Finding affordable and comprehensive health insurance can be a daunting task, but it doesn’t have to be. “Where to purchase health insurance near me” is a question many ask, and the answer is surprisingly multifaceted. From understanding your individual needs and exploring local options to utilizing online resources and consulting with professionals, this guide equips you with the knowledge and tools to make an informed decision.

The first step involves assessing your individual needs. Different health insurance plans, like HMOs, PPOs, POSs, and EPOs, offer varying levels of coverage and cost. Factors such as age, health status, and family size play a crucial role in determining the most suitable plan for you. Once you understand your needs, you can explore the various health insurance providers in your area, comparing their features, benefits, and pricing to find the best fit.

Understanding Your Needs

Choosing the right health insurance plan can be a daunting task. There are many factors to consider, such as your health, budget, and lifestyle. Understanding your needs is crucial to making an informed decision.

Types of Health Insurance Plans

Health insurance plans are categorized into different types based on how they cover healthcare services. The most common types include:

- Health Maintenance Organization (HMO): HMO plans offer coverage through a network of doctors and hospitals. You must choose a primary care physician (PCP) who will refer you to specialists within the network. HMO plans typically have lower premiums than other plans, but you may have to pay more for out-of-network services.

- Preferred Provider Organization (PPO): PPO plans provide coverage both in-network and out-of-network. You have more flexibility in choosing your doctor and hospital, but you will pay higher premiums and copayments for out-of-network services.

- Point of Service (POS): POS plans combine features of HMO and PPO plans. You need a PCP within the network, but you can also access out-of-network providers for a higher cost.

- Exclusive Provider Organization (EPO): EPO plans are similar to HMOs, but they generally offer a wider network of providers. You must choose a PCP within the network and will generally not be covered for out-of-network services.

Factors to Consider When Choosing a Health Insurance Plan

Choosing the right health insurance plan involves considering various factors that impact your healthcare costs and coverage. Here are some key factors:

- Coverage: Consider the types of services covered by the plan, such as preventive care, hospital stays, prescription drugs, and mental health services.

- Cost: Compare the premiums, deductibles, copayments, and coinsurance for different plans. You need to understand how much you’ll pay out-of-pocket for healthcare services.

- Deductibles: The deductible is the amount you pay before your insurance coverage kicks in. A higher deductible generally means lower premiums, but you’ll pay more upfront for healthcare services.

- Copayments: Copayments are fixed amounts you pay for specific services, such as doctor visits or prescriptions. Copayments are typically lower than deductibles but can add up over time.

- Coinsurance: Coinsurance is a percentage of the cost of healthcare services that you pay after meeting your deductible. A higher coinsurance rate means you’ll pay more out-of-pocket for healthcare services.

- Network: Ensure the plan’s network includes your preferred doctors and hospitals. You may need to pay more for out-of-network services.

Determining Your Health Insurance Needs

Your individual circumstances will influence your health insurance needs. Here are some factors to consider:

- Age: Younger individuals may need less comprehensive coverage, while older individuals may require more extensive coverage due to potential health risks.

- Health Status: If you have pre-existing health conditions, you may need a plan with broader coverage and lower deductibles.

- Family Size: Families with children or dependents may need a plan with higher coverage limits and more comprehensive benefits.

- Lifestyle: Consider your lifestyle and health habits. If you engage in risky activities or have a high risk of certain health conditions, you may need a plan with more extensive coverage.

