, including individual, family, and employer-sponsored options. UnitedHealthcare’s network is extensive and includes a large number of healthcare providers.

- Aetna: Aetna is a well-established health insurer with a strong presence in Georgia. It provides a variety of health insurance plans, including HMO, PPO, and POS options. Aetna’s network is vast and includes a wide range of healthcare providers.

- Cigna: Cigna is a national health insurer that offers a variety of health insurance plans in Georgia. It is known for its innovative programs and focus on preventative care. Cigna’s network is extensive and includes a wide range of healthcare providers.

- Humana: Humana is a health insurer that specializes in Medicare and Medicare Advantage plans. It also offers individual and employer-sponsored health insurance plans in Georgia. Humana’s network is extensive and includes a wide range of healthcare providers.

Comparison of Top 5 Health Insurance Providers

To provide a clearer understanding of the top 5 health insurance providers in Georgia, the table below compares them based on key factors such as coverage, premiums, and customer satisfaction.

| Provider | Coverage | Premiums | Customer Satisfaction |

|---|---|---|---|

| Blue Cross Blue Shield of Georgia | Comprehensive plans, including HMO, PPO, and POS options | Competitive premiums, varying based on plan and coverage | High customer satisfaction ratings, consistently ranked among the best in Georgia |

| UnitedHealthcare | Wide range of plans, including individual, family, and employer-sponsored options | Premiums vary based on plan and coverage, with options for different budgets | Above-average customer satisfaction ratings, with a focus on member experience |

| Aetna | Variety of health insurance plans, including HMO, PPO, and POS options | Premiums vary based on plan and coverage, with a focus on affordability | Good customer satisfaction ratings, with a strong emphasis on provider network |

| Cigna | Innovative health insurance plans, with a focus on preventative care | Premiums vary based on plan and coverage, with options for different needs | Above-average customer satisfaction ratings, known for its digital tools and resources |

| Humana | Specializes in Medicare and Medicare Advantage plans, also offers individual and employer-sponsored plans | Premiums vary based on plan and coverage, with a focus on value for seniors | High customer satisfaction ratings, particularly for its Medicare plans |

Essential Considerations for Choosing Health Insurance

Choosing the right health insurance plan is crucial for safeguarding your financial well-being and ensuring access to necessary medical care. Understanding your individual needs and coverage requirements is paramount to making an informed decision.

Factors to Consider When Selecting a Health Insurance Plan

It’s essential to consider various factors when selecting a health insurance plan. This checklist will help you navigate the complexities of health insurance and make a decision that aligns with your specific needs and budget.

- Premium Costs: Monthly premiums represent the cost of your health insurance coverage. Carefully compare premiums from different insurers to find the most affordable option that meets your needs.

- Deductible: This is the amount you must pay out-of-pocket before your insurance coverage kicks in. Lower deductibles mean you pay less upfront but may have higher premiums. Higher deductibles mean lower premiums but higher out-of-pocket costs initially.

- Co-pays: These are fixed amounts you pay for specific medical services, such as doctor’s visits or prescriptions. Lower co-pays mean lower out-of-pocket expenses, but higher premiums are usually associated with them.

- Coverage Limitations: Each plan has limitations on what it covers. Carefully review the plan’s coverage details to ensure it includes the services you need, such as preventive care, hospitalization, and prescription drugs.

- Network: Health insurance plans have networks of doctors, hospitals, and other healthcare providers. Choose a plan with a network that includes providers you trust and are conveniently located.

- Out-of-Pocket Maximum: This is the maximum amount you’ll pay out-of-pocket in a year. Once you reach this limit, your insurance covers 100% of your medical expenses for the rest of the year.

Pre-existing Conditions and Their Impact, What is the best health insurance in georgia

Pre-existing conditions are medical conditions you have before enrolling in a health insurance plan. These conditions can affect your eligibility and the cost of your coverage. The Affordable Care Act (ACA) prohibits insurers from denying coverage or charging higher premiums based solely on pre-existing conditions. However, insurers may offer different plans with varying costs and coverage levels based on your health status.

Resources for Finding and Comparing Plans

Navigating the world of health insurance can feel overwhelming, especially when trying to find the best plan for your specific needs and budget. Fortunately, Georgia offers a variety of resources to help you compare plans and make informed decisions. These resources provide valuable tools and information to ensure you find the right coverage that meets your individual requirements.

Online Resources for Comparing Health Insurance Plans

Several reputable online resources allow you to compare health insurance plans in Georgia. These platforms provide a convenient and comprehensive way to evaluate different options, making it easier to find the best fit for your circumstances.

- Healthcare.gov: This official government website serves as a central hub for health insurance information and enrollment. It allows you to compare plans, check eligibility for subsidies, and enroll in coverage.

- Georgia Health Insurance Marketplace: This state-specific website provides a platform for comparing plans offered by various insurance providers. It allows you to filter options based on your needs, budget, and location.

- eHealth: This private insurance comparison website provides a user-friendly platform to compare plans from multiple providers. It allows you to customize your search based on your specific criteria and get personalized recommendations.

