What law firm represented the weinstein company in bankruptcy – Who Represented The Weinstein Company in Bankruptcy sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Weinstein Company, once a powerhouse in Hollywood, faced a tumultuous fall from grace, ultimately leading to its bankruptcy filing in 2018. This event sent shockwaves through the entertainment industry, prompting questions about the company’s financial woes and the legal strategies employed to navigate the complex bankruptcy process.

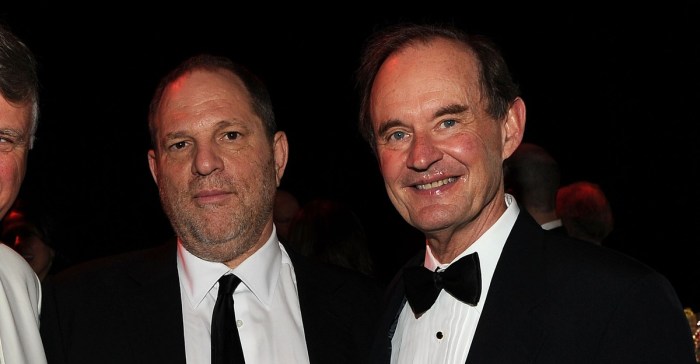

As the company grappled with a cascade of sexual misconduct allegations against its co-founder, Harvey Weinstein, financial instability set in. The company’s reputation took a severe hit, impacting its ability to secure funding and maintain its operations. These challenges ultimately culminated in the company’s bankruptcy filing, marking a significant turning point in its history.

The Weinstein Company Bankruptcy

The Weinstein Company (TWC), a prominent film production and distribution company, filed for bankruptcy in March 2018. The company’s downfall was a result of a series of events, including the emergence of sexual misconduct allegations against its co-founder, Harvey Weinstein, and subsequent financial challenges.

The Circumstances Leading to Bankruptcy

The Weinstein Company’s bankruptcy was precipitated by a series of events, including the revelation of sexual misconduct allegations against Harvey Weinstein, the company’s co-founder. These allegations led to a wave of negative publicity, boycotts, and legal actions against the company.

Key Financial Challenges Faced by the Company

The company faced significant financial challenges following the allegations against Harvey Weinstein. These challenges included:

- Loss of key talent and partnerships: The allegations against Weinstein led to the departure of several high-profile actors, directors, and producers who had worked with the company. This loss of talent significantly impacted the company’s ability to secure financing and produce successful films.

- Diminished box office performance: The negative publicity surrounding the company and its founder led to a decline in the box office performance of its films. This resulted in lower revenue and profits for the company.

- Increased legal expenses: The company faced numerous lawsuits and legal settlements related to the allegations against Weinstein. These legal expenses further strained the company’s finances.

- Difficulty securing financing: The company’s reputation was tarnished by the allegations, making it difficult to secure financing from banks and investors. This limited the company’s ability to fund new projects and operations.

Date of Bankruptcy Filing

The Weinstein Company filed for bankruptcy on March 19, 2018.

The Role of Law Firms in Bankruptcy Proceedings

Bankruptcy proceedings are complex legal processes designed to address financial distress and provide a structured framework for resolving debts. Law firms play a crucial role in navigating these proceedings, representing various parties involved, including debtors, creditors, and trustees. They possess the legal expertise and strategic acumen to guide clients through the intricate legal landscape of bankruptcy.

Responsibilities of Law Firms Representing Debtors

Law firms representing debtors in bankruptcy have a multifaceted role, encompassing a wide range of responsibilities aimed at protecting the debtor’s interests and achieving a successful outcome. These responsibilities include:

- Advising on Bankruptcy Options: Law firms provide comprehensive legal advice to debtors, evaluating their financial situation and presenting various bankruptcy options. They help debtors understand the legal and financial implications of each option, enabling them to make informed decisions about their best course of action.

- Filing Bankruptcy Petitions: Law firms prepare and file the necessary bankruptcy petitions, including the appropriate forms and supporting documentation, ensuring compliance with all legal requirements. They meticulously craft these documents to accurately reflect the debtor’s financial circumstances and legal standing.

