What is yearly deductible in health insurance? It’s a crucial concept in understanding your health insurance plan and its costs. Imagine you’re driving and get into an accident. Your car insurance deductible is the amount you pay out of pocket before your insurance kicks in. Similarly, a yearly deductible in health insurance is the amount you pay before your health insurance starts covering your medical expenses. This deductible can vary significantly between different plans and can impact your overall healthcare costs.

This article will break down the yearly deductible, explaining how it works, what factors influence its amount, and how to choose a plan with the right deductible for your needs. We’ll also explore the relationship between deductibles and out-of-pocket maximums, and discuss the potential impact of high deductibles on healthcare access.

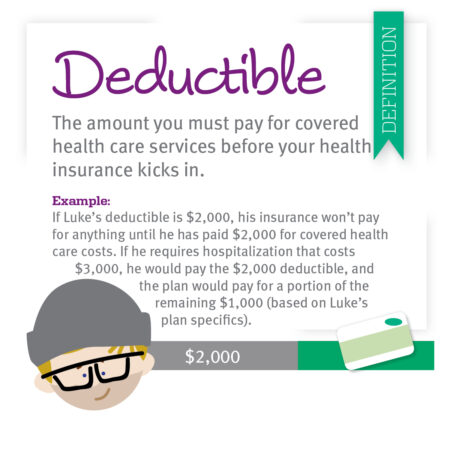

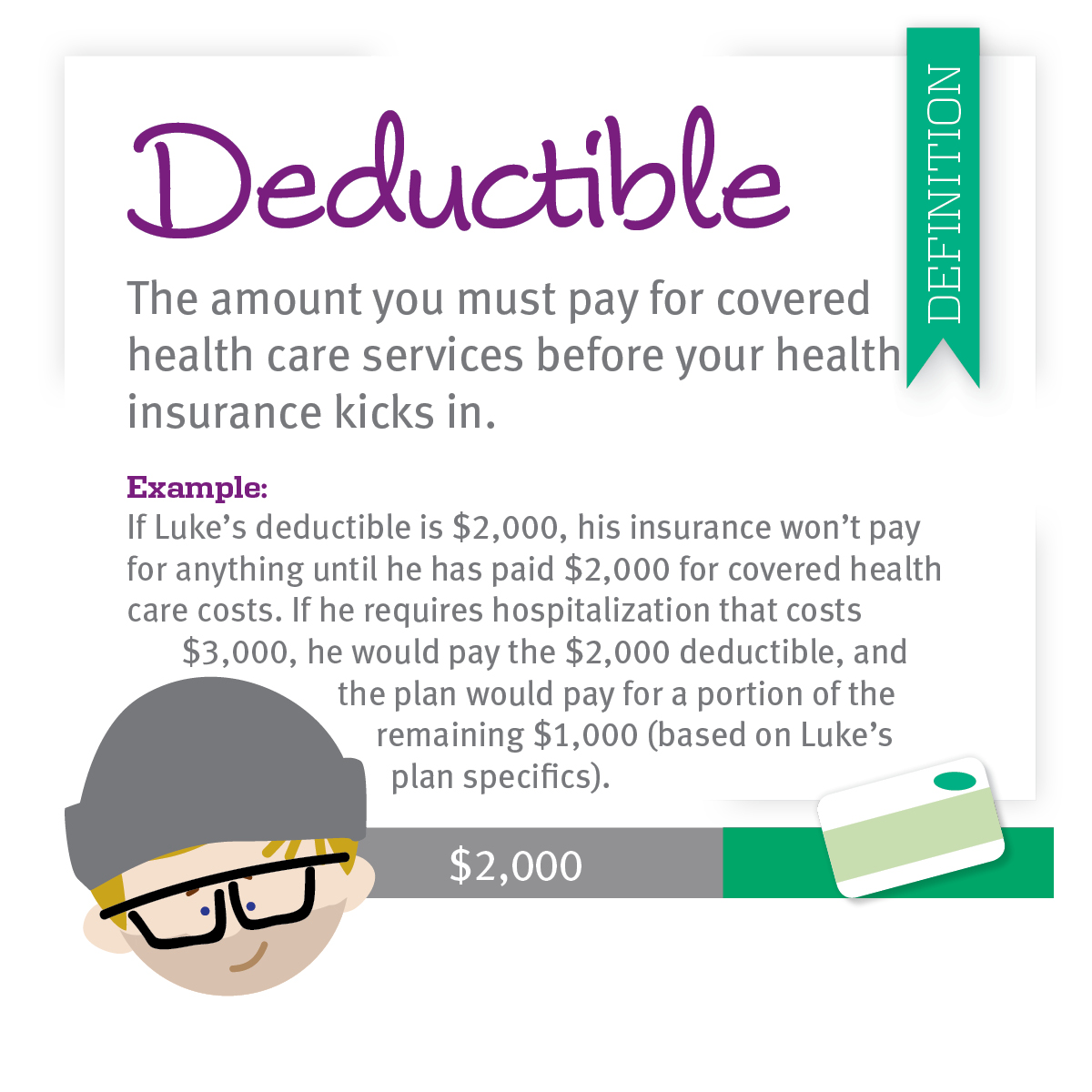

What is a Deductible?

