- Short-Term Disability Insurance Coverage

- Employer’s Role in Health Insurance During Disability: Who Pays Health Insurance While On Short Term Disability

- Employee’s Responsibilities for Health Insurance

- COBRA and Other Continuation Options

- Financial Considerations

- State Laws and Regulations

- Impact of Short-Term Disability on Long-Term Health

- End of Discussion

- Commonly Asked Questions

Who pays health insurance while on short term disability – Navigating the complexities of health insurance while on short-term disability can be a daunting task. Understanding who foots the bill for premiums during this time is crucial for both employers and employees. This guide delves into the various aspects of health insurance coverage during disability, from employer responsibilities to employee options and the role of COBRA and other continuation programs.

The question of who pays for health insurance while on short-term disability hinges on several factors, including the type of disability plan, the employer’s policies, and the employee’s individual circumstances. We’ll explore these factors in detail, providing a comprehensive overview of the financial considerations involved.

Short-Term Disability Insurance Coverage

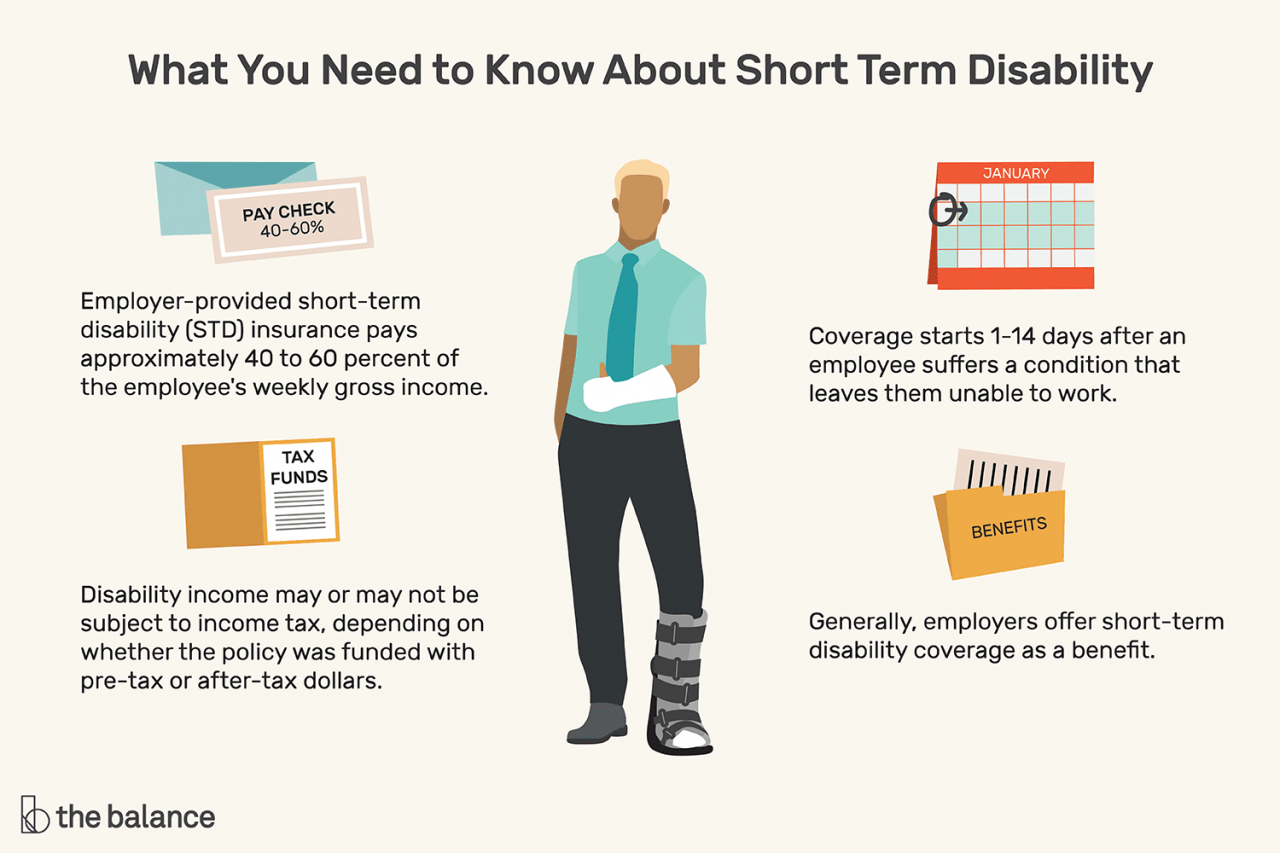

Short-term disability insurance is a type of insurance that provides income replacement for a limited period of time when you are unable to work due to an illness or injury. This coverage is designed to bridge the gap between your regular income and the time it takes to recover and return to work.

Typical Coverage Period

The coverage period for short-term disability insurance varies depending on the plan. However, most plans offer coverage for a period of 3 to 6 months. Some plans may offer coverage for up to 12 months, but this is less common.

Situations That Trigger Short-Term Disability Benefits

Short-term disability benefits are typically triggered by situations that prevent you from working for an extended period of time. Common examples include:

- Serious illness or injury, such as a broken bone, heart attack, or stroke

- Pregnancy and childbirth

- Surgery or recovery from a medical procedure

- Mental health conditions, such as depression or anxiety

- Certain types of cancer

Types of Short-Term Disability Plans

There are two main types of short-term disability plans:

- Employer-sponsored plans: These plans are offered by employers as part of their benefits package. They are typically less expensive than individual plans because the cost is shared by the employer and employees.

- Individual plans: These plans are purchased directly from an insurance company. They are typically more expensive than employer-sponsored plans, but they offer more flexibility in terms of coverage and benefits.

Employer’s Role in Health Insurance During Disability: Who Pays Health Insurance While On Short Term Disability

When you’re on short-term disability leave, your employer’s role in managing your health insurance can be a significant factor in ensuring your financial stability and well-being. Understanding how employers typically handle health insurance premiums and potential contributions during disability leave can help you navigate this period smoothly.

