What is the best health insurance plan? This is a question that many people ask themselves, and it’s a valid one. After all, health insurance is a crucial part of our financial security, and it’s important to choose a plan that meets our individual needs and budget. But with so many different plans available, how do we know which one is right for us?

The first step is to understand the basics of health insurance. There are different types of plans, each with its own set of features and benefits. It’s important to consider the key factors that influence your choice, such as your health needs, budget, and lifestyle.

Understanding Health Insurance Basics: What Is The Best Health Insurance Plan

Health insurance is a crucial aspect of financial planning, especially in the face of unexpected medical expenses. Choosing the right health insurance plan can be overwhelming, given the wide range of options and terminology. This section will guide you through the fundamentals of health insurance, helping you make informed decisions about your coverage.

Types of Health Insurance Plans, What is the best health insurance plan

Different health insurance plans offer varying levels of coverage and flexibility. Understanding the key characteristics of each plan type can help you determine which best suits your needs and budget.

- Health Maintenance Organization (HMO): HMOs provide comprehensive coverage within a network of providers. You typically need a referral from your primary care physician to see specialists. HMOs often have lower premiums but may have stricter rules regarding out-of-network care.

- Preferred Provider Organization (PPO): PPOs offer more flexibility than HMOs. You can see providers both in and out of the network, although out-of-network care usually comes with higher costs. PPOs generally have higher premiums than HMOs.

- Point-of-Service (POS): POS plans combine features of both HMOs and PPOs. You have the option to choose in-network or out-of-network providers, but out-of-network care typically requires pre-authorization and incurs higher costs. POS plans usually have premiums between HMOs and PPOs.

- Exclusive Provider Organization (EPO): EPOs are similar to HMOs in that they require you to choose providers within a specific network. However, unlike HMOs, EPOs do not typically offer out-of-network coverage, even in emergencies. EPOs often have lower premiums than PPOs but less flexibility.

Key Features and Benefits of Health Insurance Plans

- Coverage: Health insurance plans cover a range of medical services, including preventive care, hospitalization, surgery, and prescription drugs. The specific services covered vary by plan, so it’s crucial to review the plan details carefully.

- Network: The network refers to the group of doctors, hospitals, and other healthcare providers contracted by the insurance company. You generally pay lower costs for services within the network.

- Premiums: Premiums are the monthly payments you make to maintain your health insurance coverage.

- Deductible: The deductible is the amount you pay out-of-pocket for medical expenses before your insurance coverage kicks in. For example, if your deductible is $1,000, you’ll need to pay the first $1,000 of medical expenses yourself.

- Co-pay: A co-pay is a fixed amount you pay for specific services, such as doctor visits or prescriptions. Co-pays are usually lower than deductibles and help to control healthcare costs.

- Co-insurance: Co-insurance is a percentage of the cost of medical services that you pay after your deductible is met. For example, if your co-insurance is 20%, you’ll pay 20% of the cost of medical services after your deductible is met.

Common Health Insurance Terms

- Out-of-pocket maximum: This is the maximum amount you’ll pay for covered medical expenses in a year. Once you reach this limit, your insurance company will cover the remaining costs.

- Pre-existing conditions: These are medical conditions you had before enrolling in a health insurance plan. Some plans may exclude coverage for pre-existing conditions or have higher premiums for those with such conditions.

- Open enrollment: This is a period when you can enroll in or change your health insurance plan without penalty. Open enrollment periods vary by state and insurance company.

- Health Savings Account (HSA): An HSA is a tax-advantaged savings account that can be used to pay for qualified medical expenses. HSAs are often paired with high-deductible health plans (HDHPs).

- Flexible Spending Account (FSA): An FSA is a tax-advantaged account that allows you to set aside pre-tax dollars for eligible medical expenses.

Ending Remarks

Choosing the right health insurance plan is a crucial decision that can impact your financial well-being and access to healthcare. By understanding the different types of plans, considering your individual needs, and utilizing available resources, you can make an informed choice that provides you with the coverage and protection you require. Remember to review your policy periodically and seek professional advice when needed to ensure your plan remains aligned with your evolving needs.

Question & Answer Hub

What are the main types of health insurance plans?

The most common types of health insurance plans include HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), POS (Point of Service), and EPO (Exclusive Provider Organization). Each plan has its own structure for accessing healthcare services and associated costs.

How do I compare different health insurance plans?