- Negotiating with Creditors: Law firms engage in extensive negotiations with creditors on behalf of their clients, aiming to reach mutually agreeable settlements and debt restructuring agreements. They leverage their legal expertise and negotiation skills to protect the debtor’s interests and minimize the impact of bankruptcy on their future financial well-being.

- Representing Debtors in Court: Law firms represent debtors in court proceedings related to their bankruptcy cases. They present arguments, respond to motions, and advocate for their client’s interests before the bankruptcy judge. Their legal expertise and courtroom experience are crucial in navigating the complexities of bankruptcy litigation.

- Developing and Implementing Reorganization Plans: For debtors seeking Chapter 11 reorganization, law firms play a critical role in developing and implementing comprehensive plans for restructuring their debts and operations. They work closely with the debtor to create a feasible plan that addresses the concerns of creditors and enables the business to emerge from bankruptcy in a stronger financial position.

Specific Tasks Undertaken by Law Firms

Law firms representing debtors in bankruptcy undertake a wide range of specific tasks to fulfill their responsibilities. These tasks include:

- Gathering Financial Information: Law firms meticulously gather and analyze financial information from the debtor, including financial statements, tax returns, and other relevant documents. This comprehensive financial analysis forms the foundation for all subsequent legal and strategic decisions.

- Identifying and Notifying Creditors: Law firms identify all creditors of the debtor and ensure they are properly notified of the bankruptcy filing. This notification process is essential for ensuring due process and fairness in the bankruptcy proceedings.

- Preparing and Filing Schedules and Statements: Law firms prepare and file various schedules and statements required under the bankruptcy code, including a list of creditors, a statement of financial affairs, and a schedule of assets and liabilities. These documents provide a detailed picture of the debtor’s financial situation and form the basis for the bankruptcy court’s decisions.

- Managing the Bankruptcy Estate: Law firms assist the debtor in managing the bankruptcy estate, which includes the debtor’s assets and liabilities. They ensure that the estate is properly administered, creditors’ claims are processed, and the debtor’s legal obligations are met.

- Communicating with Stakeholders: Law firms facilitate communication between the debtor, creditors, and other stakeholders involved in the bankruptcy proceedings. They ensure that all parties are informed of important developments and provide clear and concise legal guidance.

The Law Firm Representing The Weinstein Company

The Weinstein Company’s bankruptcy proceedings were complex and attracted significant media attention due to the nature of the allegations against its former co-founder, Harvey Weinstein. A prominent law firm was instrumental in guiding the company through this challenging process.

This section delves into the identity of the law firm that represented The Weinstein Company in bankruptcy, highlighting its expertise in bankruptcy law and its track record in handling high-profile cases. It examines the firm’s role in the Weinstein Company’s restructuring and its contributions to the eventual outcome of the bankruptcy proceedings.

The Law Firm Representing The Weinstein Company

The law firm that represented The Weinstein Company in bankruptcy was Kirkland & Ellis LLP. Kirkland & Ellis is a multinational law firm with a global presence and a strong reputation in bankruptcy law. The firm has a dedicated team of experienced bankruptcy lawyers who have a deep understanding of the complexities of bankruptcy proceedings.

Kirkland & Ellis has a proven track record of handling high-profile bankruptcy cases, including representing major corporations and financial institutions. The firm’s expertise in bankruptcy law, coupled with its experience in handling complex and high-stakes cases, made it a suitable choice for representing The Weinstein Company in its bankruptcy proceedings.

Kirkland & Ellis’ Expertise in Bankruptcy Law

Kirkland & Ellis is renowned for its expertise in bankruptcy law. The firm’s lawyers have extensive experience in all aspects of bankruptcy proceedings, including:

- Chapter 11 Reorganization: Kirkland & Ellis has a deep understanding of the Chapter 11 process, which allows debtors to restructure their debts and continue operating as a business. The firm’s lawyers have successfully represented debtors in numerous Chapter 11 cases, helping them to achieve their restructuring goals.