Employer Practices Regarding Health Insurance Premiums

Employers often have established policies regarding health insurance premiums during disability leave. These policies can vary widely depending on the company, industry, and state regulations.

It’s crucial to review your employer’s policy, which is usually Artikeld in your employee handbook or benefits documentation. Here’s a common approach employers take:

- Continued Premium Coverage: Many employers continue to cover your health insurance premiums during your disability leave, as if you were still actively working. This practice aims to ensure continuous health coverage for employees experiencing temporary health challenges.

- Employee Contribution: Some employers may require you to continue paying your portion of the health insurance premium while on disability leave. This approach aligns with the principle of shared responsibility for health insurance costs.

- COBRA Continuation: In cases where your employer doesn’t cover premiums during disability leave, you may be eligible for COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation coverage. This federal law allows you to continue your group health insurance plan for a limited period, but you’ll be responsible for the full premium cost, including your employer’s contribution.

Employer Contributions to Health Insurance

While employers typically cover a portion of health insurance premiums for active employees, their contributions during disability leave can vary. Here are some common scenarios:

- Full Employer Contribution: Some employers continue to contribute their full share of the premium during disability leave, demonstrating their commitment to employee well-being.

- Reduced Employer Contribution: Some employers may reduce their contribution to the premium during disability leave, often aligning this reduction with the employee’s reduced income during this period.

- No Employer Contribution: Some employers may not contribute to the premium during disability leave, leaving the full cost to the employee. This practice is less common but can occur in certain circumstances.

It’s essential to understand your employer’s specific policy regarding contributions to your health insurance during disability leave. This information can help you budget accordingly and ensure you have adequate financial resources to cover your healthcare expenses.

Employee’s Responsibilities for Health Insurance

While on short-term disability leave, employees typically retain responsibility for maintaining their health insurance premiums. This responsibility is crucial because it ensures continued coverage during a time of potential vulnerability and financial strain.

Maintaining Health Insurance Coverage

Employees have several options for maintaining their health insurance coverage during disability leave. The specific options and associated costs may vary depending on the employer’s plan, the employee’s individual circumstances, and state regulations.