Exploring Local Options

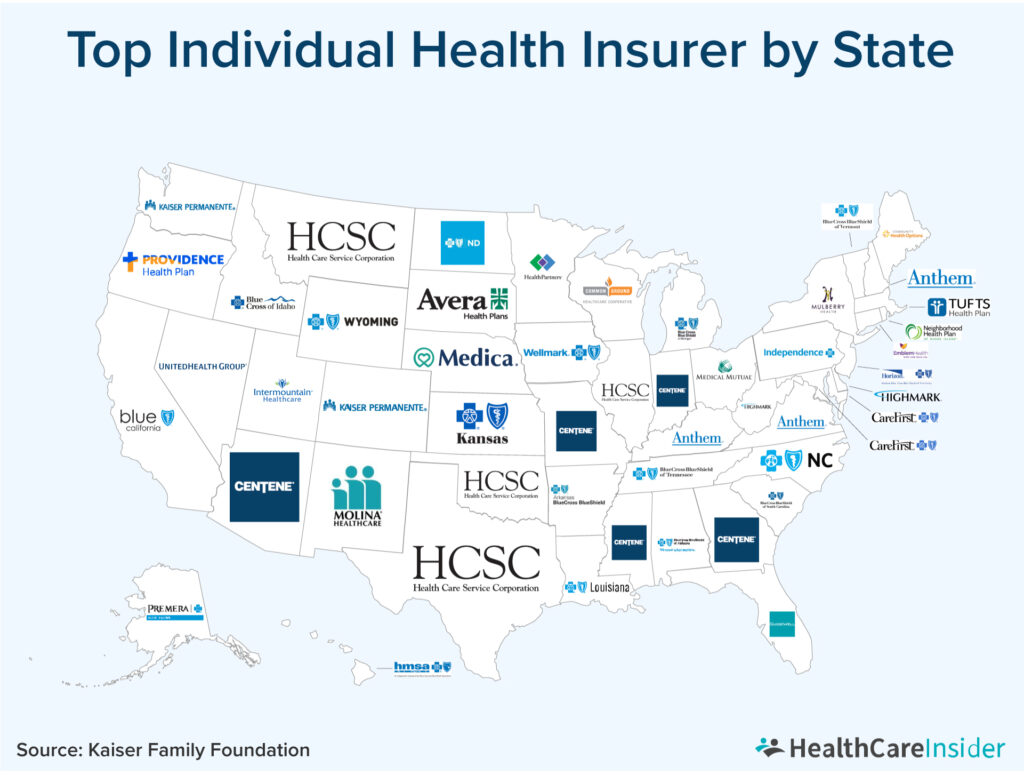

Once you understand your health insurance needs, the next step is to explore the various options available in your area. You’ll likely find a mix of national, regional, and local health insurance providers, each with its own set of plans and features.

Comparing Local Health Insurance Providers

Understanding the key features and benefits of different health insurance providers is crucial for making an informed decision. This comparison table will help you analyze the providers in your area.

| Provider | Plan Types | Coverage | Premiums | Out-of-Pocket Costs |

|---|---|---|---|---|

| [Provider 1 Name] | [List of plan types] | [Summary of coverage] | [Range of premiums] | [Out-of-pocket cost details] |

| [Provider 2 Name] | [List of plan types] | [Summary of coverage] | [Range of premiums] | [Out-of-pocket cost details] |

| [Provider 3 Name] | [List of plan types] | [Summary of coverage] | [Range of premiums] | [Out-of-pocket cost details] |

Note: The specific plans, coverage, premiums, and out-of-pocket costs will vary depending on your location, age, health status, and other factors.

Detailed Plan Information

Each health insurance provider offers a variety of plans, each with its own set of benefits and costs. Understanding these details is essential for selecting the plan that best fits your individual needs.

- Plan Name: [Plan name]

- Coverage: [Summary of plan coverage]

- Premiums: [Monthly premium amount]

- Deductible: [Deductible amount]

- Co-pays: [Co-pay amounts for different services]

- Out-of-Pocket Maximum: [Maximum out-of-pocket expense]

- Network: [List of in-network providers]

Tip: Compare the coverage, premiums, and out-of-pocket costs of different plans from the same provider and from different providers to find the best value for your needs.

Utilizing Online Resources

Online health insurance marketplaces offer a convenient and efficient way to compare plans, get quotes, and enroll in coverage. These platforms provide a centralized hub for accessing information from multiple insurance providers, streamlining the process of finding the right plan for your needs.

Navigating Online Marketplaces

Online health insurance marketplaces provide a user-friendly interface that allows you to search for plans based on your specific requirements. You can filter plans by factors such as coverage level, deductible, co-pay, and network. These platforms also offer a variety of tools to help you compare plans side-by-side and make informed decisions.

- Search for Plans Based on Your Needs: Start by entering your zip code and other relevant information, such as your age and whether you’re applying for individual or family coverage. This will allow the marketplace to display a list of plans available in your area.

- Use Filtering Options: Utilize the filtering options to narrow down your search based on factors like coverage level (e.g., bronze, silver, gold, platinum), deductible, co-pay, and network. You can also filter by specific medical conditions or desired benefits.

- Compare Plans Side-by-Side: Most online marketplaces offer a plan comparison tool that allows you to view the key features of different plans side-by-side. This makes it easier to identify the best options based on your individual needs and budget.

- Read Plan Details: Before making a decision, take the time to carefully read the details of each plan. Pay attention to the coverage levels, deductibles, co-pays, and out-of-pocket maximums. These details will help you understand the costs associated with each plan.

- Contact Customer Support: If you have any questions or need help navigating the platform, don’t hesitate to contact customer support. They can provide guidance and answer your questions.

Consulting with Professionals: Where To Purchase Health Insurance Near Me

Navigating the world of health insurance can be overwhelming, especially with the vast array of plans and providers available. A health insurance broker or agent can be a valuable asset in this process, offering guidance and expertise to help you find the right coverage for your individual needs.