- Debt Restructuring: The firm’s lawyers have a proven track record of negotiating debt restructuring agreements with creditors. They are skilled in identifying creative solutions that meet the needs of both debtors and creditors.

- Bankruptcy Litigation: Kirkland & Ellis has a strong litigation practice that allows the firm to effectively represent clients in bankruptcy-related disputes. The firm’s lawyers have extensive experience in handling complex bankruptcy litigation matters.

The firm’s expertise in bankruptcy law was crucial in guiding The Weinstein Company through its bankruptcy proceedings. Kirkland & Ellis’ lawyers were able to navigate the complex legal landscape and develop strategies to protect the interests of the company and its stakeholders.

Kirkland & Ellis’ Track Record in Handling High-Profile Bankruptcy Cases

Kirkland & Ellis has a long history of representing companies in high-profile bankruptcy cases. The firm has been involved in some of the most significant bankruptcy proceedings in recent history, including:

- General Motors (2009): Kirkland & Ellis represented General Motors in its 2009 bankruptcy, which involved the restructuring of the automaker’s operations and the sale of its assets.

- Lehman Brothers (2008): The firm represented Lehman Brothers in its 2008 bankruptcy, which was the largest bankruptcy filing in U.S. history at the time.

- Toys “R” Us (2017): Kirkland & Ellis represented Toys “R” Us in its 2017 bankruptcy, which involved the liquidation of the toy retailer’s assets.

The firm’s experience in handling high-profile bankruptcy cases demonstrates its ability to manage complex and sensitive situations. Kirkland & Ellis’ lawyers are skilled in dealing with the media scrutiny and public pressure that often accompany high-profile bankruptcy cases.

The Bankruptcy Process and its Impact

The bankruptcy process for The Weinstein Company, like any other company facing financial distress, involved a series of legal steps designed to restructure the company’s debts and assets. This process, governed by the United States Bankruptcy Code, aims to provide a fair and equitable solution for both the company and its creditors.

Key Stages of the Bankruptcy Process, What law firm represented the weinstein company in bankruptcy

The bankruptcy process for The Weinstein Company followed the general framework of Chapter 11 bankruptcy, which allows companies to reorganize their finances while continuing to operate. The key stages of this process include:

- Filing for Bankruptcy: The Weinstein Company filed for Chapter 11 bankruptcy in March 2018, seeking protection from creditors while it restructured its debts and operations.

- Debtor-in-Possession (DIP) Financing: To continue operating during the bankruptcy proceedings, the company sought DIP financing, which provided it with the necessary funds to cover its expenses.

- Developing a Plan of Reorganization: The company, with the guidance of its legal and financial advisors, developed a plan to restructure its debts and assets. This plan would propose a new financial structure for the company and Artikel how creditors would be treated.

- Creditors’ Committee: A creditors’ committee, representing the interests of various creditors, was formed to negotiate with the company and provide input on the proposed plan.

- Confirmation Hearing: The bankruptcy court held a confirmation hearing to review the proposed plan and determine if it met the requirements of the Bankruptcy Code and was fair to all parties involved.

- Implementation of the Plan: Once the plan was confirmed by the court, the company began implementing the plan, restructuring its debts and assets according to the agreed-upon terms.

- Emergence from Bankruptcy: After completing the restructuring process, the company emerged from bankruptcy, a new entity with a reorganized financial structure.

Role of Creditors in the Bankruptcy Process

Creditors play a crucial role in bankruptcy proceedings. They are the entities owed money by the company, and their interests are protected throughout the process. Creditors’ rights include:

- Filing Claims: Creditors must file claims with the bankruptcy court, detailing the amount of money owed to them by the company.

- Voting on the Plan of Reorganization: Creditors have the right to vote on the proposed plan of reorganization, which will determine how their claims will be treated.

- Negotiating with the Debtor: Creditors can negotiate with the company through the creditors’ committee to try and reach an agreement on how their claims will be resolved.

- Objecting to the Plan: If creditors disagree with the proposed plan, they can object to it in court.