- Employer-Sponsored Coverage: In most cases, employees can continue their existing employer-sponsored health insurance plan during disability leave. However, they may be required to pay the premiums themselves, either directly or through deductions from their disability benefits. The specific payment arrangements will be Artikeld in the employer’s disability plan and the health insurance policy.

- COBRA Continuation: If the employee’s employer offers a group health plan, they may be eligible for COBRA continuation coverage. COBRA allows individuals who lose their health insurance due to certain events, such as disability, to continue coverage for a limited period. However, COBRA premiums are typically much higher than employer-sponsored premiums, as the employee is responsible for the full cost of the plan.

- Individual Health Insurance: Employees may also choose to purchase individual health insurance coverage during disability leave. This option can provide flexibility and potentially lower premiums than COBRA, but it may be challenging to find a plan that meets the individual’s needs and affordability.

Paying Premiums

Employees can pay their health insurance premiums in several ways:

- Direct Payment: Employees can pay their premiums directly to the insurance company. This method requires the employee to make timely payments and manage their own insurance account.

- Deductions from Disability Benefits: In some cases, employers may allow employees to have their health insurance premiums deducted directly from their disability benefits. This arrangement simplifies the payment process and ensures timely premium payments. However, it’s important to note that deductions from disability benefits may reduce the amount of money available for other expenses.

COBRA and Other Continuation Options

When an employee loses their job or experiences a change in employment status, they may be eligible for continuation of health insurance coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA allows employees to continue their group health insurance coverage for a limited period, even after they are no longer employed by the company.

COBRA Coverage

COBRA is a federal law that provides continuation of health insurance coverage for certain individuals who lose their group health insurance coverage due to a qualifying event. These events include termination of employment, reduction in hours of work, death of the covered employee, divorce or legal separation, and the employee becoming eligible for Medicare.

- Eligibility: To be eligible for COBRA coverage, the individual must have been covered under the employer’s group health insurance plan at the time of the qualifying event. They must also be a covered beneficiary under the plan, such as a spouse, child, or dependent.

- Duration: The duration of COBRA coverage varies depending on the qualifying event. For example, if an employee loses their job, they are generally eligible for COBRA coverage for up to 18 months. However, if the employee is eligible for Medicare, their COBRA coverage may be limited to 18 months or until they become eligible for Medicare, whichever is earlier.

- Cost: COBRA coverage is not free. The individual is typically responsible for paying the full premium cost of the plan, plus a 2% administrative fee. This cost can be significantly higher than the premium they paid while employed, as employers often subsidize a portion of the premium cost for their employees.

State-Specific Programs

In addition to COBRA, some states offer their own continuation programs for health insurance. These programs may provide more affordable options than COBRA, or they may offer coverage for individuals who are not eligible for COBRA.

- State Continuation Programs: These programs are typically funded by state taxes or employer contributions and may provide continuation coverage for individuals who lose their employer-sponsored health insurance due to job loss, job change, or other qualifying events. They may offer different eligibility requirements and coverage options than COBRA.

- State-Specific Eligibility Requirements: The eligibility requirements for state continuation programs vary by state. For example, some states may require individuals to have been employed in the state for a certain period of time, while others may have income-based eligibility requirements.

- Premium Costs: Premium costs for state continuation programs can vary significantly depending on the state and the program. However, they are generally lower than COBRA premiums, as they may be subsidized by the state.

Individual Health Insurance Plans

Another option for individuals who lose their employer-sponsored health insurance is to purchase an individual health insurance plan. These plans are offered by private insurance companies and are available to individuals who are not eligible for COBRA or state continuation programs.

- Open Enrollment Periods: Individuals can typically purchase individual health insurance plans during an open enrollment period, which is a set time each year when people can enroll in or change their health insurance plan. However, there may be other times when individuals can purchase individual health insurance plans, such as if they experience a qualifying event, such as losing their job or getting married.

- Cost: The cost of individual health insurance plans varies depending on factors such as age, health status, location, and the plan’s coverage. Some individuals may be able to find affordable individual health insurance plans, while others may find them to be very expensive.