Imagine you have a car insurance policy with a deductible of $500. If you get into an accident, you’ll have to pay the first $500 of repair costs out of your pocket. The insurance company will then cover the remaining costs. A deductible in health insurance works similarly, acting as a threshold you must meet before your insurance plan starts covering your medical expenses.

Deductibles and Out-of-Pocket Expenses

Deductibles play a crucial role in determining your out-of-pocket costs for healthcare. Think of it as a financial buffer you need to overcome before your insurance coverage kicks in. Once you’ve reached your deductible for the year, your insurance company will begin to cover a larger portion of your medical expenses, based on your plan’s co-insurance or co-pay structure.

Yearly Deductible Explained

A yearly deductible is a fixed amount you need to pay out-of-pocket for covered healthcare expenses before your health insurance plan starts paying its share. Think of it as a threshold you need to cross before your insurance kicks in.

How a Yearly Deductible Works

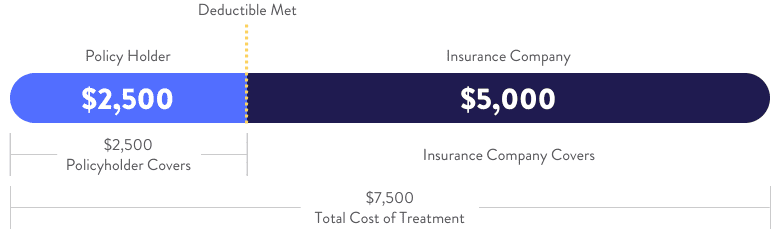

Here’s how it works:

* You receive medical care: Let’s say you have a yearly deductible of $1,000 and need medical treatment.

* You pay out-of-pocket: You pay the first $1,000 in medical bills yourself.

* Insurance coverage starts: Once you’ve reached your deductible, your insurance plan starts paying for the rest of your medical expenses, usually according to your plan’s co-insurance or co-pay structure.

Individual vs. Family Deductibles, What is yearly deductible in health insurance

- Individual deductible: Applies to each person covered under the health insurance plan. If you have a family plan with a $1,000 individual deductible, each member needs to pay $1,000 in medical expenses before their coverage kicks in.

- Family deductible: Applies to the entire family as a group. For example, if your family deductible is $3,000, your family needs to pay a total of $3,000 in medical expenses before your insurance starts paying. This doesn’t mean each individual has to pay $3,000. One person could reach the $3,000 mark, and the rest of the family would be covered for the remainder of the year.

Factors Affecting Deductible Amount

Your health insurance deductible is the amount you pay out of pocket before your insurance coverage kicks in. The amount of your deductible can vary based on several factors.

Factors Influencing Deductible Amount

Several factors influence the amount of your deductible. These include:

- Type of health insurance plan: Deductibles are typically higher for plans with lower monthly premiums. For example, a high-deductible health plan (HDHP) will have a higher deductible than a traditional health insurance plan. This is because you’re essentially paying less upfront for your coverage, but you’ll need to pay more out of pocket before your insurance starts covering your healthcare costs.

- Age: In some cases, insurers may offer higher deductibles to younger individuals, as they tend to have fewer health issues. However, this isn’t always the case, and deductibles can vary depending on the specific insurance plan.

- Geographic location: The cost of healthcare varies across different regions, which can influence the amount of your deductible. For instance, a person living in a high-cost area like New York City may have a higher deductible than someone living in a lower-cost area like rural Iowa.

- Health status: If you have pre-existing health conditions, you may be required to pay a higher deductible. This is because you are more likely to use healthcare services, and insurers need to factor in this increased risk. However, this practice is subject to regulations under the Affordable Care Act.

Deductibles Across Different Plans

Deductibles can vary significantly across different health insurance plans. Here’s a comparison of deductibles for common plan types:

| Plan Type | Typical Deductible |

|---|---|

| High-Deductible Health Plan (HDHP) | $1,400 – $7,000 per person |

| Preferred Provider Organization (PPO) | $500 – $2,500 per person |

| Health Maintenance Organization (HMO) | $250 – $1,000 per person |

It’s important to note that these are just general ranges, and actual deductibles can vary based on the specific plan and factors mentioned earlier.

Relationship Between Deductibles, Copayments, and Coinsurance

Deductibles, copayments, and coinsurance are all components of your health insurance plan that affect your out-of-pocket costs. Here’s how they relate:

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in.

- Copayment: A fixed amount you pay for each service, such as a doctor’s visit or prescription drug.

- Coinsurance: A percentage of the cost of a service that you pay after your deductible has been met.