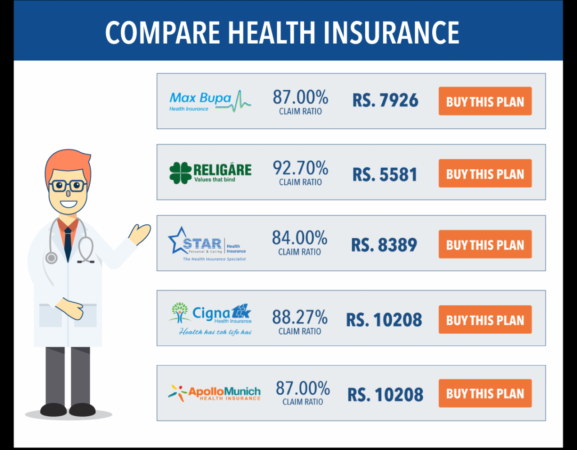

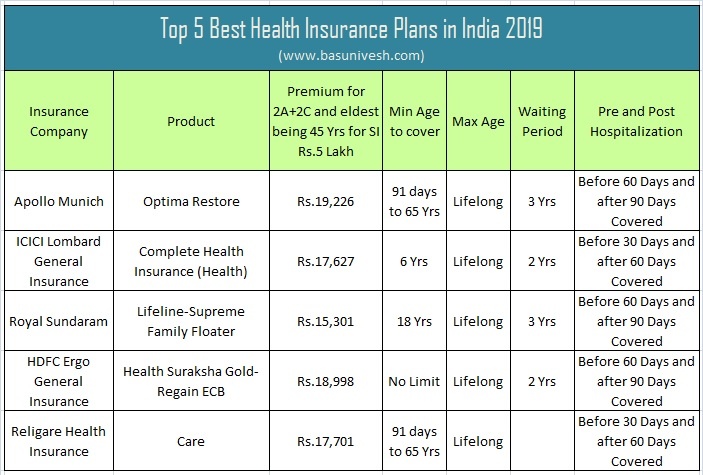

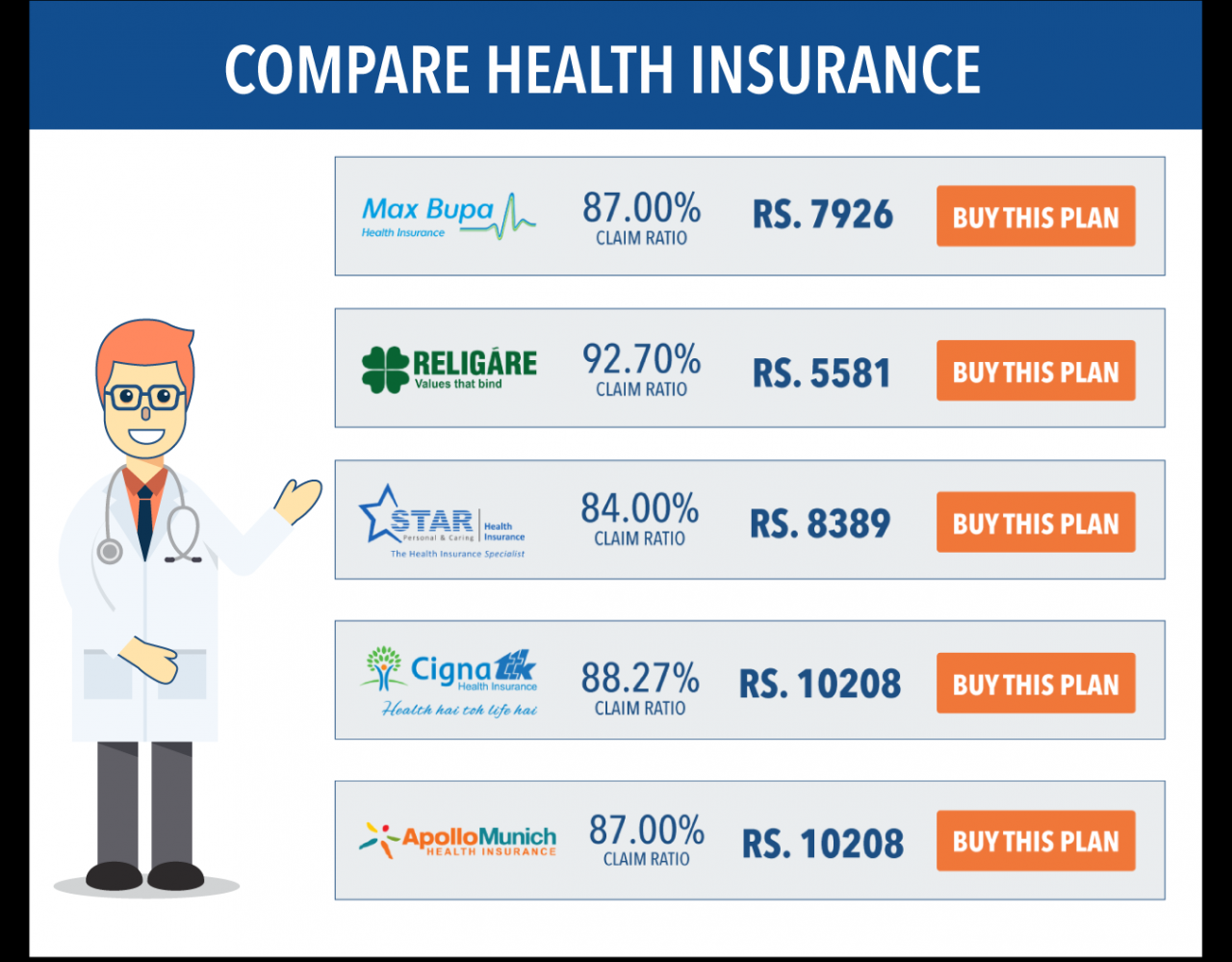

When comparing plans, consider factors such as premiums, deductibles, co-pays, co-insurance, network coverage, and out-of-pocket maximums. Use online tools, insurance marketplaces, or consult with an insurance broker to compare different plans side-by-side.

What are the benefits of having health insurance?

Health insurance provides financial protection against unexpected medical expenses, ensuring access to necessary healthcare services without facing significant financial burden. It also helps with preventative care and early detection of health issues.