- Coverage Options: Individual health insurance plans offer a variety of coverage options. Individuals can choose a plan that meets their specific needs and budget.

Examples of When Continuation Options May Be Beneficial

- Short-Term Disability: An individual on short-term disability may be eligible for COBRA coverage, allowing them to continue their existing health insurance plan while they are unable to work. This can be particularly beneficial if the individual has a pre-existing medical condition that requires ongoing treatment.

- Job Loss: If an individual loses their job, they may be eligible for COBRA coverage or state continuation programs. This can provide them with continued health insurance coverage until they find a new job or become eligible for other coverage options, such as Medicare.

- Open Enrollment: If an individual is not eligible for COBRA or state continuation programs, they may be able to purchase an individual health insurance plan during the open enrollment period. This can ensure that they have continuous health insurance coverage without a gap in coverage.

Financial Considerations

Navigating the financial aspects of short-term disability is crucial, as it directly impacts your income and ability to manage healthcare expenses. This section explores the costs and benefits associated with maintaining health insurance during a disability period, providing insights into making informed financial decisions.

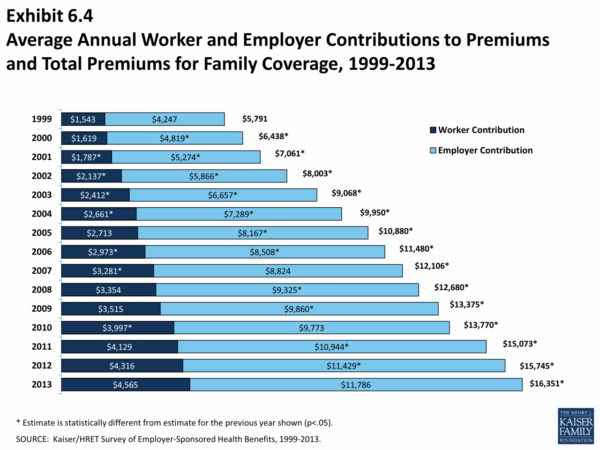

Cost of Maintaining Health Insurance, Who pays health insurance while on short term disability

Maintaining health insurance during a disability period involves balancing the cost of premiums against the potential benefits of having coverage.

- Premium Costs: While on disability, you might be responsible for a portion or the entire premium cost depending on your employer’s policy and the type of disability plan you have.

- Potential Benefits: Having health insurance during disability offers peace of mind, knowing you have access to essential medical care without facing significant financial burdens. It covers a range of healthcare services, including doctor’s visits, hospital stays, medications, and preventive care.

Financial Implications of Losing Health Insurance

Losing health insurance during a disability period can have severe financial consequences.

- High Medical Expenses: Without health insurance, you become fully responsible for medical bills, which can quickly accumulate, especially during a time of reduced income.

- Limited Access to Care: Losing health insurance can limit your access to essential medical care, potentially leading to delayed treatment and worsened health outcomes.

- Financial Stress: The financial burden of unexpected medical expenses can lead to significant stress and anxiety, further complicating your recovery process.

Comparing Health Insurance Continuation Options

Here’s a comparison of the costs and benefits of various health insurance continuation options:

| Option | Cost | Benefits |

|---|---|---|

| Employer-Sponsored Plan | May involve a reduced premium or co-pay | Continues coverage under your existing plan with familiar providers and benefits. |

| COBRA | Full premium cost (typically higher than employer-sponsored plan) | Continues coverage under your existing plan for a limited time, providing continuity of care. |

| Individual Health Insurance | Varies depending on the plan and your health status | Offers flexibility in choosing a plan that meets your specific needs, but may involve higher premiums and limited coverage. |

State Laws and Regulations

State laws and regulations play a crucial role in determining the interplay between short-term disability leave and health insurance coverage. These laws vary significantly from state to state, impacting how employers and employees handle health insurance during disability leave.