Impact of the Bankruptcy on The Weinstein Company’s Stakeholders

The bankruptcy of The Weinstein Company had a significant impact on its various stakeholders, including:

- Employees: Many employees lost their jobs as the company downsized during the bankruptcy process. Some employees were able to secure employment with the new company that emerged from bankruptcy.

- Creditors: Creditors faced uncertainty regarding the recovery of their debts. Some creditors received a portion of their claims, while others received nothing. The bankruptcy process prioritized the repayment of secured creditors, such as banks, over unsecured creditors, such as suppliers.

- Shareholders: Shareholders of The Weinstein Company lost most, if not all, of their investments as the company’s stock value plummeted during the bankruptcy proceedings.

- Filmmakers and Talent: Filmmakers and talent who had worked with The Weinstein Company faced challenges, including delayed payments and the uncertainty of their projects’ future.

The Aftermath of the Bankruptcy

The bankruptcy of The Weinstein Company, a major Hollywood studio, had a profound impact on the entertainment industry and its stakeholders. The proceedings, which commenced in 2018, resulted in the liquidation of the company’s assets and the distribution of funds to its creditors. While the bankruptcy offered a path to financial resolution, it also left a lasting mark on the company’s legacy and the individuals involved.

Distribution of Assets to Creditors

The bankruptcy process involved the sale of The Weinstein Company’s assets to recover funds for its creditors. This included the sale of its film library, which encompassed popular titles like “The King’s Speech” and “Django Unchained.” The proceeds from these sales were used to pay off the company’s debts, including those owed to banks, studios, and employees. The distribution of assets was overseen by the bankruptcy court, ensuring fairness and transparency in the process.

- The distribution of assets to creditors was determined based on the priority of their claims. Secured creditors, such as those holding liens on specific assets, were typically prioritized over unsecured creditors, such as employees and trade creditors.

- The bankruptcy process also involved the resolution of legal disputes between the company and its creditors. This included negotiations over the value of claims and the allocation of proceeds from asset sales.

Long-Term Consequences for the Company and its Stakeholders

The bankruptcy of The Weinstein Company had significant long-term consequences for the company, its employees, and the entertainment industry as a whole. The company ceased to operate, and its brand was tarnished by the scandals that led to its demise.

- The bankruptcy had a devastating impact on the company’s employees, who lost their jobs and faced financial hardship. Many employees were owed back wages and benefits, which were only partially recovered through the bankruptcy process.

- The bankruptcy also had a ripple effect on the entertainment industry, highlighting the risks of unchecked power and the need for greater accountability in the workplace. It prompted a broader conversation about sexual harassment and misconduct in the industry and led to reforms aimed at preventing similar situations from occurring in the future.

Wrap-Up: What Law Firm Represented The Weinstein Company In Bankruptcy

The Weinstein Company’s bankruptcy case serves as a compelling example of the complexities involved in navigating high-profile legal battles. The legal team representing the company played a crucial role in guiding the company through the intricacies of bankruptcy proceedings, working to protect the interests of its stakeholders and ensure a fair and equitable distribution of assets. This case underscores the critical role of legal expertise in navigating complex financial and legal challenges, particularly in the high-stakes world of corporate bankruptcy.

FAQ Summary

What were the key financial challenges faced by The Weinstein Company?

The Weinstein Company faced a number of financial challenges, including a decline in revenue, increasing debt, and a loss of investor confidence. These challenges were exacerbated by the negative publicity surrounding the sexual misconduct allegations against Harvey Weinstein.

What was the impact of the bankruptcy on The Weinstein Company’s stakeholders?

The bankruptcy had a significant impact on The Weinstein Company’s stakeholders, including its employees, creditors, and investors. Employees lost their jobs, creditors faced delays in receiving payments, and investors lost their investments.

What were the long-term consequences of the bankruptcy for The Weinstein Company?

The bankruptcy had a lasting impact on The Weinstein Company. The company’s assets were sold off, and its operations were ceased. The company’s legacy is now tarnished by the scandal surrounding Harvey Weinstein.