Benefits of Working with a Broker or Agent, Where to purchase health insurance near me

Seeking advice from a professional can save you time, effort, and potentially even money. Brokers and agents possess extensive knowledge of the insurance market, enabling them to compare plans from multiple insurers and identify those that best align with your specific requirements. They can also help you understand the intricacies of coverage, deductibles, co-pays, and other key aspects of health insurance.

- Access to a Wider Range of Options: Brokers and agents often have access to a wider range of plans than you might find on your own, including those offered by insurers who don’t sell directly to the public. This expanded selection increases your chances of finding a plan that perfectly suits your budget and needs.

- Personalized Guidance and Support: A broker or agent can provide personalized guidance tailored to your unique circumstances. They will take the time to understand your health history, lifestyle, and financial situation, helping you make informed decisions about your coverage. This personalized approach ensures you get the right level of protection without overpaying for unnecessary features.

- Negotiation Expertise: Brokers and agents are skilled negotiators who can often secure better rates and coverage terms on your behalf. They have relationships with insurers and can leverage their expertise to obtain favorable deals, potentially saving you money in the long run.

- Ongoing Support: The relationship with a broker or agent doesn’t end after you purchase a plan. They can provide ongoing support throughout the year, helping you understand your coverage, file claims, and navigate any changes to your policy.

Finding a Reputable Broker or Agent

Finding a trustworthy and reputable broker or agent is essential. Here are some tips to help you find the right professional:

- Seek Recommendations: Ask friends, family, or colleagues for recommendations. Word-of-mouth referrals are often a good indicator of a broker or agent’s competence and integrity.

- Check Credentials and Licenses: Ensure that the broker or agent is licensed and registered in your state. You can verify their credentials with the state’s insurance department.

- Look for Expertise: Consider the broker or agent’s experience and specialization. Some brokers specialize in certain types of insurance, such as health insurance. Look for someone with a proven track record of success in helping clients find the right coverage.

- Review Client Testimonials: Check online reviews and testimonials from previous clients. This can provide valuable insights into the broker or agent’s reputation, communication style, and responsiveness.

- Schedule a Consultation: Schedule a free consultation with several brokers or agents to discuss your needs and compare their services. This will allow you to get a feel for their expertise and approach before making a decision.

Making an Informed Decision

Choosing the right health insurance plan is crucial for ensuring your financial security and well-being. This involves careful consideration of various factors and a thorough understanding of your individual needs.

Evaluating Your Needs

Before diving into the options available, it’s essential to understand your health insurance requirements. This involves considering your current health status, any pre-existing conditions, your family’s health needs, and your anticipated healthcare usage in the future.

Factors to Consider

- Affordability: Compare premiums, deductibles, copayments, and coinsurance to find a plan that fits your budget.

- Coverage: Evaluate the types of services covered, such as preventive care, hospitalization, prescription drugs, and mental health services. Ensure the plan aligns with your healthcare needs.

- Provider Network: Check if your preferred doctors, hospitals, and specialists are included in the plan’s network. Out-of-network costs can be significantly higher.

- Customer Service: Research the insurer’s reputation for customer service, claims processing, and responsiveness. Consider online reviews and ratings.

- Flexibility: Explore options for customizing your plan, such as adding riders or adjusting coverage based on your changing needs.

Negotiating with Insurance Providers

While insurance providers generally have standard plans, there’s often room for negotiation, particularly if you’re a high-value customer. Consider these tips:

- Shop Around: Compare quotes from multiple providers to leverage competition and secure better terms.

- Bundle Policies: If you’re considering multiple insurance policies, such as home or auto, inquire about discounts for bundling them with your health insurance.

- Negotiate Deductibles: If you’re willing to pay a higher premium, you might be able to negotiate a lower deductible.

- Request a Health Assessment: Some insurers offer discounts for individuals who maintain a healthy lifestyle. Consider getting a health assessment to potentially qualify for lower premiums.

End of Discussion

Navigating the world of health insurance can feel overwhelming, but by understanding your needs, exploring your options, and seeking professional guidance, you can make an informed decision that provides you with the peace of mind of knowing you have the right coverage for your health and well-being. Remember, health insurance is an essential investment in your future, and with careful planning and research, you can find a plan that meets your specific requirements and fits your budget.

Commonly Asked Questions

What are the different types of health insurance plans?

Common health insurance plans include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), POSs (Point-of-Service plans), and EPOs (Exclusive Provider Organizations). Each plan offers varying levels of coverage, cost, and flexibility, so it’s important to compare them based on your individual needs.

How do I find a reputable insurance broker or agent?

Look for brokers or agents with experience, good online reviews, and affiliations with reputable insurance companies. You can also ask for recommendations from friends, family, or your doctor.

Can I negotiate with insurance providers for better terms?

Yes, you can often negotiate with insurance providers, especially if you have a good health history or are willing to accept a higher deductible or co-pay. Be prepared to present your case and be assertive in your negotiations.