State-Specific Laws and Regulations

The table below provides a concise overview of state-specific laws and regulations related to health insurance during disability leave. It Artikels key provisions and examples of state-specific programs that offer assistance.

| State | Key Provisions | State-Specific Programs |

|---|---|---|

| California | Employers must continue health insurance coverage for employees on disability leave for up to 18 months. | California’s Covered California marketplace offers subsidies and tax credits to eligible individuals and families to help them afford health insurance. |

| New York | Employees on disability leave are entitled to continue their health insurance coverage under the same terms as before the leave. | New York’s Essential Plan provides affordable health insurance to low-income individuals and families. |

| Texas | No specific state laws mandate continuation of health insurance during disability leave. | Texas offers the Texas Health Steps program, which provides health insurance assistance to low-income children and families. |

| Florida | Employers are not required to continue health insurance coverage for employees on disability leave. | Florida’s Healthy Kids program offers subsidized health insurance to children from low-income families. |

Key Provisions of State Laws and Regulations

State laws and regulations governing health insurance during disability leave typically address the following key provisions:

- Duration of Coverage: States may specify the duration for which employers must continue health insurance coverage during disability leave. For instance, some states mandate coverage for a specific period, such as 18 months, while others may have no specific duration requirements.

- Eligibility Criteria: State laws may define eligibility criteria for employees to continue their health insurance coverage during disability leave. These criteria might include factors such as the nature of the disability, the duration of the leave, and the employee’s employment status.

- Premium Costs: States may have regulations regarding premium costs during disability leave. Some states may require employers to continue covering the full premium, while others may allow employees to contribute to the premium cost.

- COBRA Continuation: Some states may have provisions that mandate COBRA continuation rights for employees on disability leave. COBRA allows employees to continue their health insurance coverage after leaving their job, but they are typically responsible for paying the full premium cost.

Impact of Short-Term Disability on Long-Term Health

Short-term disability can have a significant impact on an individual’s long-term health, particularly if it leads to a disruption in access to necessary medical care. While short-term disability benefits provide financial support during a temporary period of illness or injury, they don’t always address the ongoing health needs that may arise.

The Importance of Maintaining Health Insurance During Disability

Maintaining health insurance during a period of disability is crucial for ensuring continued access to essential medical care. This coverage helps individuals manage existing health conditions, receive treatment for new medical issues that may arise, and prevent potential complications from untreated health problems.

Examples of Situations Where Continued Health Insurance Coverage Can Be Crucial for Long-Term Health Outcomes

- Chronic Conditions: Individuals with chronic conditions, such as diabetes, heart disease, or asthma, require regular medical care and medication to manage their health. Without health insurance, they may struggle to afford these essential services, leading to potential complications and deterioration of their health.

- Post-Injury Rehabilitation: After a serious injury, individuals often need extensive physical therapy, occupational therapy, and other rehabilitation services to regain their functional abilities. Health insurance coverage helps cover these costs, enabling individuals to access the necessary care for a full recovery.

- Mental Health Support: Disability can significantly impact mental health, leading to stress, anxiety, and depression. Continued access to mental health services, such as therapy and medication, is essential for maintaining emotional well-being and preventing further complications.

End of Discussion

Ultimately, understanding the intricacies of health insurance during short-term disability is essential for maintaining financial stability and access to critical medical care. By carefully evaluating the available options and understanding the relevant laws and regulations, both employers and employees can make informed decisions to ensure seamless coverage during a challenging time.

Commonly Asked Questions

Can I use my short-term disability benefits to pay for my health insurance premiums?

It depends on the specific terms of your disability plan. Some plans allow you to use your disability benefits to pay for premiums, while others do not. It’s important to review your plan documents carefully.

What if I lose my job while on short-term disability?

If you lose your job while on short-term disability, you may be eligible for COBRA continuation coverage. This allows you to continue your employer-sponsored health insurance for a limited period of time, but you will be responsible for paying the full premium cost.

What happens to my health insurance if I’m on short-term disability for longer than the coverage period?

If your disability lasts longer than your short-term disability coverage period, you may be eligible for long-term disability benefits. Long-term disability plans often include health insurance coverage, but the details vary. It’s essential to review your plan documents or contact your insurance provider.