- HealthMarkets: Similar to eHealth, HealthMarkets provides a comprehensive comparison tool for health insurance plans. It offers a wide range of options and provides detailed information about each plan, including coverage details, premiums, and deductibles.

Government-Sponsored Programs and Subsidies

Georgia offers various government-sponsored programs and subsidies to make health insurance more affordable for individuals and families. These programs provide financial assistance to help offset the cost of premiums and out-of-pocket expenses.

- Medicaid: This government-funded health insurance program provides coverage for low-income individuals and families. Eligibility requirements vary based on income and other factors.

- PeachCare for Kids: This program provides health insurance coverage for children from low-income families. It offers comprehensive benefits and helps ensure children have access to essential medical care.

- Premium Tax Credits: These tax credits are available to individuals and families who purchase health insurance through the Healthcare.gov marketplace. The amount of the credit depends on income and the chosen plan.

- Cost-Sharing Reductions: These subsidies help reduce out-of-pocket costs for individuals with lower incomes who purchase plans through the marketplace. They lower deductibles, copayments, and coinsurance amounts.

Obtaining Quotes and Enrolling in a Plan

The process of obtaining quotes and enrolling in a health insurance plan in Georgia is relatively straightforward. Most online resources and insurance providers allow you to get quotes online, compare plans, and enroll in coverage directly through their platforms.

- Gather Your Information: Before starting the process, gather essential information, such as your income, household size, and any dependents. This information is necessary to determine your eligibility for subsidies and compare plans accurately.

- Use Online Comparison Tools: Utilize online resources, such as Healthcare.gov or the Georgia Health Insurance Marketplace, to compare plans based on your specific needs and budget. These platforms allow you to filter options based on factors like coverage, premiums, and deductibles.

- Contact Insurance Providers: If you need further clarification or have questions about specific plans, contact insurance providers directly. They can provide detailed information about their coverage options and answer any inquiries you may have.

- Enroll in Coverage: Once you’ve chosen a plan, you can enroll in coverage through the chosen platform or directly with the insurance provider. The enrollment period typically runs for a specific timeframe each year, so it’s important to enroll within the designated window.

Understanding Health Insurance Terminology

Navigating the world of health insurance can feel overwhelming, especially with the numerous terms and concepts involved. Understanding these terms is crucial for making informed decisions about your health coverage. Here’s a breakdown of some common health insurance terms:

Key Health Insurance Terms

These terms are essential for understanding the cost and coverage of your health insurance plan:

| Term | Definition |

|---|---|

| Premium | The monthly cost you pay to maintain your health insurance coverage. |

| Deductible | The amount you pay out-of-pocket for healthcare services before your insurance starts covering costs. |

| Co-pay | A fixed amount you pay for specific healthcare services, such as doctor visits or prescriptions. |

| Co-insurance | The percentage of healthcare costs you share with your insurance company after you’ve met your deductible. |

| Out-of-pocket maximum | The maximum amount you’ll pay for healthcare costs in a year, including deductibles, co-pays, and co-insurance. |

| Network | A group of healthcare providers (doctors, hospitals, etc.) that have contracted with your insurance company to provide services at discounted rates. |

Here are some examples to illustrate the practical application of these terms:

- Premium: You pay a monthly premium of $200 to maintain your health insurance coverage.

- Deductible: Your plan has a $1,000 deductible. This means you’ll pay the first $1,000 of your healthcare costs before your insurance starts covering expenses.

- Co-pay: Your plan has a $25 co-pay for doctor visits. This means you’ll pay $25 each time you visit a doctor within your network.

- Co-insurance: Your plan has an 80/20 co-insurance after you’ve met your deductible. This means your insurance company will cover 80% of your healthcare costs, and you’ll pay 20%.

- Out-of-pocket maximum: Your plan has an out-of-pocket maximum of $5,000. This means you won’t pay more than $5,000 for healthcare costs in a year, even if your total healthcare expenses exceed that amount.

- Network: Your plan has a network of healthcare providers in Georgia. This means you’ll receive discounted rates for services from providers within this network. You may have to pay more for services from providers outside the network.

Closing Notes

Choosing the best health insurance in Georgia requires careful consideration of individual needs, coverage requirements, and financial constraints. By understanding the available options, comparing plans, and utilizing available resources, you can navigate the process with confidence and secure the coverage that best meets your health and financial goals.

Essential FAQs

How do I know if I qualify for Medicaid in Georgia?

You can check your eligibility for Medicaid in Georgia by visiting the Georgia Department of Human Services website or contacting their customer service line. They will assess your income, household size, and other factors to determine if you qualify.

What is the difference between a PPO and an HMO health insurance plan?

A PPO (Preferred Provider Organization) allows you to see any doctor or hospital, but you’ll pay lower costs if you choose from their network. An HMO (Health Maintenance Organization) requires you to choose a primary care physician (PCP) within their network and get referrals for specialists. HMOs typically have lower premiums than PPOs, but offer less flexibility.

What are some of the best resources for comparing health insurance plans in Georgia?

The Health Insurance Marketplace (healthcare.gov) is a great resource for comparing plans and finding subsidies. You can also check with insurance brokers and independent websites that specialize in health insurance comparisons.