For example, let’s say your deductible is $1,000, your copayment for a doctor’s visit is $20, and your coinsurance is 20%. If you have a doctor’s visit that costs $150, you’ll first pay the $20 copayment. Then, you’ll pay 20% of the remaining $130, which is $26. You’ll only start paying coinsurance after you’ve met your deductible of $1,000.

Choosing a Plan with the Right Deductible

Choosing the right health insurance plan with the appropriate deductible is crucial for managing your healthcare costs. A deductible is the amount you pay out-of-pocket before your health insurance starts covering your medical expenses. Your deductible amount can significantly impact your overall healthcare costs, so it’s important to consider your individual needs and budget.

Deductible Comparison Across Plans

To help you compare deductible amounts across different health insurance plans, consider the following table:

| Plan Name | Deductible Amount | Coverage Details | Key Features |

|---|---|---|---|

| Plan A | $1,000 | Covers 80% of medical expenses after deductible | Includes preventive care, prescription drug coverage |

| Plan B | $2,500 | Covers 90% of medical expenses after deductible | Includes mental health coverage, vision care |

| Plan C | $5,000 | Covers 100% of medical expenses after deductible | Includes dental coverage, telehealth services |

Determining the Appropriate Deductible

Several factors can influence the appropriate deductible for your individual needs. Here are some key considerations:

* Expected Healthcare Costs: If you anticipate frequent doctor visits or expensive medical procedures, a lower deductible might be more beneficial.

* Budget: A higher deductible can lead to lower monthly premiums but could result in higher out-of-pocket expenses.

* Risk Tolerance: If you’re comfortable with a higher deductible, you can potentially save on premiums. However, if you’re risk-averse, a lower deductible might provide more financial security.

* Health Status: Individuals with pre-existing conditions or a history of chronic illnesses might prefer a lower deductible to minimize out-of-pocket costs.

* Coverage Needs: Consider the specific medical services you require, such as prescription drugs, mental health care, or dental care, and choose a plan that offers adequate coverage.

It’s essential to carefully evaluate your individual circumstances and financial situation to determine the right deductible for your health insurance plan.

Impact of Deductibles on Healthcare Access: What Is Yearly Deductible In Health Insurance

High deductibles in health insurance can significantly impact healthcare access, especially for individuals with limited financial resources. The need to pay a substantial amount out-of-pocket before insurance coverage kicks in can deter individuals from seeking necessary medical care, leading to potential health complications and increased healthcare costs in the long run.

Financial Barriers to Healthcare

Individuals with limited financial resources may struggle to meet high deductible requirements, making it difficult to afford essential medical services. This financial barrier can lead to delayed or forgone care, potentially resulting in worsening health conditions and higher healthcare costs in the long term. For example, a person with a high deductible may delay a necessary medical procedure due to the upfront cost, leading to more complex and expensive treatment later.

Alternative Options for Managing Healthcare Costs

Several strategies can help individuals manage healthcare costs and improve access to care, even with high deductibles:

- Health Savings Accounts (HSAs): These tax-advantaged accounts allow individuals to save pre-tax dollars to pay for qualified medical expenses. The funds can be used to cover deductibles, copayments, and other healthcare costs.

- Negotiating Medical Bills: Negotiating medical bills with providers or hospitals can help reduce the overall cost of healthcare. Individuals can often request discounts or payment plans to make medical expenses more manageable.

- Exploring Financial Assistance Programs: Many government and non-profit organizations offer financial assistance programs to help individuals with low incomes access healthcare. These programs can cover deductibles, copayments, and other healthcare expenses.

“High deductibles can create a significant financial barrier to accessing necessary healthcare services, particularly for individuals with limited financial resources. This can lead to delayed or forgone care, potentially resulting in worsening health conditions and higher healthcare costs in the long term.”

Final Conclusion

Understanding the yearly deductible in health insurance is essential for making informed decisions about your healthcare coverage. By carefully considering the factors that influence deductible amounts and comparing plans, you can choose a plan that fits your budget and healthcare needs. Remember, your deductible is just one component of your health insurance plan, and it’s important to understand how it interacts with other elements like copayments, coinsurance, and out-of-pocket maximums. By being well-informed, you can navigate the world of health insurance with confidence and ensure that you have the coverage you need when you need it.

FAQ Insights

What happens if I don’t meet my deductible?

If you don’t meet your deductible for the year, you’ll be responsible for paying the full cost of your medical expenses until you reach the deductible amount.

Does my deductible reset every year?

Yes, your deductible resets at the beginning of each calendar year.

Can I pay my deductible in installments?

This depends on your insurance provider. Some providers may allow you to pay your deductible in installments, while others may require you to pay it in full upfront.

Does my deductible apply to all medical expenses?

Not necessarily. Some health insurance plans may have separate deductibles for different types of medical expenses, such as preventive care or prescription drugs.